Is there a fee to buy crypto on Crypto com with a credit card?

Can you buy crypto on Crypto com with a credit card

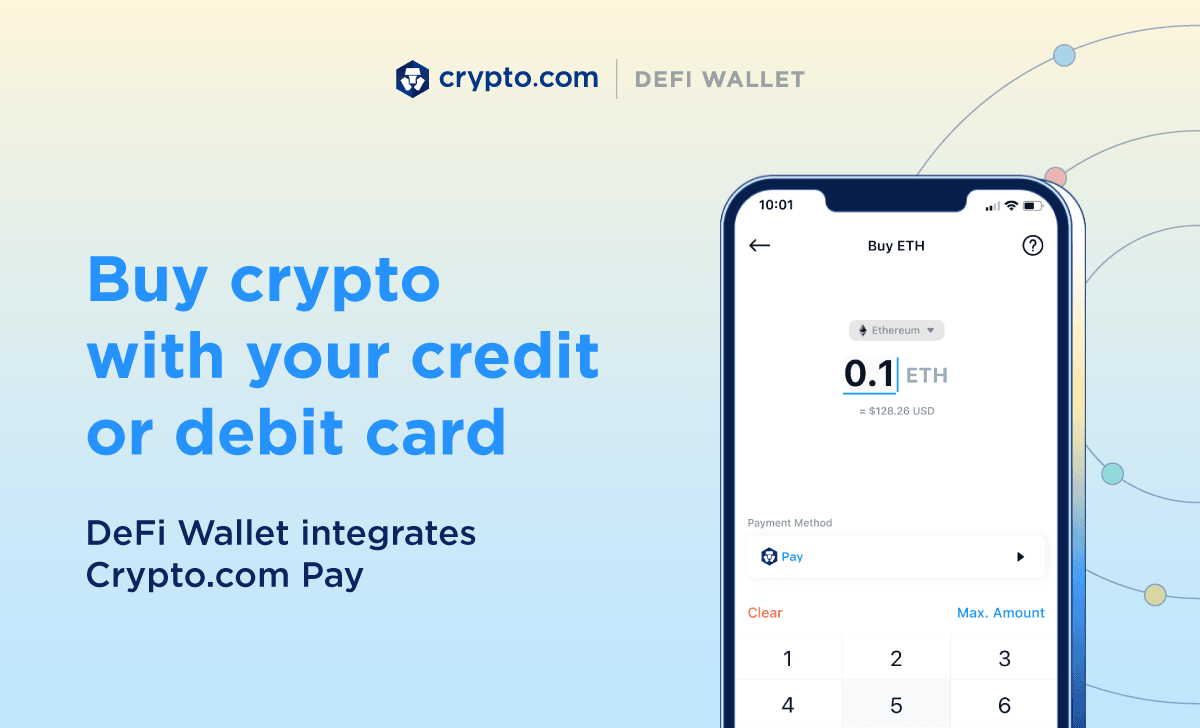

We're thrilled to announce that the Crypto.com DeFi Wallet has enabled consumers to buy crypto directly through their credit or debit card with Crypto.com Pay!

How much does crypto charge for credit card payments

Merchants that accept Bitcoin also save on credit card fees; fees can range anywhere from 0.5% to 5%, plus a $. 20 to $. 30 flat fee for each transaction.

What is the fee of buying crypto in crypto com

Crypto.com does not charge fees for purchasing an NFT, but if you choose to resell you'll pay a fee of 1.99%. Creators also pay a 1.99% fee for selling on the platform.

How do I avoid fees on Crypto com

Withdrawals- Fees & Limits

Note: Transferring crypto to your Crypto.com Wallet App's address will also incur a fee if completed on-chain. To avoid a fee, please use the Withdraw to App function. Withdrawal fees will be settled in the currency you are receiving and can not be paid with CRO.

What is the 2.99 fee on Crypto com

Fees for Crypto Trading

Buying with a credit or a debit card will have a 2.99% fee, and if you exchange crypto within your account, the transaction will be free. SWIFT deposits and withdrawals will have varying bank transfer fees, and ACH and SEPA deposits and withdrawals are usually free.

