Is there a phase out for the American Opportunity credit?

Does American Opportunity Credit phase out

American Opportunity Credit phaseout – If your modified adjusted gross income (MAGI) is more than $80,000 ($160,000 if you're married filing jointly), your eligibility will start to “phase out” – meaning you may only qualify for a partial credit or none at all.

Cached

What is the cutoff for American Opportunity Credit

What are the income limits for AOTC To claim the full credit, your modified adjusted gross income (MAGI) must be $80,000 or less ($160,000 or less for married filing jointly).

Cached

What is the income limit for the American Opportunity Credit 2023

American Opportunity Credit

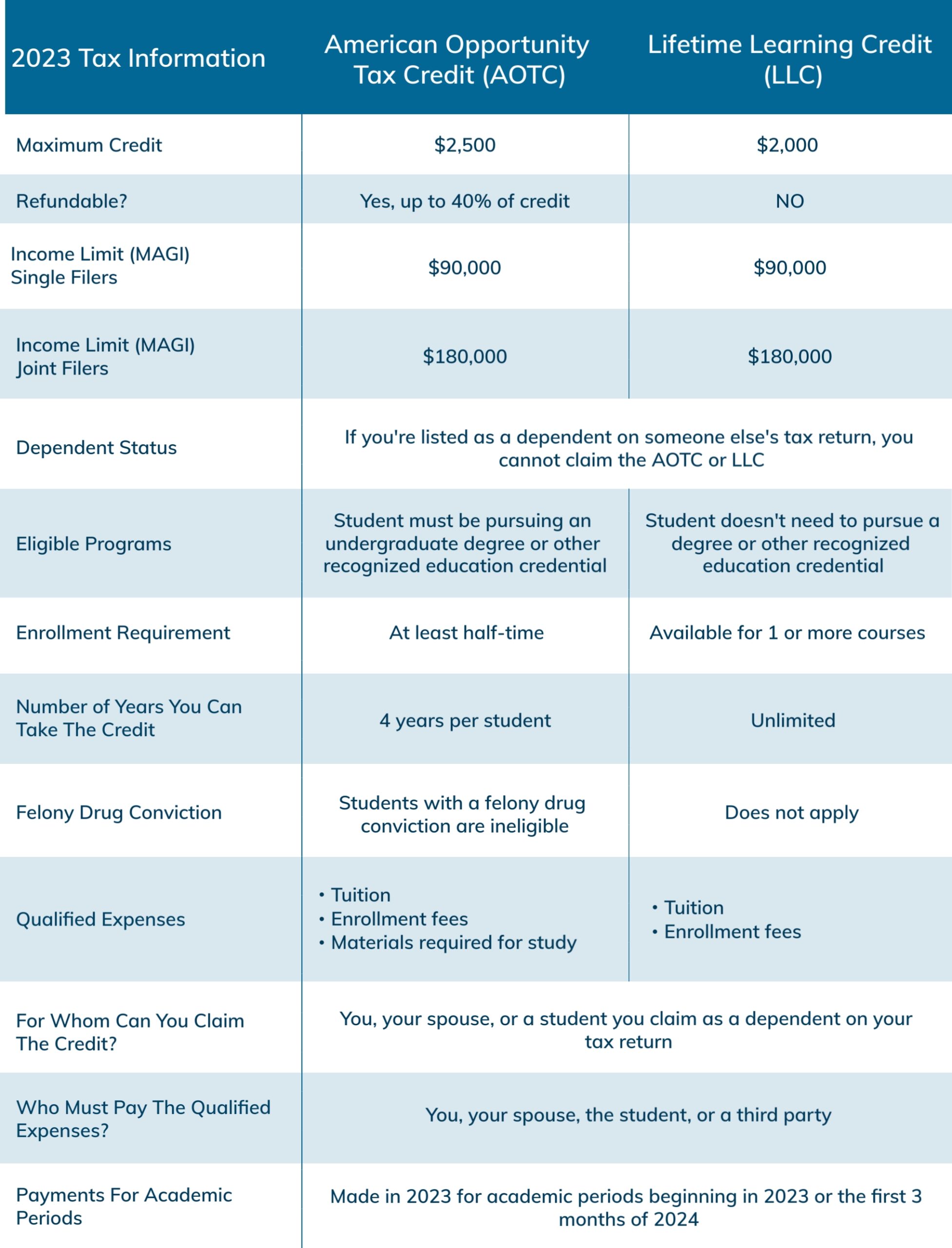

To claim a $2,500 tax credit in 2023, single filers must have a MAGI of $80,000 or less, and joint filers must have a MAGI of $160,000 or less. A partial credit is available for single filers with a MAGI between $80,000 and $90,000, and joint filers with a MAGI between $160,000 and $180,000.

