Should I pay off closed credit card accounts?

Is it good to pay off a closed credit card

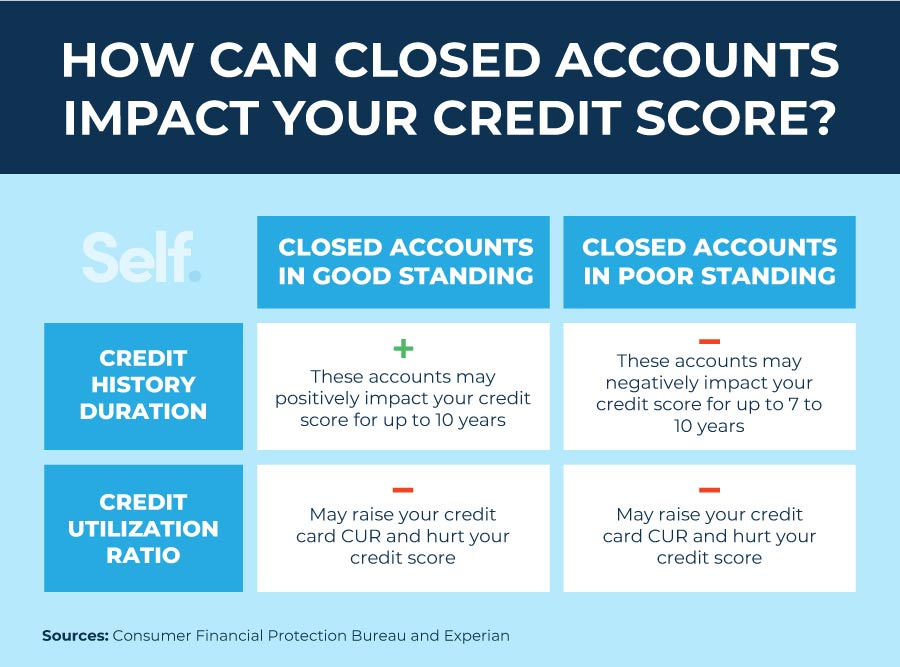

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time.

Cached

Is it better to pay off a closed credit card or an open one

There are good reasons to keep your credit card open, even if you recently paid it off: Lower credit utilization: Keeping your credit card account open can preserve your credit utilization rate, which is how much of your available credit you're using.

Will paying off closed credit cards increase my score

If the account defaulted, it could be transferred to a collection agency. Paying off closed accounts like these should improve your credit score, but you might not see an increase right away.

Will paying a closed accounts increase credit score

Even after an account is closed, a solid history of paying on time can help your credit score. The positive effect will not be the same as an open account, but it can still bolster your credit score, according to the credit bureau Experian.

How do I get closed accounts off my credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

How many points will my credit score drop if I close a credit card

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.

What happens if I pay off a closed account

If the account defaulted, it could be transferred to a collection agency. Paying off closed accounts like these should improve your credit score, but you might not see an increase right away.

Should I continue to pay on a closed account

It's important that you keep making at least the minimum payment on time each month, even after the account is closed, to protect your credit score. Late payments will hurt your credit score just as if the credit card was still open.

Will my credit go up if I pay off a closed account

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

How bad is a closed account on credit report

Remember, the presence of this type of account on your credit report is a positive. As TransUnion and Experian note, a closed account that shows a positive history of payments is likely to help your credit score. Generally, a closed account with negative history can continue to hurt your credit score for seven years.

Why did my credit score drop 40 points after paying off credit card

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

Is it bad to have a lot of credit cards with zero balance

It is not bad to have a lot of credit cards with zero balance because positive information will appear on your credit reports each month since all of the accounts are current. Having credit cards with zero balance also results in a low credit utilization ratio, which is good for your credit score, too.

Does paying off a closed account increase credit score

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

Does paying off closed accounts improve credit

Even after an account is closed, a solid history of paying on time can help your credit score. The positive effect will not be the same as an open account, but it can still bolster your credit score, according to the credit bureau Experian.

Does paying off closed accounts increase credit score

Even after an account is closed, a solid history of paying on time can help your credit score. The positive effect will not be the same as an open account, but it can still bolster your credit score, according to the credit bureau Experian.

Do I still owe if the account is closed

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

How much does credit score drop with closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

How many points does your credit drop for a closed account

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.

Do I still owe money on a closed account

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.