Is WACC the same as cost of debt?

What is the difference between WACC and cost of debt

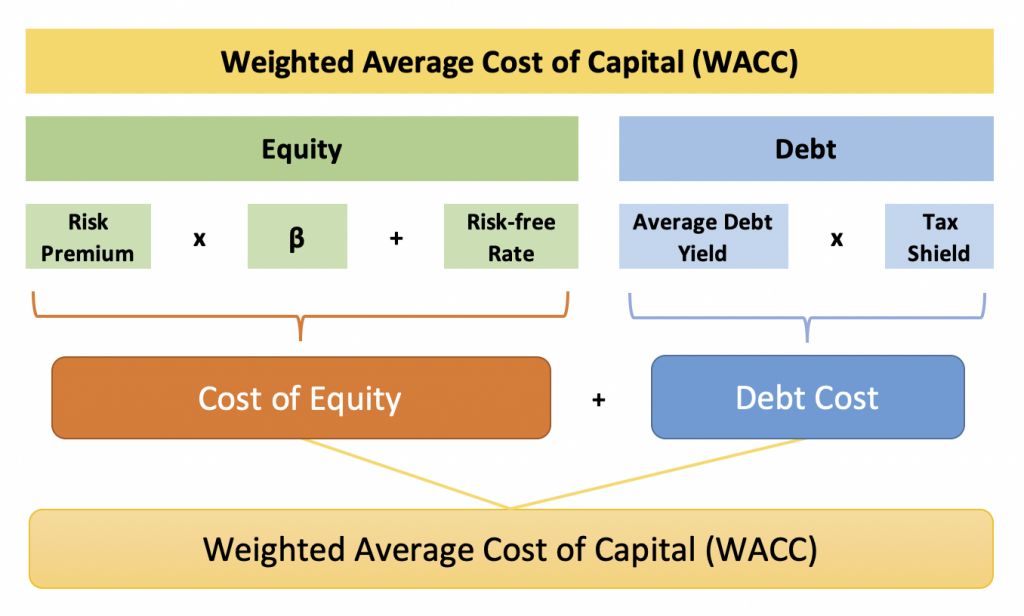

Cost of capital is the total of cost of debt and cost of equity, whereas WACC is the weighted average of these costs derived as a proportion of debt and equity held in the firm.

Cached

How do you calculate cost of debt from WACC

Take the weighted average current yield to maturity of all outstanding debt then multiply it one minus the tax rate and you have the after-tax cost of debt to be used in the WACC formula.

Cached

What is another name for WACC

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. The WACC is commonly referred to as the firm's cost of capital.

CachedSimilar

Is WACC lower than cost of debt

The main sources of capital are debt and equity. Debt is usually cheaper than equity, so the WACC will be lower if a company has a higher proportion of debt in its capital structure. The WACC is the minimum return that a company must earn on its investment projects to satisfy its owners and creditors.

Cached

How do you calculate cost of debt

To calculate the cost of debt, first add up all debt, including loans, credit cards, etc. Next, use the interest rate to calculate the annual interest expense per item and add them up. Finally, divide total interest expense by total debt to get the cost of debt or effective interest rate.

What is the formula for cost of debt

Total interest / total debt = cost of debt

To find your total interest, multiply each loan by its interest rate, then add those numbers together. To calculate your total debt, add up all your loans. Then, divide total interest by total debt to get your cost of debt.

How to calculate the cost of debt

Total interest / total debt = cost of debt

To find your total interest, multiply each loan by its interest rate, then add those numbers together. To calculate your total debt, add up all your loans. Then, divide total interest by total debt to get your cost of debt.

Where can I find cost of debt

All you need to do to measure your total debt cost is simply add all your loans, credit card balances, and so on. Once you have calculated the interest rate expense for each year, add them all up. Finally, divide the total debt by the total interest to arrive at the cost of debt.

What is cost of debt

What Is the Cost of Debt The cost of debt is the effective interest rate that a company pays on its debts, such as bonds and loans. The cost of debt can refer to the before-tax cost of debt, which is the company's cost of debt before taking taxes into account, or the after-tax cost of debt.

What is the relationship between debt and WACC

If the financial risk to shareholders increases, they will require a greater return to compensate them for this increased risk, thus the cost of equity will increase and this will lead to an increase in the WACC. more debt also increases the WACC as: gearing. financial risk.

What is the cost of debt

The debt cost is the effective rate of interest a firm pays on its debts. It's the cost of debt, including bonds and loans. The debt expense also refers to the pre-tax debt expense, which is the debt cost to the company before taking into account the taxes.

Is CAPM used to calculate the cost of debt

CAPM is used to determine the estimated cost of the shareholder equity. The cost of equity calculated from the CAPM can be added to the cost of debt to calculate the WACC.

How do you calculate cost of debt and cost of equity for WACC

WACC Formula = (E/V * Ke) + (D/V) * Kd * (1 – Tax rate)E = Market Value of Equity.V = Total market value of equity & debt.Ke = Cost of Equity.D = Market Value of Debt.Kd = Cost of Debt.Tax Rate = Corporate Tax Rate.

What is also considered as a cost of debt

The debt cost is the effective rate of interest a firm pays on its debts. It's the cost of debt, including bonds and loans. The debt expense also refers to the pre-tax debt expense, which is the debt cost to the company before taking into account the taxes.

Which cost is also considered as a cost of debt

While debt allows a company to leverage a small amount of money into a much greater sum, lenders typically require interest payments in return. This interest rate is the cost of debt capital.

How do I calculate cost of debt

Total interest / total debt = cost of debt

To find your total interest, multiply each loan by its interest rate, then add those numbers together. To calculate your total debt, add up all your loans. Then, divide total interest by total debt to get your cost of debt.

Is cost of capital equal to cost of debt

The cost of capital includes both the cost of equity and the cost of debt.

How does cost of debt affect WACC

If shareholders and debt-holders become concerned about the possibility of bankruptcy risk, they will need to be compensated for this additional risk. Therefore, the cost of equity and the cost of debt will increase, WACC will increase and the share price reduces.

How to calculate WACC with cost of debt and cost of equity

WACC is calculated by multiplying the cost of each capital source (debt and equity) by its relevant weight by market value, then adding the products together to determine the total.

How do you find the cost of debt

Total interest / total debt = cost of debt

To find your total interest, multiply each loan by its interest rate, then add those numbers together. To calculate your total debt, add up all your loans. Then, divide total interest by total debt to get your cost of debt.