Should I keep money in Robinhood?

Is it safe to keep money in Robinhood

Your securities and cash are protected by SIPC

Robinhood Financial LLC and Robinhood Securities, LLC are both members of SIPC, which protects securities for customers of its members up to $500,000 (including $250,000 for claims for cash).

Cached

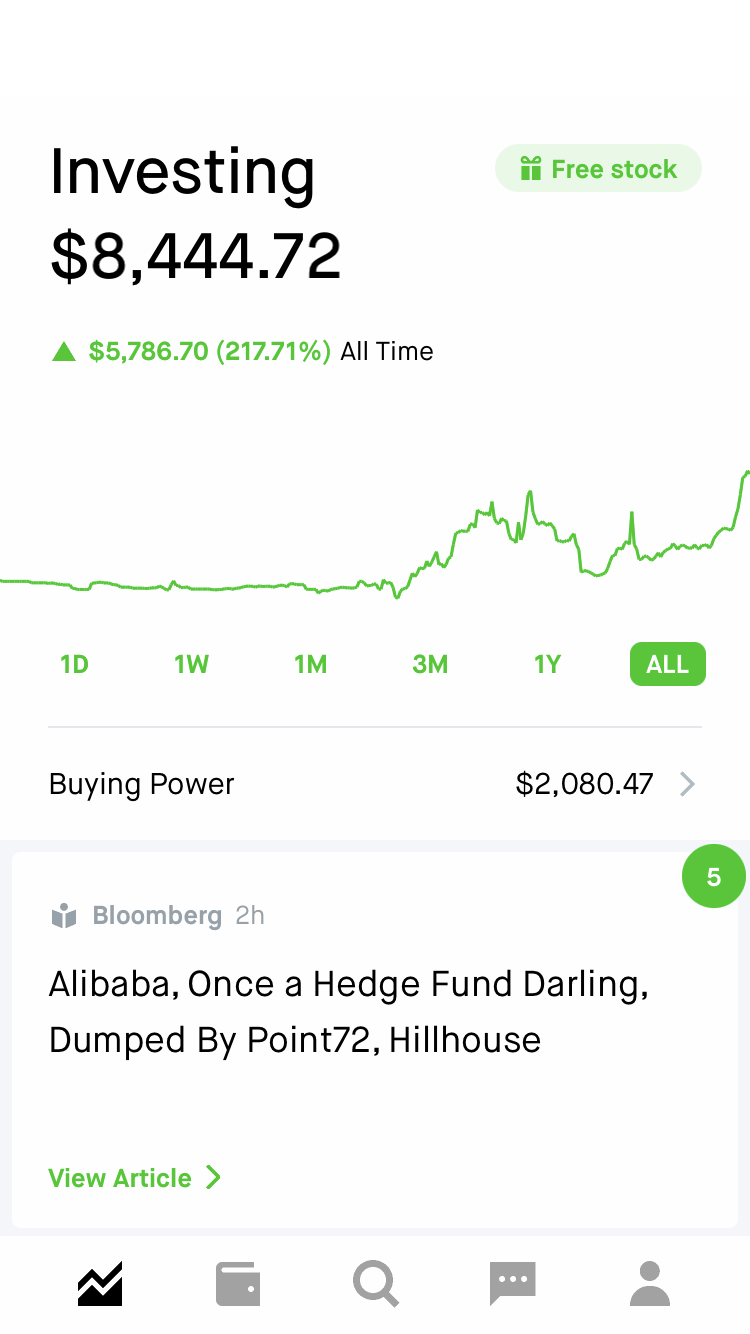

What is the average account balance on Robinhood

Robinhood Yearly Average Account Size

| Robinhood Average Account Size 2023 | $2,371 |

|---|---|

| Robinhood Average Account Size 2023 | $2,771 |

| Robinhood Average Account Size 2023 | $5,038 |

| Robinhood Average Account Size 2023 | $4,317 |

| Robinhood Average Account Size 2023 | $2,695 |

Should I hold or sell Robinhood

Robinhood Markets has received a consensus rating of Hold. The company's average rating score is 2.00, and is based on 3 buy ratings, 5 hold ratings, and 3 sell ratings.

What happens if you cash out on Robinhood

An instant bank withdrawal, also known as a real-time payment (RTP), allows you to transfer money to your linked bank account in 10 minutes (or longer depending on your bank). There's a 1.5% fee for instant withdrawals and you'll see this amount before you complete the transfer.