How is American Opportunity Credit phase out calculated

Q11. How do I calculate AOTC A11. You calculate the AOTC based on 100 percent of the first $2,000 of qualifying expenses, plus 25 percent of the next $2,000, paid during the tax year.

What is the AOTC phase out for 2023

The credit begins to phase out once your adjusted gross income exceeds $200,000, or $400,000 for those married filing jointly. At a certain income level, the benefit lapses entirely.

What is the student loan interest phaseout for 2023

If you are single, head of household or a qualifying widow(er), your student loan interest phase-out starts at $75,000 modified AGI and the phase-out ends at $90,000. If you are married you can make $150,000 before phase-out begins.

How to get the full $2,500 American Opportunity credit

To claim AOTC, you must file a federal tax return, complete the Form 8863 and attach the completed form to your Form 1040 or Form 1040A. Use the information on the Form 1098-T Tuition Statement, received from the educational institution the student attended.

Can you take the American Opportunity credit if you are over 24

You cannot claim any portion of the American Opportunity Credit as a refundable credit on your tax return if you were under the age of 24 at the end of 2023 and any of the criteria mentioned below apply to you. Instead, you can only use the non-refundable portion of your allowable credit to lower your tax.

What is the range for CTC phase out

The Child Tax Credit won't begin to be reduced below $2,000 per child until your modified AGI in 2023 exceeds: $400,000 if married and filing a joint return; or. $200,000 for all other filing statuses.

How do I get the full $2500 American Opportunity credit

To claim AOTC, you must file a federal tax return, complete the Form 8863 and attach the completed form to your Form 1040 or Form 1040A. Use the information on the Form 1098-T Tuition Statement, received from the educational institution the student attended.

What changes are the IRS making for 2023

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2023.

Are 2023 student loans eligible for forgiveness

June 30, 2023

Student loan debt relief has been on pause and under review of the Supreme Court since Nov. 2023. If the program is approved or a decision isn't made by the Supreme Court before June 30, 2023, then payments will resume to those who are entitled to them 60 days after that.

What will student loan interest rates be in 2023 2024

Direct Loan Interest Rates for 2023-2024

| Loan Type | 10-Year Treasury Note High Yield | Fixed Interest Rate |

|---|---|---|

| Direct Subsidized Loans and Direct Unsubsidized Loans for Undergraduate Students | 3.448% | 5.50% |

| Direct Unsubsidized Loans for Graduate and Professional Students | 3.448% | 7.05% |

Why do I not get the full American Opportunity credit

You must be pursuing a degree or other recognized educational credential. You must be enrolled at least half-time for at least one academic period that began in the tax year. You must be in your first four years of higher education, which means you can't claim the credit if you are in your fifth, sixth, etc.

What’s the difference between Hope credit and American Opportunity Credit

The American Opportunity Tax credit (formerly Hope Credit) is a tax credit that may be available to you if you pay higher education costs. You may be able to claim Hope credit for qualified tuition and related expenses paid for each eligible student in your family.

Can I claim American Opportunity Tax Credit after 4 years

You can claim the tax credit for all four years of higher education as long as you have not claimed the AOTC or the former Hope credit for more than four tax years. If in fact you are not eligible for the AOTC you may still be eligible for the Lifetime Learning Tax Credit for any tuition and fees paid in 2023.

Can a 25 year old claim the American Opportunity Credit

Can a student under 24 claim the AOTC You cannot claim any portion of the American Opportunity Credit as a refundable credit on your tax return if you were under the age of 24 at the end of 2023 and any of the criteria mentioned below apply to you.

Is there a phase out amount for child tax credit

The Child Tax Credit is reduced (“phased out”) in two different steps, which are based on your modified adjusted gross income (AGI) in 2023. The first phaseout can reduce the Child Tax Credit down to $2,000 per child.

What is the ACTC tax credit for 2023

Families must have at least $2,500 in earned income (AGI) to claim any portion of the child tax credit and can receive a refund worth 15 percent of earnings above $2,500, up to $1,500 per child (referred to as the Additional CTC). The refundable, or ACTC, portion of the tax credit will increase to $1,600 in 2023.

Why am I not eligible for the American Opportunity Credit

For tax year 2023, the credit begins to phase out for: Single taxpayers who have adjusted gross income between $80,000 and $90,000. Joint tax filers when adjusted gross income is between $160,000 and $180,000.