Is Venmo credit card available?

Is there such thing as a Venmo credit card

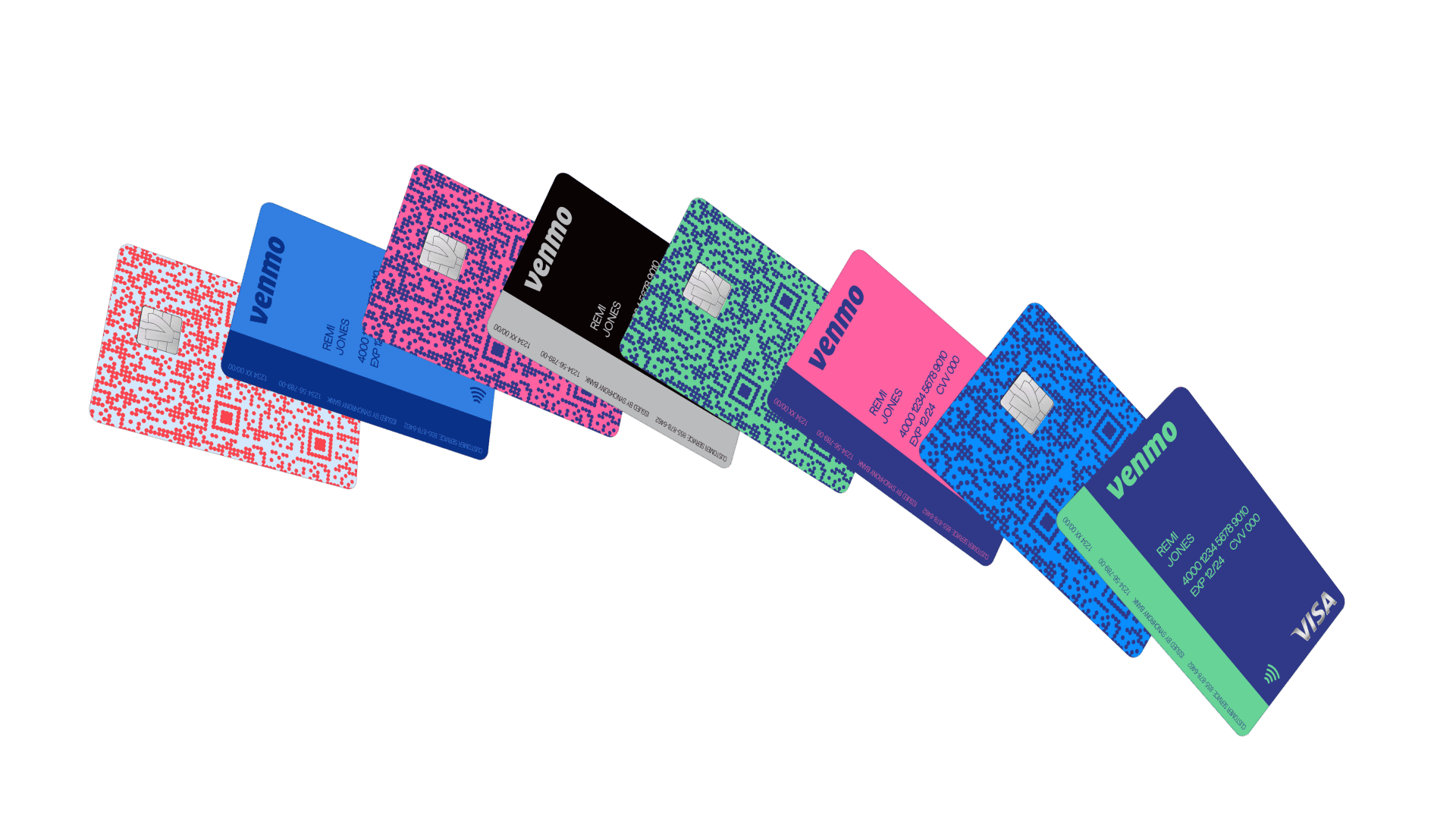

The Venmo Credit Card is a Visa® credit card issued by Synchrony Bank. You can split Venmo Credit Card transactions with friends on Venmo and use the money in your Venmo account to make payments towards your bill. The Venmo Credit Card and the Venmo Debit Card also have unique rewards programs specific to each card.

