Is there a way to see all the credit cards you have?

Is there a way to see how many credit cards I have

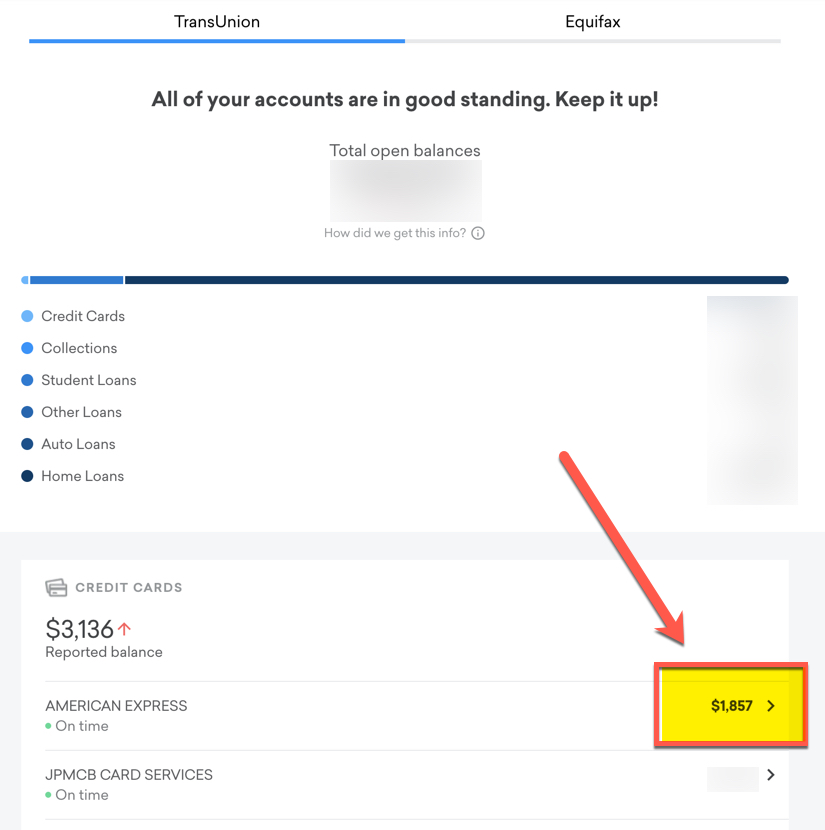

To find out if someone opened a credit card in your name, get a copy of your credit report from all three major credit bureaus: Experian, Equifax and TransUnion. You'll be able to see all of the credit cards opened in your name on those reports.

Cached

Is there an app to see all my credit cards

Tally tracks the balance, APR and due date of every credit card you add into the app. Every month, we pay your cards for you based on what saves you the most money.

Cached

How do I find my old credit card accounts

To find old credit card accounts, start by looking at your credit reports. Head to the website AnnualCreditReport.com, which will let you access your reports from all three credit bureaus—Experian, Equifax and TransUnion—for free. Currently, you can access your credit reports from each of the bureaus once per week.

How do I find all my card information

Besides your physical card, you can usually find your card number on billing statements and in your profile online or in your bank's mobile app. Your credit card account number by itself usually isn't available for you to view. This helps protect your information.

How many credit cards is too many to have open

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

What is a deadbeat in the credit card sense

Usually used as a derogatory term, a deadbeat in the credit card world is someone who pays off their balance in full every month. Deadbeats often reap the rewards from credit card programs without having to pay high fees or interest due to regular and full payments on their cards.

How do I see what credit cards are on my iPhone

So go ahead and open up settings on your iOS. Device scroll down until you see wallet and Apple pay and tap on that. Find the Apple card and tap on that. Card. Information is what we are looking for.

How do I manage my all credit cards

What's in this guideKeep your PIN secure.Check your bill.Plan to pay off in full each month.Avoid the late payment trap.Avoid the minimum payment trap.Keep within your credit limit.Increasing your credit limit.Avoid cash withdrawals or credit card cheques.

How long is credit card history kept

seven years

A credit reporting company generally can report most negative information for seven years.

How long are credit card records kept

Documents that should be shredded include the following: Credit Card Statements: Keep them for 60 days unless they include tax-related expenses. In these cases, keep them for at least three years.

How do I find my saved credit cards on Google

View Stored Credit Card Data in Google Chrome

Open Google Chrome and click the three horizontal dots in the upper-right hand corner of the window followed by Settings. Select Autofill from the left navigation panel followed by Payment methods. Under Payment methods, there will be a list of all saved credit cards.

How can I find my CVV number without my card chase

If you don't have a physical credit card, you can usually find your CVV number by logging into your account online. Once you're logged in, go to the “My Account” section and look for a link that says “Credit Cards.” Click on that link, and you should see your CVV number listed.

Does cancelling a card hurt credit

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Does canceling a credit card hurt your credit

Your entire history with a credit card stays on your credit report for up to seven years, even after you've canceled the card. So don't expect that closing a card in 2023 that you've missed payments on will improve your score.

What is a credit card trap

A debt trap is when you spend more than you earn and borrow against your credit to facilitate that spending. While this can certainly be caused by unnecessary spending, having inadequate savings to handle unforeseen costs can also result in a debt trap.

Do credit card companies like when you pay in full

Yes, credit card companies do like it when you pay in full each month. In fact, they consider it a sign of creditworthiness and active use of your credit card. Carrying a balance month-to-month increases your debt through interest charges and can hurt your credit score if your balance is over 30% of your credit limit.

Is there a way to display the full credit card number from your Apple wallet

How can I view it. Open the wallet app on your iPhone, tap on the card and then on the ℹ on the bottom right. Then tap on information and you will be able to see the last four digits of your device account number as well as the last four digits of the original card you added to Apple Pay.

How do I find my full credit card number on Apple wallet

How to view your Apple Card card numberOpen the Wallet app on your iPhone.Choose Apple Card from your list of cards.Tap the three dots in the upper-right corner.Tap “Card Information”Authenticate with Face ID or Touch.

Is it too much to have 7 credit cards

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

Is 25 credit cards too many

Credit scoring formulas don't punish you for having too many credit accounts, but you can have too few. Credit bureaus suggest that five or more accounts — which can be a mix of cards and loans — is a reasonable number to build toward over time.