Is treasury stock an asset or expense?

Is treasury stock an expense

In this scenario, the treasury stock held by the company is recorded as a reduction of shareholders' equity on its balance sheet. The cost of the treasury stock is recorded as an expense in the company's income statement in the period in which it is repurchased.

Cached

What is treasury stock on balance sheet

Treasury stock is a company's own stock that it has reacquired from shareholders. When a company buys back shares, the expenditure to repurchase the stock is recorded in a contra equity account. This is a balance sheet account that has a natural debit balance.

Cached

Is treasury stock reported as an asset in balance sheet

On the balance sheet, treasury stock is listed under shareholders' equity as a negative number. It is commonly called "treasury stock" or "equity reduction". That is, treasury stock is a contra account to shareholders' equity.

What type of activity is treasury stock

Answer and Explanation: The purchase of treasury stock is classified as a FINANCING activity in the statement of cash flows. The purchase of equity securities of other companies as an investment is presented as a cash outflow from investing activities.

Where does treasury stock go on the cash flow statement

Any purchase of treasury stock or subsequent reissuance would be recorded in the financing section of the cash flow statement as it is a form of equity financing (#3 in the visual below).

What is the difference between capital stock and treasury stock

Capital stocks are the shares outstanding for a company. They may be purchased, and with them, an investor gains voting rights and sometimes dividends. Treasury stock, or treasury shares, are shares a company owns. They do not carry voting power and do not pay out dividends.

