Is there a fee to pay TurboTax with credit card?

Does TurboTax charge for paying with credit card

For example, TurboTax has a convenience fee of 2.49% for credit card payments. Federal taxes can be paid with a fee of 1.85% though PayUSATax.

Cached

Is there a fee if I pay my taxes with a credit card

Processing fees

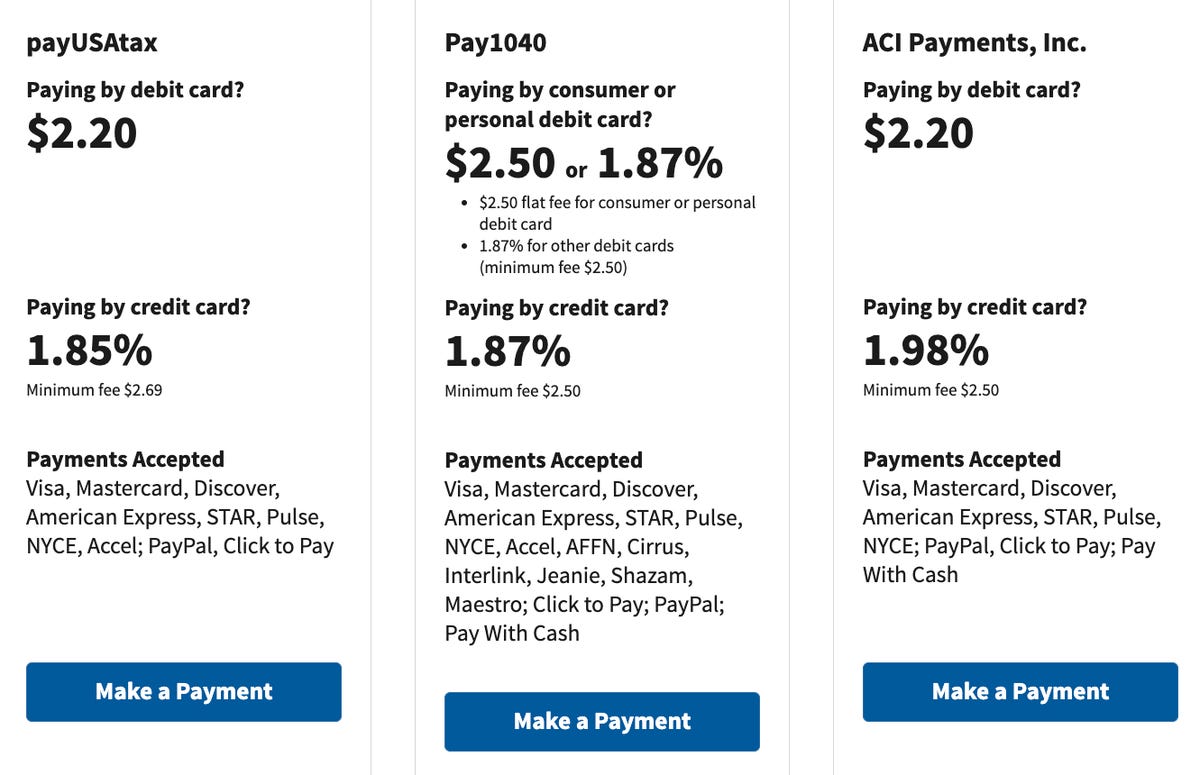

Credit card tax payments incur a fee from the payment processor. The fee varies by processor and is currently 1.85% to 3.93% of the payment with a $2.50 to $3.95 minimum, according to the IRS.

How do I avoid paying TurboTax fees

Pay upfront using a credit or debit card instead of choosing to have the fees deducted from your federal refund to avoid that $39.99 fee.

What is the $39 processing fee for TurboTax

The $39 is only if you use the option to pay the TurboTax online account fees with the federal tax refund. Note – There is a 2.49% convenience fee to pay the taxes owed by credit card through TurboTax.

