Is Upstart a monthly payment?

How often is Upstart payment

You can schedule two automatic recurring payments per month. Automatic recurring payments will occur on the same day every month. If you choose to set up bi-monthly payments, you will need to do so at least 15 days before your next due date.

Cached

How does Upstart payment work

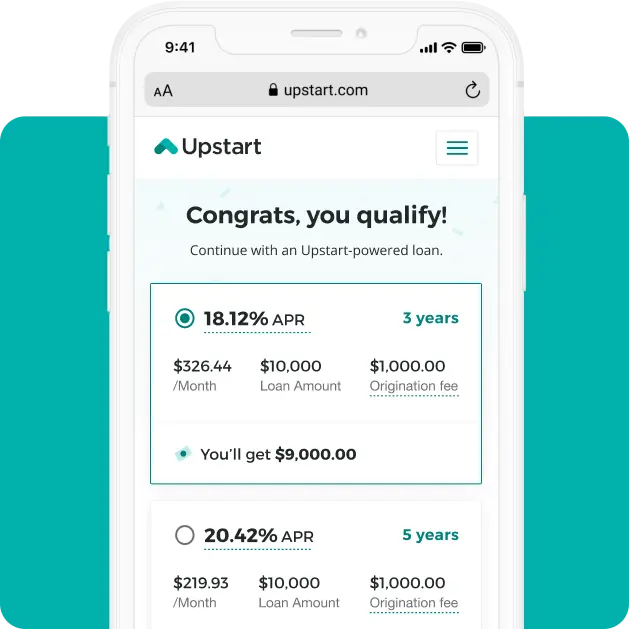

A portion of the monthly payment goes toward repaying the funds provided upfront, the remainder goes toward interest charged at the agreed upon APR and/or fees. – Through Upstart, your rates will vary based on a combination of factors including non-traditional factors such as education³, employment and credit history.

CachedSimilar

How much would a $5000 personal loan cost a month

What is the monthly payment on a $5,000 personal loan The monthly payment on a $5,000 loan ranges from $68 to $502, depending on the APR and how long the loan lasts. For example, if you take out a $5,000 loan for one year with an APR of 36%, your monthly payment will be $502.

How long is Upstart repayment

Your loan is a debt obligation that requires you to repay full principal and accrued interest in 36, 60, or 84 monthly installments (depending on the loan term you select). You may also prepay your loan at any time without penalty.

Cached

Can you only have 1 Upstart loan at a time

However, borrowers can take out a second Upstart loan and use it to pay off existing debt. You've made on-time payments for the six previous consecutive months. You have no past-due payments. You have no more than one outstanding Upstart loan.

Can you skip a payment on Upstart

If a borrower fails to pay the full monthly payment amount within 10 calendar days of its due date, Upstart charges a late fee equal to 5% of the past due amount or $15, whichever is greater.

How much monthly is a 50k loan

How much would a monthly payment be on a $50,000 personal loan If you take a $50,000 personal loan at a 6.99% interest rate and a 12-year repayment term your monthly payment should be around $462. If you take the full 12 years to repay the loan you should pay about $16,556 in interest.

What is the monthly payment on a 15k loan

Cost to repay a $15k loan

| Repayment term | Interest rate | Monthly payment |

|---|---|---|

| 2 years | 5% | $658 |

| 3 years | 6% | $456 |

| 4 years | 7% | $359 |

| 5 years | 8% | $304 |

How much is a $10,000 loan for 5 years

Example 1: A $10,000 loan with a 5-year term at 13% Annual Percentage Rate (APR) would be repayable in 60 monthly installments of $228 each.

How much is a 20 000 loan over 5 years

A $20,000 loan at 5% for 60 months (5 years) will cost you a total of $22,645.48, whereas the same loan at 3% will cost you $21,562.43. That's a savings of $1,083.05.

What happens when I pay off my Upstart loan

There are no penalties or fees associated with paying off your loan early. You are only responsible for the amount of interest accrued until the date of payoff. If your account has recurring payments on, any payoff amount on or after that date assumes the recurring payment scheduled will be successful.

Can you skip a month with Upstart

Your due date cannot be changed however, you can change your payment date at any time through your Upstart dashboard. As a reminder, your promissory note states a 10 day grace period and Upstart offers 5 additional days as a courtesy before assessing a late fee, for a total of a 15 day grace period.

Does Upstart accept everyone

Credit Score Requirements

Borrowers must have a minimum FICO or Vantage score of 600 to qualify for a personal loan. However, Upstart does consider non-conventional variables—like college education, job history and residence. Even applicants who don't have enough credit history to have a FICO score may be accepted.

How do I stop recurring payments on Upstart

If you'd prefer to turn off automatic recurring payments, click on "Manage recurring payments", then select "Turn off recurring payments". Make sure to save your changes. Please allow at least 2 business days for the change to take effect.

What is 6% interest on a $30000 loan

For example, the interest on a $30,000, 36-month loan at 6% is $2,856.

How much is a $50000 loan payment for 7 years

But if you take out a $50,000 loan for seven years with an APR of 4%, your monthly payment will be $683. Almost all personal loans offer payoff periods that fall between one and seven years, so those periods serve as the minimum and maximum in our calculations.

How much is a $20000 loan for 5 years

A $20,000 loan at 5% for 60 months (5 years) will cost you a total of $22,645.48, whereas the same loan at 3% will cost you $21,562.43. That's a savings of $1,083.05. That same wise shopper will look not only at the interest rate but also the length of the loan.

How much would a $50 000 loan cost per month

How much would a monthly payment be on a $50,000 personal loan If you take a $50,000 personal loan at a 6.99% interest rate and a 12-year repayment term your monthly payment should be around $462.

How much is a $200,000 loan at 4 for 30 years

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 — not including taxes or insurance. But these can vary greatly depending on your insurance policy, loan type, down payment size, and more.

Does Upstart have hidden fees

Fees. The origination fee for this loan is 0% to 8% of the loan you are approved for. One drawback of this loan is that this fee is automatically withheld from the loan before it is delivered to you. Upstart charges a late fee that is either 5% of the amount that is past due or $15, whichever is greater.