Is TurboTax refund advance based on credit?

Does TurboTax check credit for advance

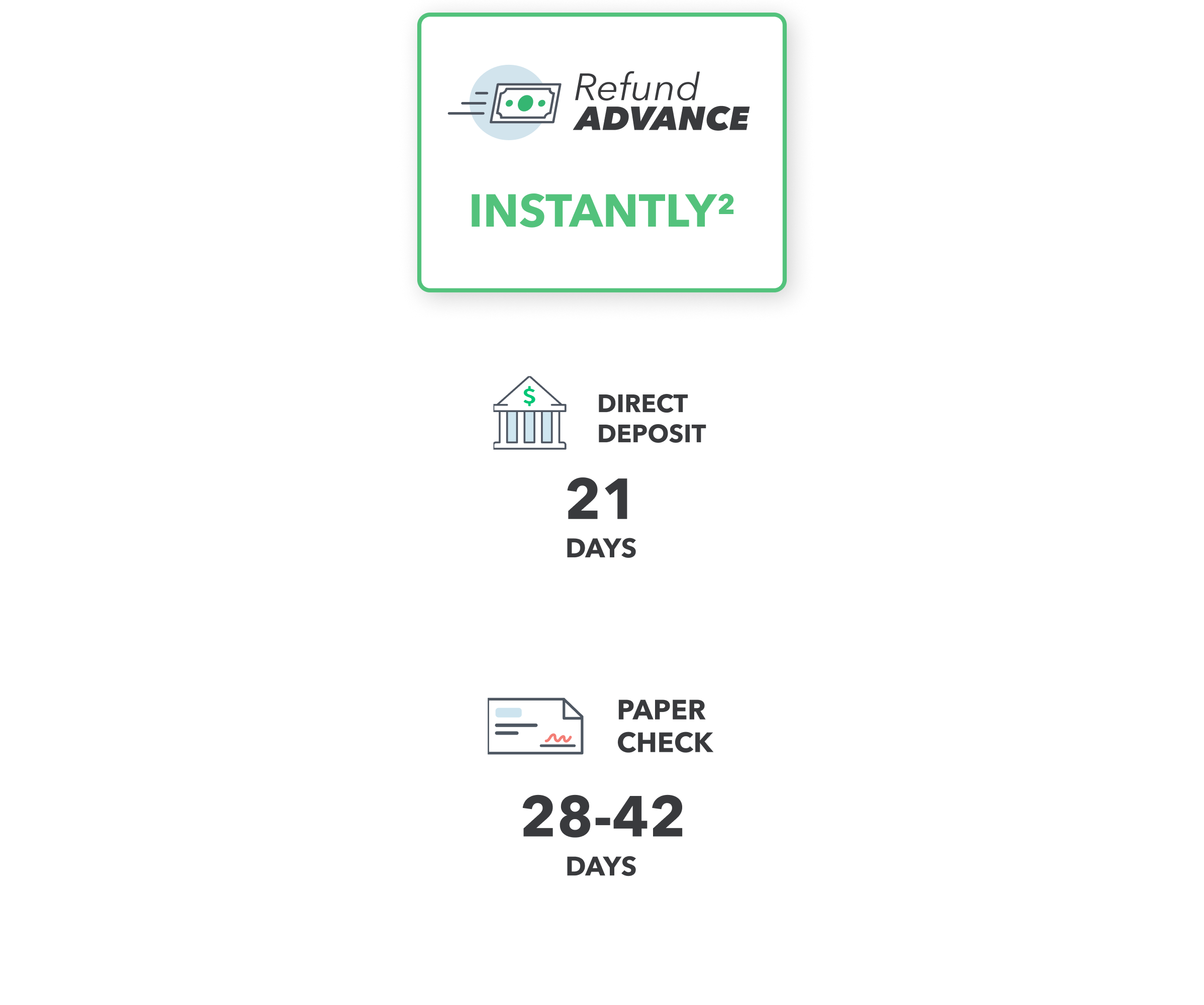

Both TurboTax and H&R Block are offering interest-free refund advances to their customers. There's no credit check and no extra fees — you really do get your money just minutes after you file.