Does buying crypto with credit card count as cash advance

Cryptocurrency purchases are treated as cash-equivalent transactions, which fall under the scope of a credit card cash advance. So, on top of the exchange's credit card fee, you'll likely be charged a cash advance fee, which can mean another 3% to 5% charge per transaction.

Is it risky to buy crypto with credit card

High investment risk: Investing in crypto using your credit card can lead to serious debt. Cardholders can quickly accrue fees and interest they may later be unable to pay back, significantly increase their credit utilization rate or can lose their investment value due to a volatile crypto market.

Are crypto fees lower than credit card fees

Cryptocurrency payments = significantly lower fees

It is a well-known fact that credit card payment providers are charging merchants interchange fees for processing payments. These costs can reach up to 3-4% from every purchase a customer makes.

Does crypto com report to IRS

Does Crypto.com report to the IRS Crypto.com provides American customers with a Form 1099-MISC when they earn more than $600 in ordinary income from Crypto.com. In the past, Crypto.com issued Form 1099-K to users and the IRS. Crypto.com no longer sends this tax form as of the 2023 tax year.

Where will CRO be in 5 years

It's possible that before the end of the year, the average price of Cronos (CRO) will reach $0.094. We predict that within five years, the price of one coin will have increased to about $0.42. Deposit and Receive Up to 3,500 USDT!

How to buy crypto without fees

Use Robinhood or Trade Bitcoin Stocks to Trade Crypto Commission-free: You can essentially still trade crypto without commission by using Robinhood to trade crypto or by trading Grayscale trusts (like GBTC) or Bitcoin ETFs (like BITO) with some brokers (some brokers charge fees, others don't; check with your's).

Does crypto com have hidden fees

Crypto.com does not charge any fees for buying or selling cryptocurrencies on its platform. However, there are some fees to consider when trading cryptocurrencies. These include trading fees, withdrawal fees, and other fees. Trading Fees Trading fees are charged when you buy or sell cryptocurrencies on the platform.

What are the new rates for crypto com visa cards

The rewards are paid on weekly basis. Cardholders with an existing lockup (before 1 June, 2023 00:00 UTC will continue to earn Card CRO lockup rewards at 10% p.a. (12% p.a. for private users) until their 180-day lockup expires. Thereafter, the new rates of 4% p.a. (8% p.a. for private users) will apply.

What is the cheapest debit card that crypto com offer

Crypto.com's most popular (and affordable) $400 Ruby Steel card offers 1% back on every purchase, a 100% rebate on a yearly Spotify subscription, and no ATM withdrawal fees for up to $400 per month.

Is it a good idea to buy crypto with credit card

There's a reason some creditors won't let you buy cryptocurrency with their cards. On top of the volatility of crypto, using credit adds more unnecessary risk to your investment. Unfortunately, Bratcher says that high-risk payment methods will continue to emerge in the crypto sector.

Should I buy crypto with debit or credit

Cardholders should consider the major disadvantages before deciding to buy crypto using a method involving a credit card. Purchasing crypto is often best accomplished using direct deposits, debit cards or wire transfers. Credit card purchases of cryptocurrency often come with high fees.

What is the 2.99 fee on crypto

Fees for Crypto Trading

Buying with a credit or a debit card will have a 2.99% fee, and if you exchange crypto within your account, the transaction will be free. SWIFT deposits and withdrawals will have varying bank transfer fees, and ACH and SEPA deposits and withdrawals are usually free.

How do I lower crypto transaction fees

Choose a lower fee: Most wallets offer different transaction fees. Choosing a lower fee level can result in a slower confirmation time but lower fees. Use a different cryptocurrency: If Bitcoin fees are too high, consider using another cryptocurrency with lower fees, such as Litecoin or Bitcoin Cash.

Do you have to report crypto under $600

However, you still need to report your earnings to the IRS even if you earned less than $600, the company says. The IRS can also see your cryptocurrency activity when it subpoenas virtual trading platforms, Chandrasekera says.

Do I have to report crypto on taxes if I lost money

Cryptocurrencies such as Bitcoin are treated as property by the IRS, and they are subject to capital gains and losses rules. This means that when you realize losses after trading, selling, or otherwise disposing of your crypto, your losses offset your capital gains and up to $3,000 of personal income.