Should I pay on closed accounts?

Should I still pay off a closed account

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Cached

What happens if you owe money on a closed account

Often, when an account is written off or charged off, the creditor will sell the debt to a collection agency and the balance on the original account will be updated to zero. If so, you no longer owe the balance to the original creditor. Instead, the collection agency becomes the legal owner of the debt.

Cached

Should you pay off open or closed accounts first

For this reason, leaving your credit card accounts open after you pay them off is usually better for credit scores as their credit limit will continue to factor into your utilization ratio.

Will paying a closed account hurt my credit

If the account defaulted, it could be transferred to a collection agency. Paying off closed accounts like these should improve your credit score, but you might not see an increase right away.

Do closed accounts look bad on your credit

Closed accounts that were never late can remain on your credit report for up to 10 years from the date they were closed. If the accounts you mentioned are showing as potentially negative, it's likely due to delinquencies noted in the history of the account.

Can closed accounts hurt your credit

As TransUnion and Experian note, a closed account that shows a positive history of payments is likely to help your credit score. Generally, a closed account with negative history can continue to hurt your credit score for seven years.

Should I pay off credit card that is closed

The bottom line

While you technically can close a credit card with a balance, that doesn't mean you should. Ideally, you'll keep your card open while you pay off your debt (to avoid an impact on your credit score) and to have access to this line of credit for emergencies.