How much does it cost to pay for TurboTax

TurboTax Plan Prices

| Products Offered | Price | Additional State Fees |

|---|---|---|

| Free Edition | Free | Free |

| Deluxe | $59 and Up | $59 and Up Per State |

| Premier | $89 and Up | $59 and Up Per State |

| Self-Employed | $119 and Up | $59 and Up Per State |

How much is the processing fee for TurboTax

You pay TurboTax from your refund.

It sounds more convenient than pulling out a debit or credit card on the spot, but beware: a $39 processing fee applies.

What are downsides to paying your taxes with a credit card

Downsides of paying taxes with a credit card

If you finance a tax payment using your card's regular APR, you'll end up paying interest. And using a card for a large payment can impact your credit score.

Is it safe to pay your taxes online with a credit card

The IRS uses third party payment processors for payments by debit and credit card. It's safe and secure; your information is used solely to process your payment.

Why am I being charged a $40.00 fee TurboTax

The $40 service charge is because you requested to have your TurboTax account fees paid from your federal tax refund. This is the service charge the third party processor charges for receiving your tax refund, deducting the fees and then direct depositing the remainder of the tax refund.

Why did TurboTax charge me $120

Why is TurboTax charging me $120 If you are charged $120 you are most likely using TurboTax Deluxe for both your Federal and state tax filing and as such you are charged fees for both.

Why did TurboTax charge me $150

You appear to be using Online Deluxe Edition, which is a paid version–$60 for Federal and $50 for state, and if you choose to pay the fees out of your Federal refund, there is an additional $40 service fee ($45 for California filers.) So if you chose those 3 things, that would account for your $150 in fees.

Is TurboTax no longer free

And at that point, he said, most people do not want to start all over again. Both TurboTax and H&R Block quietly left the Free File Alliance during the pandemic, the IRS says. You may still be able to file free through them for basic returns, but anything more complicated may trigger fees.

Why does TurboTax charge $40 twice

H&R Block and TurboTax each charge an additional processing fee of $40 if you agree to pay through your refund. That's $40 on top of the fee you're paying for the package you selected, meaning you could easily double what you expected to pay.

Is it better to pay the IRS with a credit card or set up a payment plan

With average credit card interest rates being around 16%, paying with a credit card could mean additional interest on top of your tax bill. On the other hand, the IRS late payment penalty is 0.5% each month of your unpaid taxes — up to 25% total.

Is paying taxes with credit card a cash advance

Don't worry, you will not be charged cash advance fees when you pay with a rewards credit card. It's even in the payment processor FAQs: Will I be charged a cash advance fee No, your tax payment will be treated like a retail purchase and not a cash advance.

What are two downsides to paying your taxes with a credit card

Downsides of paying taxes with a credit card

If you finance a tax payment using your card's regular APR, you'll end up paying interest. And using a card for a large payment can impact your credit score.

Can you pay TurboTax with a credit card or refund

You can also pay taxes with a credit card using tax-preparation tools like TurboTax Tax Software. TurboTax charges a credit card convenience fee of 2.49% to pay taxes when you e-file.

What is the extra fee for TurboTax

TurboTax Plan Prices

| Products Offered | Price | Additional State Fees |

|---|---|---|

| Free Edition | Free | Free |

| Deluxe | $59 and Up | $59 and Up Per State |

| Premier | $89 and Up | $59 and Up Per State |

| Self-Employed | $119 and Up | $59 and Up Per State |

Jun 1, 2023

Is TurboTax not free anymore 2023

TurboTax Live Assisted Basic is $0 through March 31, 2023 for simple tax returns only. You can see if you qualify here. Intuit is a proud supporter of US military members, veterans, and their families in their communities and overseas.

Which TurboTax is actually free

For example, TurboTax Free Edition, TurboTax Live Basic, and TurboTax Live Full Service Basic are all free right now — but only if your return is simple. (Note that TurboTax defines "simple" as "Form 1040 only" and that not all taxpayers qualify.)