Is there a penalty for paying Upstart off early?

What happens if you pay off Upstart early

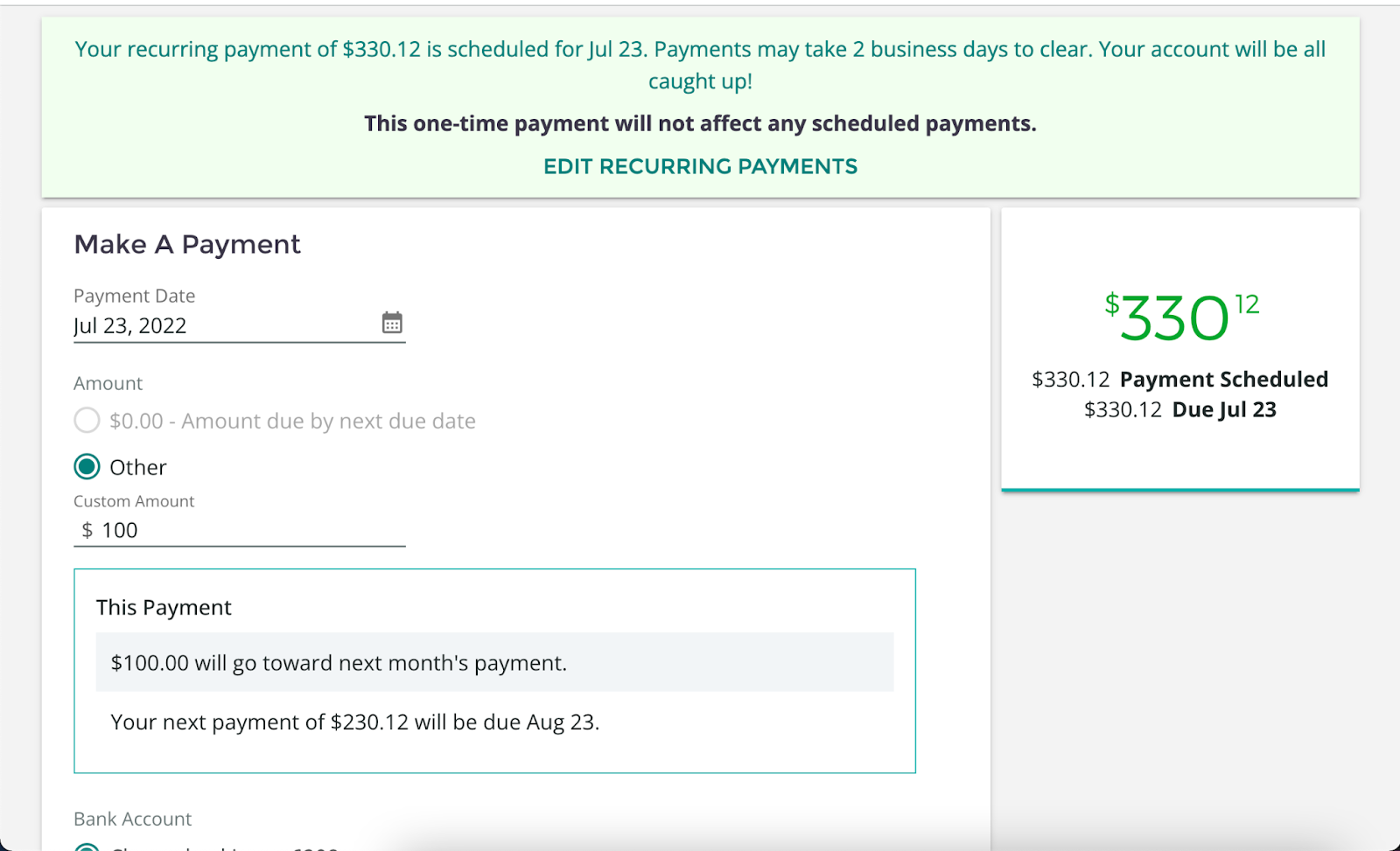

There are no penalties or fees associated with paying off your loan early. You are only responsible for the amount of interest accrued until the date of payoff. If your account has recurring payments on, any payoff amount on or after that date assumes the recurring payment scheduled will be successful.