Cached

Do you have to have good credit to get a tax refund advance

Pro: You Don't Need Great Credit to Qualify

But tax refund loans are backed by the refund that you'll get from the IRS. Because of that, you don't need good credit or any credit to qualify for the loan.

Cached

How does TurboTax refund Advance work

If approved, your Refund Advance will be deposited into your Credit Karma Money™ Spend (checking) account, typically within 15 minutes after the IRS accepts your e-filed federal return and you may access your funds online through a virtual card. Your physical Credit Karma Visa Debit Card* should arrive in 7 – 14 days.

Cached

Do they check credit for refund advance

No credit check: In most cases, you won't face a hard credit check or a dip in your credit scores. Borrow from yourself: Even though you go through a tax preparation service to get your money, you're simply borrowing money now from your future self—not a bank or online lender.

Cached

Why would you get denied for a refund advance

Your approval is based on the size of your federal refund and your tax information, along with other factors. You may not receive the Refund Advance if one of these factors doesn't meet the qualifying standards of the lender.

How do I get approved for TurboTax advance

To qualify for a tax refund advance from Intuit TurboTax, you must file your federal tax return through TurboTax by February 15, 2023. You also need to meet the following requirements: Federal refund of $500 or more. At least 18 years old.

Why do people get denied for a refund advance

You have bad credit.

That means that your tax refund must be large enough after you take out interest rates and fees, as well as any tax prep fees, to pay off the loan. All kinds of things could reduce the amount you actually receive, including tax law changes and offsets (more on those in a moment).

What disqualifies you from getting a tax advance

Qualifying for a Tax Advance

While you don't necessarily need good credit to get these types of loans, there are some things that might disqualify you. If there are reasons your tax refund might be offset—including owing child support, federal student loans, or back taxes—a lender is unlikely to advance the funds.

Who qualifies for TurboTax advance

To qualify for a tax refund advance from Intuit TurboTax, you must file your federal tax return through TurboTax by February 15, 2023. You also need to meet the following requirements: Federal refund of $500 or more. At least 18 years old.

Why did I get denied for refund advance

You will not be eligible for the loan if: (1) your physical residence is located outside of the United States, a US territory, a PO box or a prison address, (2) your physical residence is in one of the following states: IL, CT, NE, or NC, (3) you are less than 18 years old, (4) the tax return filed is on behalf of a …

Does everyone get approved for refund advance

Fact – While not everyone is approved, the Refund Advance loan program at H&R Block has high approval rates. To be approved, you must apply and meet certain eligibility requirements, (such as ID verification and a sufficient refund amount), as well as the lender's underwriting requirements.

What qualifies you for a refund advance

To be eligible for a tax refund loan, you must have your taxes prepared by the company offering the loan, and that might mean you'll pay a tax preparation fee. Tax preparers have a minimum refund amount requirement to qualify, which can vary by company, and you may get only a portion of your expected refund in advance.

How do you get approved for a tax advance

Tax refund advance loans require identity verification, a review of your tax return inputs and history. Once approved, you can typically access the loan amount quickly on a prepaid card, which could come with restrictions and fees of its own, or the funds will be deposited into your bank account.

Why would you be denied a refund advance

You have bad credit.

That means that your tax refund must be large enough after you take out interest rates and fees, as well as any tax prep fees, to pay off the loan. All kinds of things could reduce the amount you actually receive, including tax law changes and offsets (more on those in a moment).

Does everyone get approved for tax advance

Not everyone is eligible for an advance loan

They will need to verify your identity, evaluate the risk of offering you a loan, and assess other factors. Although some companies see if you're eligible for a loan before filing your taxes, some don't tell you if you qualify until after paying for tax preparation.

Why would I be denied for a tax refund advance

You have bad credit.

That means that your tax refund must be large enough after you take out interest rates and fees, as well as any tax prep fees, to pay off the loan. All kinds of things could reduce the amount you actually receive, including tax law changes and offsets (more on those in a moment).