Do I actually own stock on Robinhood

Do you actually own the stock on Robinhood Investors do own the shares of stocks and ETFs purchased on the Robinhood platform. This is the same type of stock ownership you get when you purchase stocks through most other brokerage companies.

Is my money safe if Robinhood shuts down

Since Robinhood is a member of SIPC, you are covered for up to $500,000 worth of securities, including $250,000 which can cover cash. So, if Robinhood somehow went out of business and lost customer assets, the SIPC would step in. Your assets would be safe regardless of what happens to the brokerage.

How much is Robinhood monthly fee

Investing with a Robinhood brokerage account is commission free. We don't charge you fees to open your account, to maintain your account, or to transfer funds to your account.

What’s the lowest you can invest Robinhood

On Robinhood, investors can buy fractional shares of stocks and exchange-traded funds (ETFs) with as little as $1. Stocks worth over $1.00 per share, and which have a market capitalization of more than $25 million, are eligible for fractional shares on Robinhood.

Will Robinhood stock ever recover

Summary. Shares of Robinhood, down 35% over the past year, are poised to rally as the market recovers. A broad recovery in crypto, as well as rising interest in options, will help Robinhood's transactional revenues get back on track. In addition, higher interest rates are helping Robinhood's spread.

What is the future of Robinhood stocks

Stock Price Forecast

The 13 analysts offering 12-month price forecasts for Robinhood Markets Inc have a median target of 10.00, with a high estimate of 25.00 and a low estimate of 8.00. The median estimate represents a +13.77% increase from the last price of 8.79.

Why can’t i take my money out of Robinhood

You may not be able to withdraw money while your account is restricted. Robinhood sometimes restricts users' accounts. That can happen if the user has a negative balance, had a bank account transaction reversed, if the user is suspected of fraud, or for a few other reasons.

Can I take my money out of Robinhood anytime

The average time for this stage of the process is two trading days. Therefore, the funds from a Robinhood transaction are available for you to withdraw on the third day following a trade. Robinhood allows you to make up to five withdrawals to a bank account per day, so long as they total $50,000 or less.

Does Robinhood take your profit

Investing with a Robinhood brokerage account is commission free. We don't charge you fees to open your account, to maintain your account, or to transfer funds to your account. However, self-regulatory organizations, such as the Financial Industry Regulatory Authority (FINRA) charge us a small fee for sell orders.

Do people actually make money on Robinhood

Robinhood makes money from various sources, but the company itself is not profitable. You can make money with Robinhood by earning a free stock, receiving dividends, asset appreciation, crypto investing, options trading, investing in Robinhood itself, IPO access, and savings through their cash management account.

Do I lose my money if Robinhood fails

Assets and cash in your account are covered by the SIPC for up to $500,000. This means that an investor would not lose money in the case of platform failure, up to the limits of this coverage. Any funds in accounts in excess of these coverage limits could be lost if Robinhood shuts …

Is Robinhood good for long term investing

Robinhood (HOOD) is a popular financial services company with more than 12.2 million monthly active users (MAU) as of September 2023. 1 It's considered a safe option for investors' securities and cash for various reasons: Robinhood is a member of the Securities Investor Protection Corp. (SIPC).

Is Robinhood a good idea

Bottom line: Robinhood Investing is one of the best investment apps and the best investment apps for beginners for active traders, options traders, and margin traders who want to purchase and trade investments with no commission.

What is the downside to Robinhood

Cons Explained

Limited research and educational content: Research and educational material at Robinhood don't measure up to competitor standards, making it difficult for traders to get the most out of the platform. There are no stock or ETF screeners available at all, and other research tools are rudimentary at best.

What happens if you invest $1 in Bitcoin

No matter the amount you invest, the money will increase/ decrease as Bitcoin's Price increase / decrease in percentage. While $1 per day might sound like nothing, it's important to remember that this is not a get-rich-quick type of investment scheme but rather a longer-term play.

Will I lose my money if Robinhood shuts down

Since Robinhood is a member of SIPC, you are covered for up to $500,000 worth of securities, including $250,000 which can cover cash. So, if Robinhood somehow went out of business and lost customer assets, the SIPC would step in. Your assets would be safe regardless of what happens to the brokerage.