Is Wotc an income tax credit?

What is WOTC tax credit

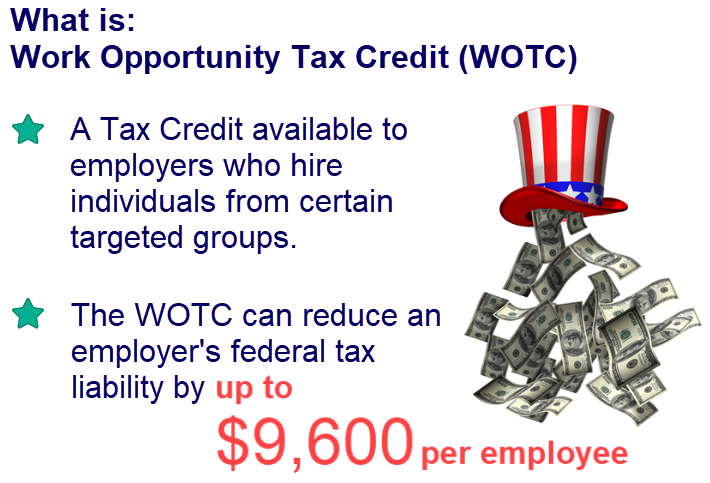

What is the Work Opportunity Tax Credit (WOTC) The WOTC promotes the hiring of individuals who qualify as members of target groups, by providing a federal tax credit incentive of up to $9,600 for employers who hire them. The Protecting Americans from Tax Hikes Act of 2015 (Pub. L.

Cached

Is WOTC a refundable credit

WOTC is non-refundable, meaning the business must have a tax liability against which to use the credit. Unused credit can be carried back one year and carried forward for 20 years.

Cached

Is WOTC a general business credit

The Work Opportunity Tax Credit, or WOTC, is a general business credit provided under section 51 of the Internal Revenue Code (Code) that is jointly administered by the Internal Revenue Service (IRS) and the Department of Labor (DOL).

Cached

Do employees benefit from WOTC

Although the tax credit only applies to employers, the WOTC program may benefit employees by making career opportunities available to those who otherwise might have had a hard time landing a job. Such individuals include ex-felons, veterans and food stamp recipients.

Cached

What is the downside of WOTC

One of the main problems with the WOTC, its critics say, is that it doesn't address the many forces that create barriers for marginalized workers. DeMond Bush is exactly the kind of person the WOTC was designed to help. He survived abuse as a child, became homeless at 14 and started selling drugs as a teenager.

Should I complete the WOTC

New hires may be asked to complete the WOTC questionnaire as part of their onboarding paperwork, or even as part of the employment application in some cases. It is voluntary on the new hire's perspective, an employer cannot require you to complete the forms.

Which tax credit is refundable

the Earned Income Tax Credit

One refundable tax credit for moderate- and low-income taxpayers is the Earned Income Tax Credit. The IRS estimates four out of five workers claim the EITC, which means millions of taxpayers are putting EITC dollars to work for them.

What qualifies as a general business credit

Your general business credit for the year consists of your carryforward of business credits from prior years plus the total of your current year business credits. In addition, your general business credit for the current year may be increased later by the carryback of business credits from later years.

What is the work opportunity credit

About the WOTC

The WOTC has two purposes: To promote the hiring of individuals who qualify as a member of a target group. To provide a federal tax credit of up to $9,600 to employers who hire these individuals.

Does WOTC reduce wages

Work Opportunity Tax Credit wages are reduced by any supplementation payments made to the employer for an employee under Social Security Act §482(e). Additional limitations may apply when calculating the credit.

What are the benefits of the WOTC

The WOTC is a business tax incentive that allows companies to receive tax credits for hiring individuals who are part of targeted groups that have consistently faced significant barriers to employment.

Why do companies ask work opportunity tax credit

This tax credit may give the employer the incentive to hire you for the job. These are the target groups of job seekers who can qualify an employer for the WOTC: Qualified recipients of Temporary Assistance to Needy Families (TANF).

Which is not a refundable tax credit

Child Tax Credit and Child and Dependent Care Tax Credit

The Child Tax Credit is nonrefundable and reduces the taxpayer's tax liability.

What are examples of nonrefundable tax credits

Examples of nonrefundable tax credits include:Adoption Tax Credit.Electric Vehicle Tax Credit.Foreign Tax Credit.Mortgage Interest Tax Credit.Residential Energy Property Credit.Credit for the Elderly or the Disabled.Credit for Other Dependents.The Saver's Credit.

What are examples of a business credit

Examples of business credit include everything from bank loans to credit cards, with availability based on your credit history and score. Business credit is separate to personal credit, though some lenders will review your personal credit as part of a new business credit application.

Is there a tax credit for starting your own business

How Much Start-up Costs Can You Deduct For the first year of its operations, the IRS permits a start-up tax deduction of $5,000 for start-up costs and an additional $5,000 for organizational costs.

How much is the opportunity credit

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

What does WOTC do for employees

The Work Opportunity Tax Credit (WOTC) can help you get a job. If you are in one of the “target groups” listed below, an employer who hires you could receive a federal tax credit of up to $9,600. This tax credit may give the employer the incentive to hire you for the job.

What is a non refundable tax credit and tax withholding

Non-refundable tax credits are a type of credit that gets applied to certain tax deductions. The credit can only reduce a taxpayer's total liability to zero. Basically, a non-refundable tax credit cannot get refunded to the taxpayer or create an overpayment. Any amount that exceeds the taxpayer's income tax is lost.

What is an example of a tax credit

A tax credit is a dollar-for-dollar reduction of your income. For example, if your total tax on your return is $1,000 but are eligible for a $1,000 tax credit, your net liability drops to zero.