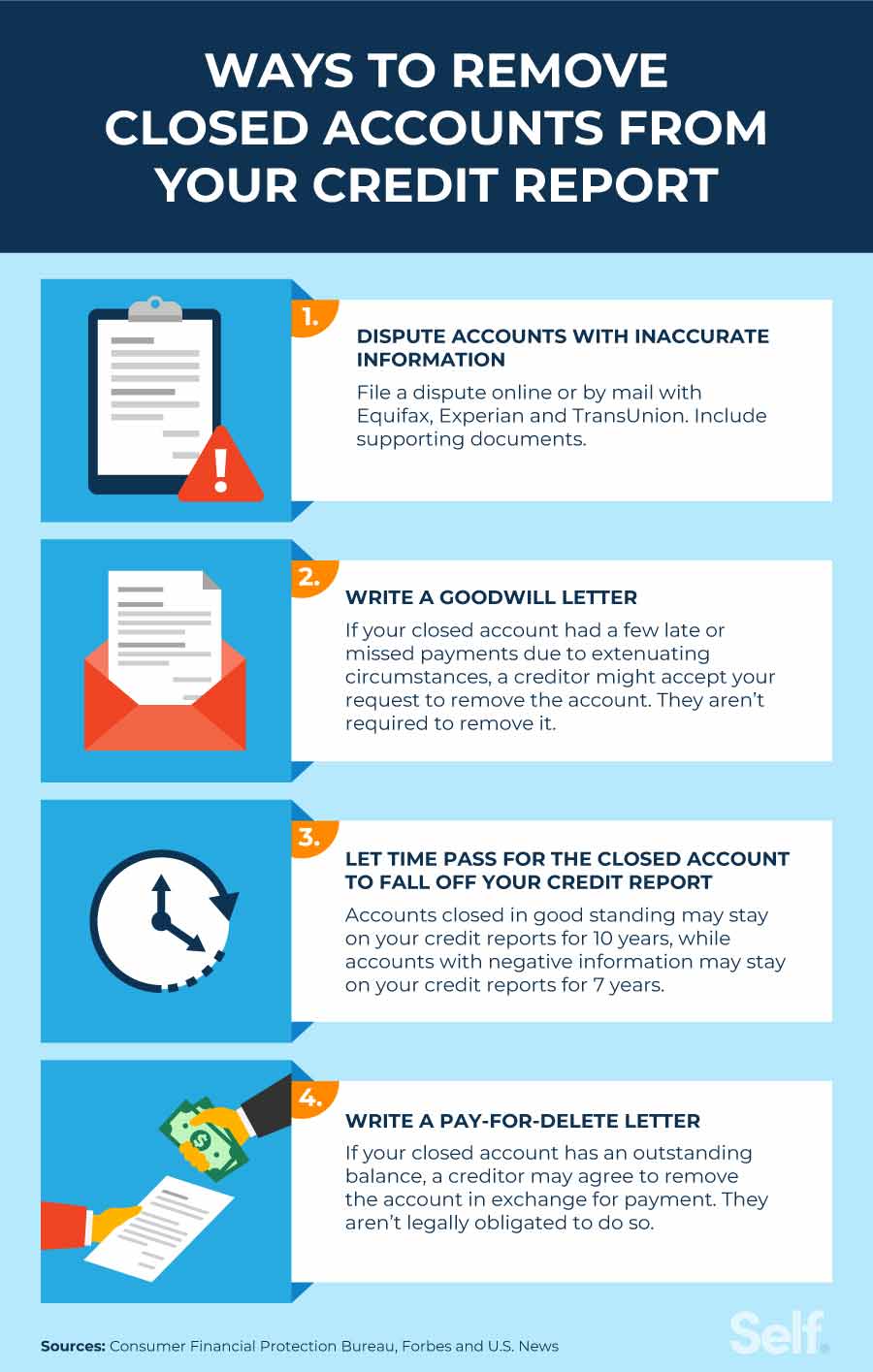

How do I get closed accounts off my credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Should I still pay off a closed credit card

What happens to your balance after you close a credit card When you close a credit card that has a balance, that balance doesn't just go away — you still have to pay it off. Keep in mind that interest will keep accruing, so it's a good idea to pay more than the minimum each billing period.

How do I pay off a closed credit card

How do I pay a closed credit card account You can still make payments on a closed credit card account, you just cannot make purchases with it. To pay off a balance, continue making payments the same way you did before it was closed. You can usually do this online or, if you get a paper bill, via check.

How much does credit score drop with closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Do you have to pay on a closed credit card

What happens to your balance after you close a credit card When you close a credit card that has a balance, that balance doesn't just go away — you still have to pay it off. Keep in mind that interest will keep accruing, so it's a good idea to pay more than the minimum each billing period.

What happens if you pay a credit card that is closed

You Are Still Liable For The Balance

You have the option to pay at least the minimum due or to send more. This process will continue until the debt is paid off. The primary cardholder is still liable for any remaining balance of a closed credit account.

Will your credit score go up if you pay off a closed credit card

Paying off your credit card balance every month may not improve your credit score alone, but it's one factor that can help you improve your score. There are several factors that companies use to calculate your credit score, including comparing how much credit you're using to how much credit you have available.

Should I remove old closed accounts from credit report

You only need to consider removing a closed account if it has an adverse payment history. Otherwise, an account that is in good standing is OK to leave. It shows future lenders you can pay off a loan and make payments on time.

How bad is a closed account on credit report

Remember, the presence of this type of account on your credit report is a positive. As TransUnion and Experian note, a closed account that shows a positive history of payments is likely to help your credit score. Generally, a closed account with negative history can continue to hurt your credit score for seven years.

What happens if I stop paying a closed credit card

The primary cardholder is still liable for any remaining balance of a closed credit account. However, if you were seriously delinquent on the account and the credit card issuer sold the balance to a third-party collection agency, you now owe the third-party debt collector.

Should I still pay a closed credit card

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor.

Will paying a closed accounts increase credit score

Even after an account is closed, a solid history of paying on time can help your credit score. The positive effect will not be the same as an open account, but it can still bolster your credit score, according to the credit bureau Experian.

Do I have to pay back a closed credit account

If your account was closed because it remains unpaid by a certain number of days, it's known as a charge-off. Keep in mind that regardless of the reason your account was closed, if you owe money on your card, you still need to pay back the debt.