Should I pay before the statement closing date?

How long before statement closing date should I pay

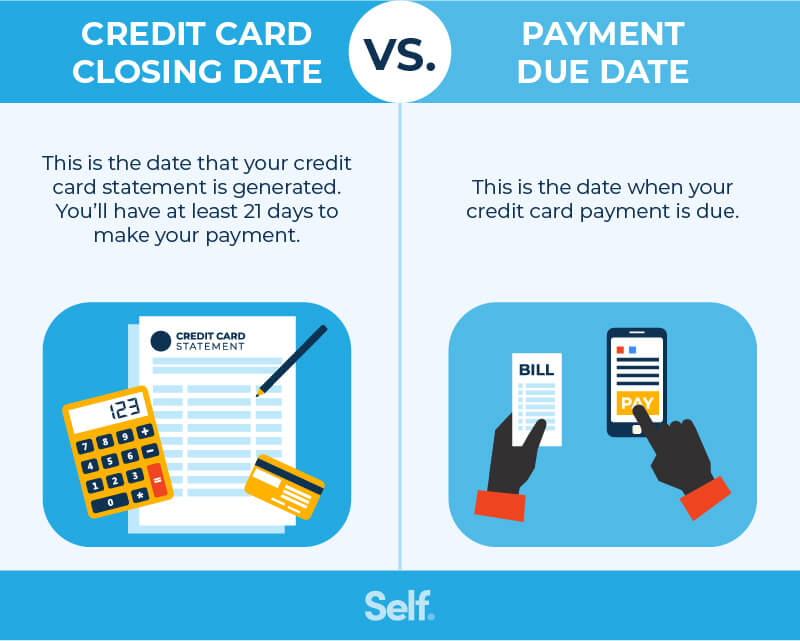

Your credit card payment is not due on the statement closing date. Instead, there is a delay of 21 to 30 days between the closing date and the payment due date. If you pay your credit card balance in full this month, a grace period may go into effect to help you avoid being charged interest during that time.

Cached

What happens if I make a purchase on my statement closing date

As an example, let's say your closing date is May 20, and you made a $2,000 purchase on your credit card on May 15. That purchase will be reported and can increase your credit utilization ratio. A high credit utilization ratio can adversely affect your credit score.

Should you pay on statement date for credit

You should always pay your credit card bill by the due date, but there are some situations where it's better to pay sooner. For instance, if you make a large purchase or find yourself carrying a balance from the previous month, you may want to consider paying your bill early.

Is it okay to pay statement balance before due date

Paying early also cuts interest

Not only does that help ensure that you're spending within your means, but it also saves you on interest. If you always pay your full statement balance by the due date, you will maintain a credit card grace period and you will never be charged interest.

Cached

Is it better to pay credit card early or on due date

Paying your credit card early reduces the interest you're charged. If you don't pay a credit card in full, the next month you're charged interest each day, based on your daily balance. That means if you pay part (or all) of your bill early, you'll have a smaller average daily balance and lower interest payments.

Should I pay my credit card before statement

Paying off your balance early or making additional payments before the billing cycle ends decreases your credit utilization — or the ratio of your total credit to your total debt. Credit utilization makes up 30% of your credit score, and it helps to keep this number low.

Can I make purchases before closing date credit card

Making a Large Purchase on Your Credit Card

Yes, you can use your credit card before your closing date, but do your best to keep your purchases small and pay off your balance swiftly.

When should I pay my credit card bill to increase credit score

The best time to pay a credit card bill is a few days before the due date, which is listed on the monthly statement. Paying at least the minimum amount required by the due date keeps the account in good standing and is the key to building a good or excellent credit score.

Should I pay credit before or after statement

Pay off all your credit cards a few days before each statement closes if you're applying for a loan soon. Paying off your cards early will decrease your overall utilization and boost your credit score for a few days.

Should you pay your credit card before you get your statement

If you can afford to pay your balance in full every month, doing so before your monthly statement closing date has the benefit of ensuring that no outstanding card balance is reported to the credit bureaus—which can boost your credit scores.

Is it OK to pay credit card before statement

Paying your credit card balance before your billing cycle ends can have a positive impact on your finances. It'll prevent you from missing a payment, help you avoid expensive interest charges, increase your credit limit and improve your credit score faster.

What happens if I pay my credit card bill early

Paying your credit card early reduces the interest you're charged. If you don't pay a credit card in full, the next month you're charged interest each day, based on your daily balance. That means if you pay part (or all) of your bill early, you'll have a smaller average daily balance and lower interest payments.

Is it better to pay before statement or after

Strengthens your on-time payment history

Credit card issuers report your card activity to the three major credit bureaus: Experian, Equifax and TransUnion. If you pay off your credit card balance before your statement ends or before the due date, that sends a positive signal to credit reporting agencies.

What happens if you pay your credit card statement early

Increases your available credit

So, if you make payments to your card before your due date, you'll have a lower balance due (and higher available credit) at the close of your cycle. That means less credit card debt gets reported to the credit bureaus, which could help your credit score.

What happens if I don t pay my credit card before the closing date

Depending on your issuer and your account terms, the lender may apply a penalty annual percentage rate (APR) to your account if it's been 60 days without a payment. In general, card issuers report late payments every 30 days. Late payments are only one of several factors that impact credit scores.

Is it bad to pay credit card too early

No. It's not bad to pay your credit card early, and there are many benefits to doing so. Unlike some types of loans and mortgages that come with prepayment penalties, credit cards welcome your money any time you want to send it.

Does it hurt credit to pay credit card early

If you are looking to increase your score as soon as possible, making an early payment could help. If you paid off the entire balance of your credit card, you would reduce your ratio to 40%. According to the Consumer Financial Protection Bureau, it's recommended to keep your debt-to-credit ratio at no more than 30%.

Should I pay statement balance or pay in full

Pay your statement balance in full to avoid interest charges

But in order to avoid interest charges, you'll need to pay your statement balance in full. If you pay less than the statement balance, your account will still be in good standing, but you will incur interest charges.

Can I pay my credit card the same day I use it

Yes, if you pay your credit card early, you can use it again. You can use a credit card whenever there's enough credit available to complete a purchase.

Is there a disadvantage to paying credit card early

Is it good or bad to pay your credit card bill early It's not a bad idea to pay your credit card bill early. Making a payment a few days, or even a couple weeks, before your due date can ensure you aren't late. The only bad time to make a card payment is after the due date.