Cached

Is it hard to get a Venmo credit card

While Venmo's audience skews younger, the Venmo Credit Card requires good to excellent credit to qualify (corresponding to a FICO score of at least 690).

Cached

What is the starting limit for Venmo credit card

The starting credit limit for the Venmo Credit Card is $250 or more; everyone who gets approved for this card is guaranteed this limit. However, depending on your credit standing, you could get a much higher credit limit.

Why can’t I use my Venmo credit card

Typically, the reason for this error is that your bank or card issuer declined the payment. Because Venmo cannot override this transaction failure, you must reach out to your bank or card issuer to resolve this issue. You could also try a different card or payment method if you think the card itself was the issue.

Can I withdraw cash from my Venmo credit card

You can get a Venmo Credit Card cash advance at an ATM. To do so, insert the card in the ATM, then enter your PIN and choose the cash advance option. After that, input the amount, and collect the cash and your card.

How much does Venmo charge for credit card

a 3%

As noted, a simple Venmo transaction from a user's bank account, Venmo debit card, or Venmo cash balance is free of charge. If a credit card is used to pay, Venmo charges the sender a 3% fee.

How do I get a credit card on Venmo

So you're going to start by opening the venmo app on your phone. And it's going to bring you to this home page to add a new credit or debit card to your account you're going to click on your profile.

Does applying for a Venmo credit card hurt your credit

Yes, the Venmo card will affect your credit score just like any other credit card. So you'll want to make sure you're always making your payments on time and keeping your credit utilization low to help keep your credit score as high as possible.

Does Venmo increase your credit limit

You can request a credit line increase for your Venmo Credit Card by contacting Synchrony Bank at 855-878-6462. Some cardholders also have the ability to request a credit line increase in the Venmo Credit Card section of the Venmo app.

Can I use Venmo credit card anywhere

In addition to the card being automatically added as a payment method in your Venmo app, you can also use your Venmo Credit Card everywhere Visa® credit cards are accepted.

Can I transfer money from my Venmo credit card to my bank account

You can Instant Transfer money from your Venmo account to any U.S. bank account or participating credit card account for a fee of 1.75%.

Can I transfer money from Venmo credit card to my bank account

You can Instant Transfer money from your Venmo account to any U.S. bank account or participating credit card account for a fee of 1.75%.

Can you use Venmo credit card anywhere

In addition to the card being automatically added as a payment method in your Venmo app, you can also use your Venmo Credit Card everywhere Visa® credit cards are accepted.

Who pays the Venmo credit card fee

Credit Card Processing Fees

You won't pay a fee if you send money to other people using your Venmo balance or funds from your bank account or debit card. However, you will pay a fee if you send a payment that's funded by your credit card. The fee is 3% of the total transaction.

How do I pay my Venmo credit card

The easiest way to pay your Venmo Credit Card bill is to make the payment from your Venmo app. Navigate to the Venmo Credit Card section of the Venmo app and click “View and Pay”. From there, you can pay your bill using the money in your Venmo account or with a verified bank account on file.

What credit score does Venmo use

What credit score do you need for the Venmo Credit Card You likely need a good or excellent credit score to qualify for the Venmo Credit Card. A good FICO score starts off around 670, and an excellent FICO score is greater than 800.

What is maxed out on Venmo

If you have not yet completed identity verification, you can send up to $999.99 to your bank per week (depending on security checks at Venmo) If you've confirmed your identity, you can transfer up to $19,999.99 to your bank per week. There's a $5,000 per transfer limit.

What is the max Venmo limit

Venmo limits for personal accounts include a $4,999.99 weekly limit on sending and receiving money. There is also a $999.99 transaction limit, which means you cannot send or receive more than $999.99 in a single transaction.

How do I get cash from my Venmo credit card

You can get a Venmo Credit Card cash advance at an ATM. To do so, insert the card in the ATM, then enter your PIN and choose the cash advance option. After that, input the amount, and collect the cash and your card.

Can I send myself money from my Venmo credit card

You cannot Venmo yourself, and Venmo will block any attempts to do so. You can sign up for the Venmo debit card and deposit funds into your Venmo balance from your bank account.