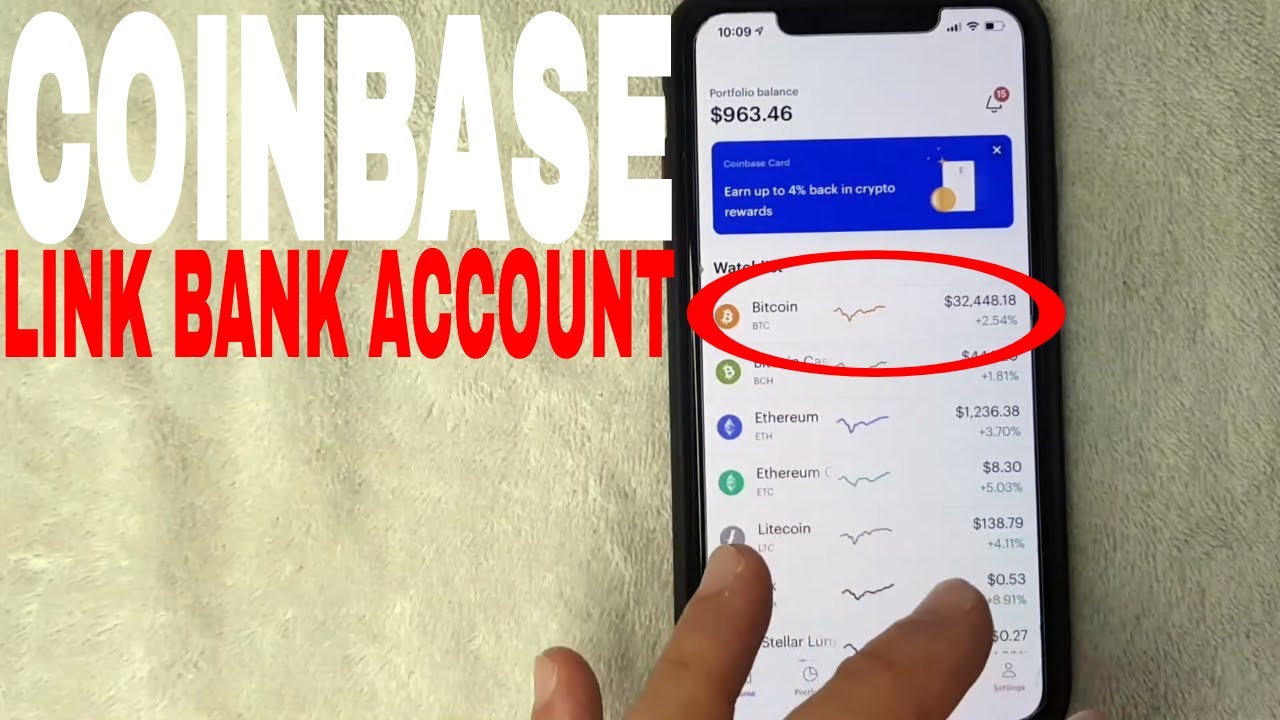

Should I link bank account to Coinbase?

Is it better to link bank account or debit card to Coinbase

If you already have a credit card linked, your bank may charge additional fees for credit card purchases on Coinbase. We encourage affected customers to switch to a debit card or linked bank account instead.

Does Coinbase take money from your bank account

You may see the funds immediately debited from your bank account when you initiate the transfer, but they will not be transferred to your balance until your payment has finished moving between the banks and clears in our bank account.

Is it safe to link bank accounts

The short answer is yes, it's safe to link bank accounts. Linking bank accounts is as safe as any other banking activity. The level of security provided depends on your bank or credit union.

Is it safe to put money into Coinbase

FDIC pass-through insurance protects funds held on behalf of a Coinbase customer against the risk of loss should any FDIC-insured bank(s) where we maintain custodial accounts fail.

Why can’t i cash out of Coinbase

If you are unable to sell or withdraw from Coinbase, it could be due to one of a few reasons: There are restrictions in your region. You are a new account holder. You haven't completed the verification.

Why can’t i cash out on Coinbase

You can still buy, sell, and trade within Coinbase. However, you'll need to wait until any existing Coinbase account holds or restrictions have expired before you can cash out with your bank account. Withdrawal-based limit holds typically expire at 4 pm PST on the date listed.

Why won t Coinbase let me cash out

You can still buy, sell, and trade within Coinbase. However, you'll need to wait until any existing Coinbase account holds or restrictions have expired before you can cash out with your bank account. Withdrawal-based limit holds typically expire at 4 pm PST on the date listed.

Is it safe to have more than $250000 in a bank account

Some examples of FDIC ownership categories, include single accounts, certain retirement accounts, employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts. Q: Can I have more than $250,000 of deposit insurance coverage at one FDIC-insured bank A: Yes.

What is the benefit of linking bank accounts

Benefits. You may be able to use a linked account as overdraft protection and avoid incurring an overdraft fee. Some banks waive the monthly maintenance fee when you link another account. It's easier to make transfers between the accounts, and you won't have to pay for a wire transfer fee.

How much does Coinbase charge to cash out

There is a 1% fee to convert and withdraw your crypto to cash in addition to standard network fees. A network fee is necessary in order to have your transaction processed by the decentralized cryptocurrency network.

Is there a monthly fee for Coinbase

about $30

Coinbase has also rolled out a newer option, called Coinbase One, which offers no-fee trades and other benefits in exchange for a monthly fee of about $30. Learn to earn.

How do I completely cash out of Coinbase

From a web browser:Click My Assets.Click the asset you'd like to cash out.From the Cash out tab, enter the amount you want to cash out and click Continue.Choose your cash out destination and click Continue.Click Cash out now to complete your transfer.

Can I withdraw all my money from Coinbase

There are no maximum withdrawal limits on Coinbase Commerce—you can withdraw all funds at any point.

Does Coinbase report to IRS

Currently, Coinbase may issue 1099 forms to both you (the account owner) and the IRS if you meet certain qualifying factors. These forms detail your taxable income from cryptocurrency transactions.

When you cash out on Coinbase Where does the money go

Once the action is complete, your cash will be available in your cash balance (US dollar balance, for example).

Can I deposit 20k in my bank account

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Is it safe to have a million dollars in one bank

FDIC insurance covers a maximum of $250,000 per depositor, per institution. That means if the bank fails, and can no longer return customer deposits, the FDIC will make up any loss to the depositors. It also means that to be fully covered, the $1 million would have to be evenly split between four different banks.

Does linking bank accounts affect credit score

If one of you has a poor credit history, it's not usually a good idea to open a joint account. As soon as you open an account together, you'll be 'co-scored' and your credit ratings will become linked. This doesn't happen by just living with someone – even if you're married. You'll lose some privacy.

Why would you ask your bank to link your accounts

Banks sometimes offer incentives to encourage you to link your accounts, such as the waiving of certain fees or offering special services to customers. Linking your checking and savings accounts may—depending upon your bank—also offer you some overdraft protection.

How much does Coinbase charge for $100

Coinbase charges a flat 1% transaction fee on all cryptocurrency transactions.