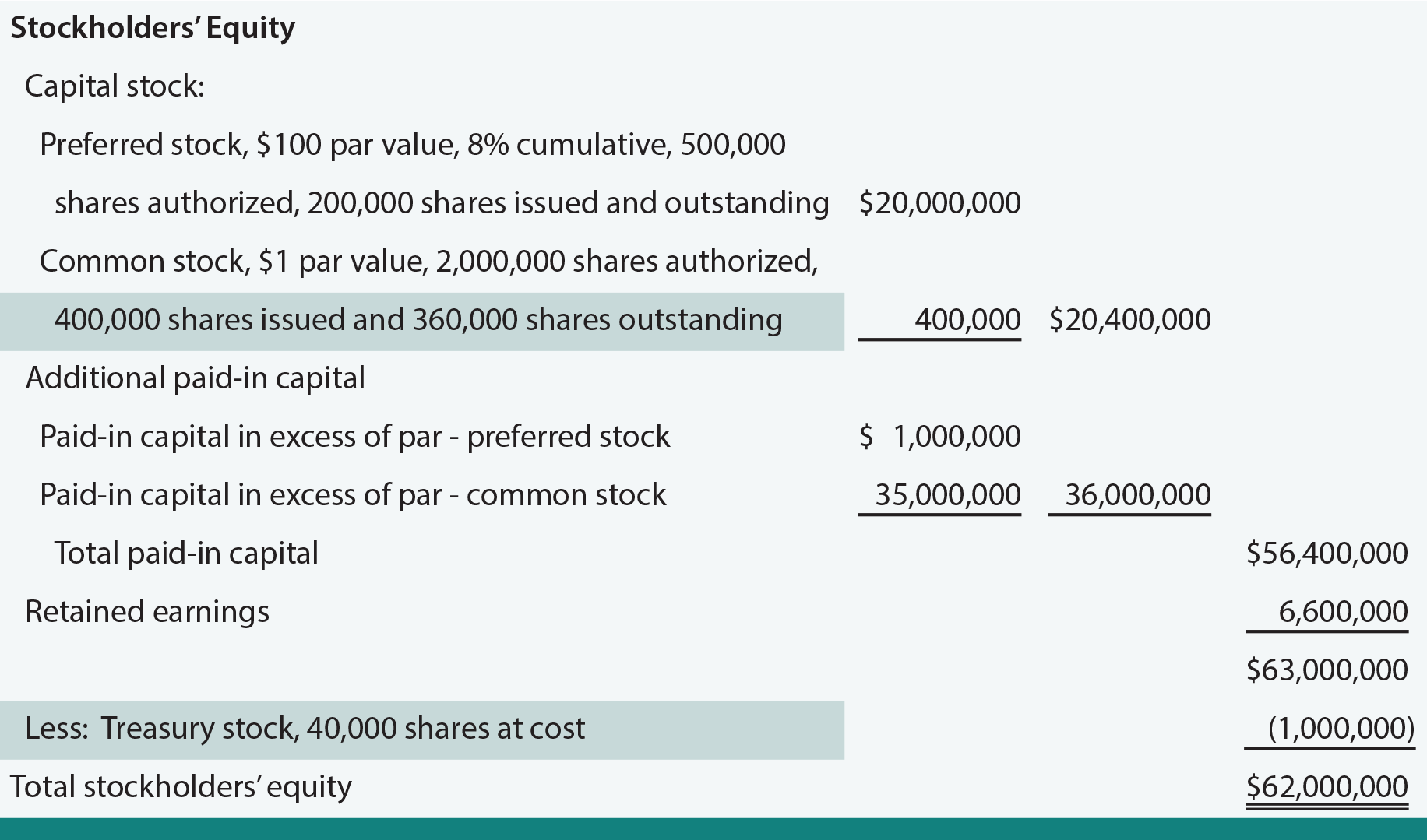

How should treasury stock be reported on the balance sheet

Under the cost method of recording treasury stock, the cost of treasury stock is reported at the end of the Stockholders' Equity section of the balance sheet. Treasury stock will be a deduction from the amounts in Stockholders' Equity.

How is treasury stock shown on the balance sheet quizlet

Normally, treasury stock is listed as the last account shown under the stockholders equity section of the balance sheet. The only item shown after the treasury stock account balance is the summary heading "Total Stockholders' Equity".

Where should treasury stock be reported in the financial statements of a corporation

Treasury stock should be reported in the financial statements of a corporation as a deduction from total paid-in capital and retained earnings.

What accounting entries are treasury stock

The cost method of accounting for treasury stock records the amount paid to repurchase stock as an increase (debit) to treasury stock and a decrease (credit) to cash. The treasury stock account is a contra account to the other stockholders' equity accounts and therefore, has a debit balance.

What is treasury stock in accounting examples

Example: The automobile company decides to buy back shares for $100 million. The company must record this in shareholder equity on its balance sheet. It will list $100 million as cash under credit and $100 million as treasury stock under debit.

Where should treasury stock be shown on the balance sheet

Treasury stock is a contra equity account recorded in the shareholders' equity section of the balance sheet.

Is treasury stock earned capital

Treasury Stock is not included in computing for Contributed Capital because Treasury Stocks are purchased using the company Retained Earnings while Contributed Capital are stocks by Shareholders at stock price. Contributed Capital can be computed by adding Preferred Stocks, Common Stocks and Additional Paid-In Capital.

What’s the difference between treasury stock and buy back

What is treasury stock Treasury stock — also called treasury shares — is stock that a company has bought back from public investors. When a company does a stock buyback, it puts the repurchased shares back under its own control and reduces the supply of shares available in the market.

Where does paid-in capital from treasury stock go on balance sheet

shareholders’ equity section

Paid-in capital is recorded on the company's balance sheet under the shareholders' equity section.

How does treasury stock affect the accounting equation

Treasury stock is a contra equity account, reports Accounting Tools, meaning that it acts as an offset to the common stock account. Thus, a $10 balance in treasury stock would offset $10 worth of common stock and, therefore, reduce stockholders' equity by $10.

Is treasury stock a quizlet asset account

Treasury stock is a contra-stockholders' equity account. Treasury stock is classified on the balance sheet as an asset.

How do you account for treasury stock transactions

In the balance sheet, treasury stock is reported as a contra account after retained earnings in the stockholders' equity section. This means the amount reported as treasury stock is subtracted from the other stockholders' equity amounts.

How do you put treasury stock on a balance sheet

Under the cost method of recording treasury stock, the cost of treasury stock is reported at the end of the Stockholders' Equity section of the balance sheet. Treasury stock will be a deduction from the amounts in Stockholders' Equity.

How do you record selling treasury stock

Cost Method Stock Resale

If the treasury stock is resold at a later date, offset the sale price against the treasury stock account, and credit any sales exceeding the repurchase cost to the additional paid-in capital account.