Is WACC and cost of capital the same?

What is difference between cost of capital and WACC

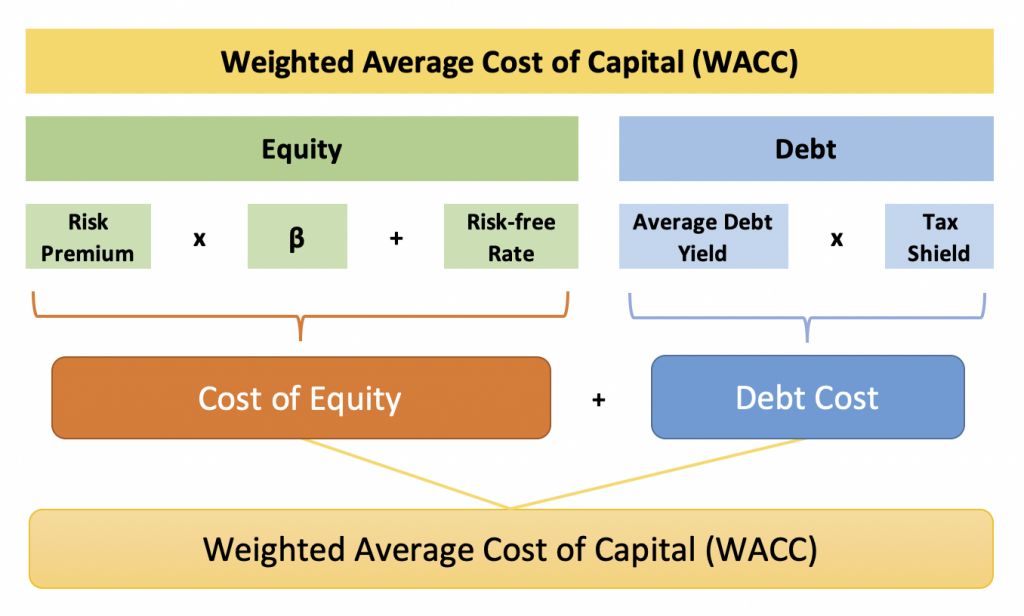

What is the difference between Cost of Capital and WACC Cost of capital is the total of cost of debt and cost of equity, whereas WACC is the weighted average of these costs derived as a proportion of debt and equity held in the firm.

Cached

Is WACC the cost of capital

What Is Weighted Average Cost of Capital (WACC) Weighted average cost of capital (WACC) represents a firm's average after-tax cost of capital from all sources, including common stock, preferred stock, bonds, and other forms of debt. WACC is the average rate that a company expects to pay to finance its assets.

Cached

Why use WACC instead of cost of equity

thanks in advance. WACC is a weighted average of cost of equity and after-tax cost of debt. Since after-tax cost of debt is lower than cost of equity, WACC is lower than cost of equity.

Is marginal cost of capital the same as WACC

What is the Marginal Cost of Capital The Marginal Cost of Capital (MCC), which is sometimes called the Opportunity Cost of Capital (OCC) or Weighted Average Cost of Capital (WACC), tells us how much we are paying for our financing. This will help us determine the required return for our investment projects.

How do you calculate cost of capital

Calculation of Cost of Capital (Step by Step)

The weight of the debt component is computed by dividing the outstanding debt by the total capital invested in the business, i.e., the sum of outstanding debt, preferred stock, and common equity.

What is the cost of capital

The cost of capital is a measure of both expected return, which takes us from the present to the future, and the discount rate, which takes us from the future to the present.

Can WACC be equal to cost of equity

If the firm is fully equity financed, WACC would be equal to cost of equity as there is no other source of funding.

What is the cost of capital also known as

Cost of capital encompasses the cost of both equity and debt, weighted according to the company's preferred or existing capital structure. This is known as the weighted average cost of capital (WACC).

How do you calculate the cost of capital

The cost of capital is based on the weighted average of the cost of debt and the cost of equity. In this formula: E = the market value of the firm's equity. D = the market value of the firm's debt.

What is cost of capital vs cost of

Key Takeaways. The cost of capital refers to what a corporation has to pay so that it can raise new money. The cost of equity refers to the financial returns investors who invest in the company expect to see.

How do you calculate cost of equity capital using WACC

WACC Formula = (E/V * Ke) + (D/V) * Kd * (1 – Tax rate)E = Market Value of Equity.V = Total market value of equity & debt.Ke = Cost of Equity.D = Market Value of Debt.Kd = Cost of Debt.Tax Rate = Corporate Tax Rate.

What are the two types of cost of capital

The cost of capital of a firm can be analyzed as explicit cost and implicit cost of capital. The explicit cost of capital of a particular source may be defined in terms of the interest or dividend that the firm has to pay to the suppliers of funds.

What is cost of capital equal to

Cost of capital is the minimum rate of return or profit a company must earn before generating value. It's calculated by a business's accounting department to determine financial risk and whether an investment is justified.

How can I calculate cost of capital

One common method is adding your company's total interest expense for each debt for the year, then dividing it by the total amount of debt.

What are the other names of cost of capital

The cost of capital and discount rate are somewhat similar and the terms are often used interchangeably.

What is the difference between cost of capital and CAPM

The difference between weighted average cost of capital (WACC) and the capital asset pricing model (CAPM) is that WACC is used to calculate the blended average of all a firm's capital sources, whereas, CAPM is used to calculate the cost of a firm's equity (ownership).

What is the difference between cost of capital and capital cost

Cost of Capital: An Overview. A company's cost of capital refers to the cost that it must pay in order to raise new capital funds, while its cost of equity measures the returns demanded by investors who are part of the company's ownership structure.

How do you calculate WACC

WACC Formula = (E/V * Ke) + (D/V) * Kd * (1 – Tax rate)E = Market Value of Equity.V = Total market value of equity & debt.Ke = Cost of Equity.D = Market Value of Debt.Kd = Cost of Debt.Tax Rate = Corporate Tax Rate.

What is WACC formula simplified

Unlike measuring the costs of capital, the WACC takes the weighted average for each source of capital for which a company is liable. You can calculate WACC by applying the formula: WACC = [(E/V) x Re] + [(D/V) x Rd x (1 – Tc)], where: E = equity market value.