Is there a limit on a Serve card?

How much money can I have on my serve account

The American Express Serve deposit limit is $2,000 per day and $10,000 per month. This includes transfers, direct deposits, and adding money from your bank account. WalletHub Answers is a free service that helps consumers access financial information.

Cached

What is the monthly limit for American Express serve

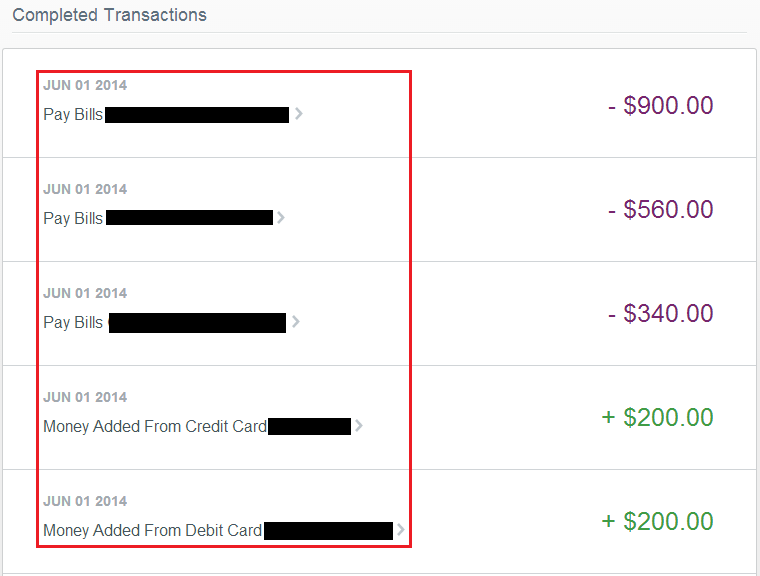

The monthly limit on bank account transfers is $2,000. The limit for debit and credit card transfers is $200 a day, up to $1,000 a month. Finally, if you know someone with a Serve account you can have them transfer money directly to your card. American Express caps Serve-to-Serve transfers at $10,000 per month.

CachedSimilar

Does American Express Serve have a limit

Unlike most cards which set daily limits for spending, the Serve card sets monthly limits. The monthly spending limit is $15,000. The average daily spending limit for other cards is around $5,000. The Serve card limits ATM withdrawals to $750, compared to an average of $500 among prepaid cards.

How can I get all my money off my Serve card

Money OutGet Cash from ATMs.Use Cash Pickup Powered by Ria®Send Money to Another Serve Accountholder.Use Serve Money Transfer Powered By Ria®Transfer Money to an External Bank Account.Get Cash Back When Shopping in Stores with the Serve® Pay As You Go Visa® Prepaid Card.

What is the daily limit on Jackson Hewitt Serve card

For Serve Cash Pickup transactions, a $2,500 daily Cash Pickup limit applies; provided, that for Cash Pickup transactions related to tax refunds or refund advances that are Direct Deposited to your Account, the daily Cash Pickup limit will be the lesser of (i) $2,900 and (ii) the tax funds amount, until you have …

Why is my Serve card being declined

There are a number of possible reasons why a purchase could be declined: You don't have enough money left on your card. You haven't activated or registered your card. The address you gave to make an online or phone purchase is different from the address you have on file with your prepaid card provider.

Does Amex serve card build credit

Unlike a credit card, prepaid cards have their funds stored in a stand-alone prepaid account which you can reload. So you can only spend what you've deposited into your account. That's why they don't help build personal or business credit.

Can I transfer money from my Serve card to my bank account

You can transfer money only to your linked checking or savings account, but not to a debit card. Log into your Serve account. Go to Money Out then select Transfer to Bank. If you already have a linked bank account, the bank name will be displayed.

Can I get money off my American Express Serve card

For Serve® American Express® Prepaid Debit Accounts, you can enjoy FREE ATM withdrawals at over 37,000 ATMs in the MoneyPass® ATM network in the US. Transactions at non-MoneyPass ATMs have an up to $2.50 Serve fee. ATM operator fees and decline fees may also apply.

Can a serve card go negative

Because you can't overdraft your Serve® American Express® Prepaid Debit Account or Serve® Pay As You Go Visa® Prepaid Card, there are no overdraft fees.

Does serve card affect credit score

Unlike traditional credit cards, activity from a prepaid card is not reported to the three credit reporting agencies (Experian®, TransUnion®, and Equifax®) and will not help in establishing or maintaining your credit score.

What is the maximum limit on a prepaid credit card

Most Visa prepaid card options will allow you to load up to $15,000 into the card account. If you're accessing a reloadable prepaid card, you can continue to add money to your account when you spend some of your current balance. In either scenario, though, you cannot surpass the $15,000 account balance limit.

Does Amex give higher credit limits

Yes, Amex increases credit limits automatically. This might happen if you have excellent creditworthiness and make all your payments on time. Paying your balances in full each month or maintaining a low credit utilization ratio might also work in your favor.

Can I send money to someone with a Serve card

You can send money to anyone with the same type of Serve account you have. For example, if you have the Serve® American Express® Prepaid Debit Account, you can send money to other Serve Prepaid Debit Account Accountholders, but not to Serve® Pay As You Go Visa® Prepaid Card Cardholders.

How long does it take to transfer money from serve to bank account

Enter the amount you'd like to transfer. Please allow 2-4 business days for the money to become available in your linked bank account.

How much money can I take off my Serve card at once

What limits apply to Cash Pickup withdrawals A daily withdrawal limit of $2,500 applies for each Serve account held, and a cumulative $2,900 daily limit applies across all your Serve accounts.

Why does my American Express Serve card keep getting declined

If you're wondering why your new credit card keeps getting declined, there's a good chance it wasn't activated yet. When you get a new card, you may need to call the number on your card or log into your online account to activate it. If it's not a new card, check to be sure it's not expired.

Can I overdraw my Serve card

Because you can't overdraft your Serve® American Express® Prepaid Debit Account, there are no overdraft fees. Additionally, you can add a backup funding source to ensure your transactions will not be declined due to lack of funds in your Account.

Do prepaid cards have daily limits

The daily withdrawal limit for a prepaid card is determined by the card's issuer, and you can find it in your card's terms and conditions or your online account. Continue reading to learn more about how to change your prepaid card's daily withdrawal limit.

Can you put 5000 on a prepaid card

THE PROMOTION PLUS CARD™ Prepaid Mastercard® Card (in silver) is GUARANTEED In-Stock, available for immediate delivery, in denominations ranging from $2500 – $5000. Accepted anywhere Mastercard prepaid cards are accepted worldwide.