Cached

Is it a bad idea to pay off a loan early

If you have personal loan debt and are in a financial position to pay it off early, doing so could save you money on interest and boost your credit score. That said, you should only pay off a loan early if you can do so without tilting your budget, and if your lender doesn't charge a prepayment penalty.

Can you pay extra on an Upstart loan

You are always welcome to make extra manual payments to pay down your loan, or pay off your loan in full. There is never a fee for making an additional payment.

Can Upstart garnish wages

If you default on an unsecured loan, the lender has a few options. They'll likely send your account to a collection agency, and may file a lawsuit against you. If they choose to pursue legal action, defaulting on a loan can result in wage garnishments as well as a legal judgment on your credit report.

Can I renegotiate an Upstart loan

Unfortunately, you cannot negotiate the loan terms or the rate you are offered.

Can I cancel my loan application with Upstart

If you wish to withdraw from the application process, please email us at [email protected] to confirm your request. We can also opt you out of receiving promotional emails and SMS. However, please note that Upstart is not able to delete your account/application at this time.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

What could potentially be the downside of paying off a loan sooner

For example, some personal loans have prepayment penalties. If you pay off a personal loan early, you might owe a fee for the privilege of doing so. Check whether your lender charges a prepayment penalty.

Can you have 3 loans with Upstart

There is no official limit on the number of personal loans you can have at the same time. It's common for lenders to only make one or two loans to the same borrower, but there's no reason you can't apply for personal loans at more than one lender.

Can you only have 1 Upstart loan at a time

However, borrowers can take out a second Upstart loan and use it to pay off existing debt. You've made on-time payments for the six previous consecutive months. You have no past-due payments. You have no more than one outstanding Upstart loan.

Is Upstart a legal loan company

Yes, personal loans through Upstart are legit because Upstart is an accredited business registered to do business in the states it services, which is a legal requirement to be a legitimate lending platform.

Does Upstart check your bank account

After submitting your rate inquiry, Upstart will ask you to verify your bank account. You may also be asked to upload supporting documents and may be contacted via phone to verify your information. At this time, Upstart will also run a hard credit check, which will show up on your credit report. Await approval.

What are the downsides of choosing Upstart for a borrower

A major drawback of Upstart personal loans are the high fees and APR, but if you have fair or average credit Upstart may offer higher approval odds compared to other traditional lenders.

How to negotiate with Upstart

Unfortunately, you cannot negotiate the loan terms or the rate you are offered. Your rate is generated based on the details that you entered into your application along with your soft credit pull.

What is the Upstart controversy

A class action complaint has been filed against Upstart. The complaint alleges that defendants repeatedly stated that Upstart's AI-based models could underwrite loans in a way that was far superior to traditional underwriting processes and lead to the origination of less risky credit.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How many points does your credit score go up when you pay off a debt

Your credit score could increase by 10 to 50 points after paying off your credit cards. Exactly how much your score will increase depends on factors such as the amounts of the balances you paid off and how you handle other credit accounts. Everyone's credit profile is different.

Does paying off an auto loan early hurt your credit score

Paying off your car loan early can hurt your credit score. Any time you close a credit account, your score will fall by a few points. So, while it's normal, if you are on the edge between two categories, waiting to pay off your car loan may be a good idea if you need to maintain your score for other big purchases.

Does Upstart verify income

A pay stub within the last 30 days is needed to verify your income, if you receive a pay stub, please provide one. If you do not have your first pay stub yet and/or starting a job in the future, please submit your official job offer stating your compensation and start date.

Can you skip a month with Upstart

Your due date cannot be changed however, you can change your payment date at any time through your Upstart dashboard. As a reminder, your promissory note states a 10 day grace period and Upstart offers 5 additional days as a courtesy before assessing a late fee, for a total of a 15 day grace period.