Is TransUnion legal?

Can TransUnion be trusted

TransUnion is a legitimate credit bureau, and its credit reports are used by lenders to judge things like loan and credit applications.

Cached

Why is TransUnion being sued

Today's lawsuit alleges that TransUnion violated the Consumer Financial Protection Act of 2010 by failing to implement requirements of the Bureau's 2023 order and by engaging in deceptive acts and practices.

Cached

Is there a lawsuit against TransUnion

TransUnion LLC was hit with a class action alleging it failed to protect the personal information of 200 million people who were affected by a 2023 data breach.

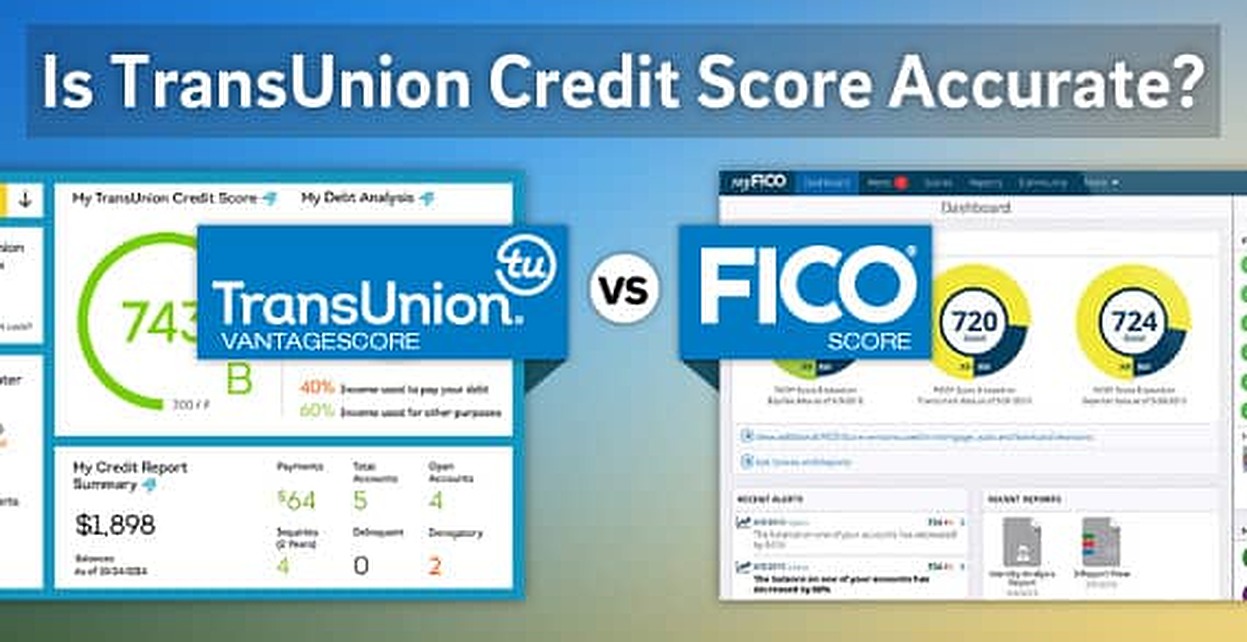

Is TransUnion a real credit score

Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Do banks look at TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score.

Should I trust Equifax or TransUnion

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

How do I get rid of TransUnion

How can I cancel my membership The easiest way to terminate your membership is through our online process, just click here. You may also terminate your membership by talking to a Customer Service Team Member at (833) 598-0673. Customer Service is available: 8AM – 6PM Eastern Time Monday-Friday.

Does TransUnion ignore paid collections

Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit report when paid in full. Use our interactive tool to learn more about how collections appear on your credit report.

Do lenders use TransUnion score

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Is TransUnion safe to check credit score

Answer: Checking your own credit report won't hurt your score because it's considered a soft inquiry.

Do lenders use TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

What’s better Equifax or TransUnion

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Is Experian or TransUnion better

Which of the three credit bureaus is the best Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Why do I have to pay for TransUnion

A paid monitoring subscription to TransUnion Credit Monitoring can help you approach credit with confidence. Subscriptions include a VantageScore® 3.0 credit score. A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

How do I stop being charged by TransUnion

How can I cancel my membership The easiest way to terminate your membership is through our online process, just click here. You may also terminate your membership by talking to a Customer Service Team Member at (833) 598-0673. Customer Service is available: 8AM – 6PM Eastern Time Monday-Friday.

Should I not pay off collections

Several potential consequences of not paying a collection agency include further negative impacts to your credit score, continuing interest charges and even lawsuits. Even if you can't pay the debt in full, it's often best to work with the collection agency to establish a payment plan.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Do banks look at TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Do places look at Equifax or TransUnion

An Equifax credit score isn't used by lenders or creditors to assess a consumers' creditworthiness. Instead, many lenders use FICO Scores® to help determine a potential borrower's creditworthiness. FICO uses credit scores from the three reporting agencies, including Equifax and Transunion, to determine their score.