Should I get my kid a credit card or debit card?

Should I get my child a debit card or credit card

Money management skills.

It's worth noting that credit cards can offer many of the same benefits above—but most children are too young to open credit accounts of their own, and a debit card is a much better way to learn about swiping, tapping, making purchases online and managing account balances.

Cached

Are debit cards for kids a good idea

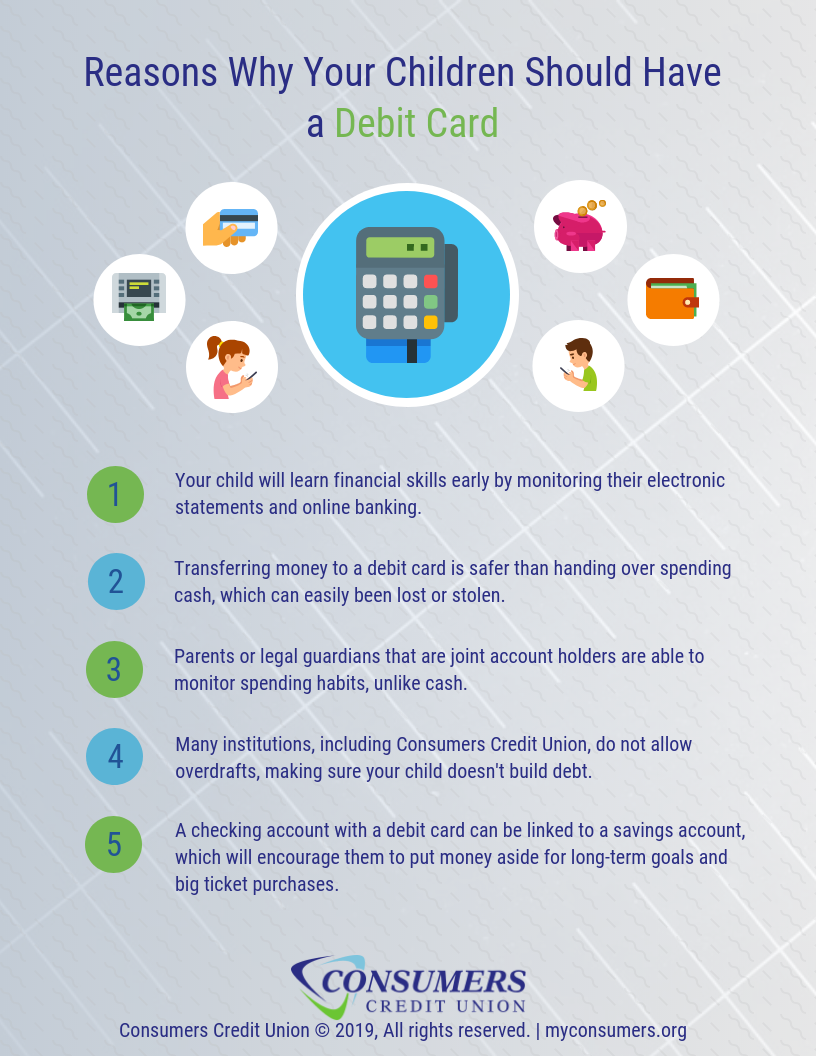

Giving kids a debit card can be an excellent way to help them learn the basics of money management. Research shows that teaching kids about money at an early age can help them grow into financially savvy adults—and fare better in their romantic relationships as well.

Is it smart to open a credit card for your child

Benefits of giving your child a credit card

While not all credit issuers report authorized user activity to the credit bureaus, there's a good chance adding your child as an authorized user on your credit card could help them build a valuable credit history they'll need later in life.

Cached

Is it good for kids to have a credit card

Having access to a credit card can help a minor develop healthy spending habits and begin to build a credit history. Adding your teen as an authorized user on one of your accounts can help them start building credit. You can explain why good credit is important with real-life examples.

What age do most kids get a debit card

13 years old

A child can typically get a teen debit card at 13 years old when a parent or legal guardian opens a teen checking joint account on their behalf. Teen checking accounts are typically available until the child turns 18.

What age should a kid get a debit card

You can get a debit card from the age of 13 at most US banks when a parent or guardian opens a joint checking account on the child's behalf. These typically come with a contactless debit card or a cash card they can use to make ATM withdrawals.

What are 5 disadvantages of debit cards

Cons of debit cardsThey have limited fraud protection.Your spending limit depends on your checking account balance.They may cause overdraft fees.They don't build your credit score.

Does adding your kid to your credit card build their score

Yes, adding children as authorized users can help their credit scores. It's up to the primary cardholder to maintain a healthy credit score so the authorized users can reap the benefits.

Does adding child to credit card build their credit

Build credit history.

Adding your child as an authorized user can help establish their credit history. Once they're added to the account (or once they turn 18, depending on the card issuer), the account's entire history will be added to their credit reports.

Is it normal for a 13 year old to have a credit card

No, you cannot get a credit card at 13 years old. By law, no one is allowed to open a credit card account on their own until they're at least 18 years old, and they will need to provide proof of an independent income until they turn 21.

Is it OK for a 12 year old to have a debit card

Teens must share a joint account with a parent or guardian, since many banks require students to be 18 before getting an account on their own (although some banks, like Citizens, will open a standalone account for a 17-year-old; learn more here).

Is it OK for a 13 year old to have a debit card

What age can you get a debit card A child can typically get a teen debit card at 13 years old when a parent or legal guardian opens a teen checking joint account on their behalf. Teen checking accounts are typically available until the child turns 18.

Should I give my 12 year old a debit card

Giving kids a debit card is ultimately a personal decision. Much may come down to your judgment and the child's maturity level. "If I were to pick an average age, I find that around 12 years old is a good time to begin practicing with a debit card, with access to small amounts of money," Henske said.

Why is debit card not recommended

You don't build credit with a debit card

A debit card draws money directly from your checking account when you make a purchase, which means that the transaction ends there. Nothing is reported to the credit bureaus and nothing shows up on your credit report, good or bad.

Are credit card more harmful than debit card

Is a Credit Card Safer Than a Debit Card Credit cards usually offer greater consumer protections on purchases related to fraud than debit cards. These fraud protections may not extend as generously or easily to debit card purchases.

At what age should I add my son to my credit card

Minimum age for credit card authorized users

| Credit card issuer/bank | Minimum age to add authorized user |

|---|---|

| Chase | None |

| Citi | None |

| Discover | 15 |

| US Bank | 16 |

How can I build my child’s credit score

8 tips for parents to help their children build good credit earlyStart early.Teach the difference between a debit card and a credit card.Incentivize saving.Help them save early for a secured credit card.Co-sign a loan or a lease.Add your child as an authorized user.Have them report all possible forms of credit.

What is the best way to add kids to credit card

How to Add Your Child as an Authorized User. Adding an authorized user is usually a straightforward process. Contact your bank or card issuer by calling them at the phone number written on the back of your credit card to begin. Some issuers allow cardholders to add authorized users through an online dashboard.

Should I add my 14 year old to my credit card

Making your child an authorized user on your credit card can help them learn to responsibly use money and build up their credit. By setting up an authorized user relationship, your child has the opportunity to start building a positive credit history even if they are still too young to open a credit card of their own.

What is the best age to get a credit card

And a good place to start is by opening a credit card at 18, so you can start building credit at an early age and developing good money habits. Below, we review why it's important to get a credit card at 18 and what you can do to protect your credit score as a new cardholder.