Should I use YNAB or mint?

What is the difference between Mint and YNAB

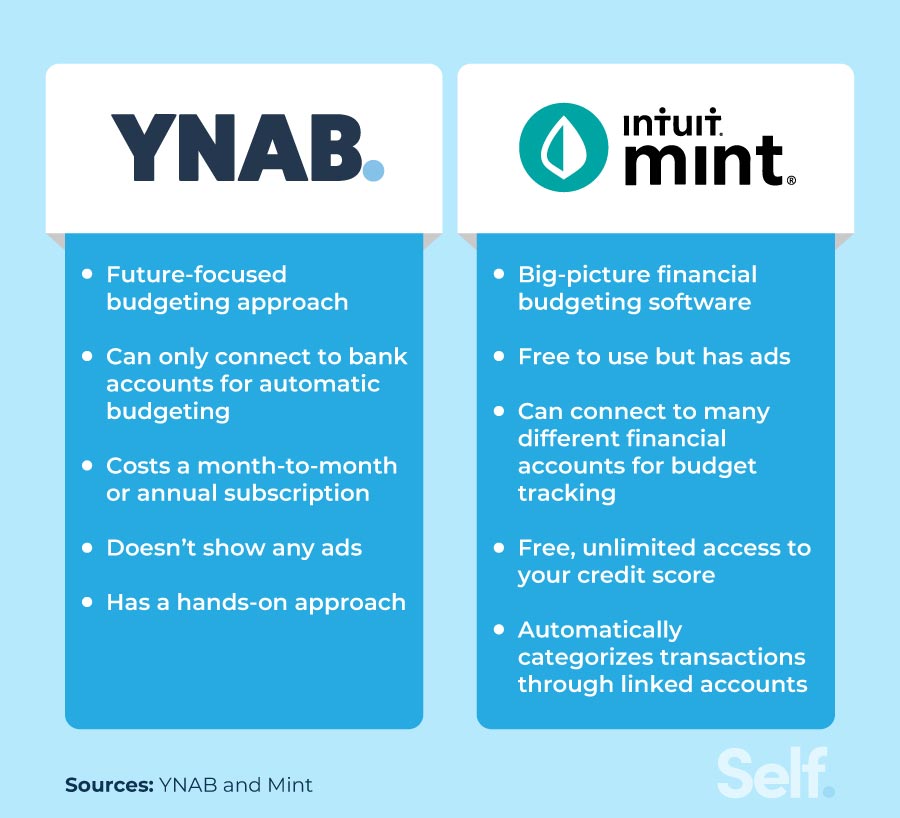

YNAB aims to change how you think about your money and how proactively you create spending plans. To bring you along, it provides many helpful videos and articles. YNAB also allows you to create spending plans for as many months into the future as you'd like, whereas Mint only allows you to set a single budget.

Cached

Is YNAB still worth it

YNAB is 100% legit. The budgeting app not only can change the way you spend money but it can also change the way you view money, with YNAB's age-old rule, “every dollar has a job.” If you know you need to cut back on your expenses, then YNAB is the app you need to try out now.

Cached

What are the downsides of using Mint

Mint is a free app, but it makes money by displaying targeted ads for credit cards and other financial products. Unfortunately, there's no option to remove the ads from the web version. You can only pay for an ad-free experience on the Mint mobile apps.

Cached

Is there a better app than Mint

Best Alternatives to Mint Budget TrackerPersonal Capital (Empower)–Best Overall Alternative to Mint.com.Tiller Money–Best for those who love spreadsheets.Monarch Money–Best for Couples.CountAbout–Best for converting data from Mint.Simplifi–Best budgeting app for smartphones.

Cached

What are the pros and cons of YNAB

Pros and Cons of YNAB

| Pros of YNAB | Cons of YNAB |

|---|---|

| Syncs with over 12,000 banks | No bill tracking or bill pay features |

| Syncs with multiple devices | No bill tracking or bill pay features |

| Easily track spending | Lack of reporting |

| Free for 34 days | Doesn't do a good job of showing your overall financial health |

Can I trust Mint budgeting

Mint is safe to use, and its bank-grade security does an excellent job of protecting your personal and financial information. The app cannot access what you type when connected to your financial accounts.

Why mint is better than YNAB

Mint Offers More Services Than YNAB

As you might expect from a service that's run by a billion-dollar company, Mint offers more services and features than YNAB does. For example, you can monitor your credit score for free with your Mint account—something you can't do with a YNAB account.

Is YNAB good for couples

YNAB Together allows you to share your subscription (and budgets of your choosing) with a loved one, which makes it ideal for managing a household budget, even if you don't share a joint bank account. Share your YNAB subscription—and your budget, if you'd like—with your partner.

What is the best budget app not linked to bank account

Goodbudget, for hands-on envelope budgeting

This app doesn't connect your bank accounts. You manually add account balances (that you can pull from your bank's website), as well as cash amounts, debts and income. Then you assign money toward envelopes. You can access the app from your phone and the web.

What is the best app to keep track of spending

Best expense tracker appsBest overall free app: Mint.Best app for beginners: Goodbudget.Best app for serious budgeters: You Need a Budget (YNAB)Best app for small business owners: QuickBooks® Online.Best app for business expenses: Expensify.

What is a good age of money in YNAB

And 30 days is an excellent age of money. It means you're a month ahead (a.k.a., living on last month's income), and it's an enviable position to be in.

Is it safe to link your bank account to Mint

Is Mint a safe app Yes. Intuit, Mint's parent company, employs the latest security and technology measures to keep its customers' personal and financial information safe. Security measures include software and hardware encryption and multifactor authentication.

Does Mint affect credit score

Here are a few facts about accessing your credit score through Mint: Checking your score does not affect your credit rating. Checking your score in Mint is free. You'll need to provide your Social Security number to access your credit score.

Why Mint is better than YNAB

Mint Offers More Services Than YNAB

As you might expect from a service that's run by a billion-dollar company, Mint offers more services and features than YNAB does. For example, you can monitor your credit score for free with your Mint account—something you can't do with a YNAB account.

Can I use Mint without linking my bank account

If you want to use Mint, you must sync all of your financial accounts, or at least the ones you want to utilize via Mint. Mint allows you to track your spending and your credit score, and you can sign-up to receive notifications on a daily, weekly, or monthly basis.

Is it safe to link bank to YNAB

All data sent between your computer and YNAB is bank-grade or better encryption. YNAB forces your browser to use an encrypted connection and won't let your computer talk to our servers unless that connection is secure. Specifically around the traffic encryption, we use 128-bit encryption (AES_128_GCM).

Can Intuit Mint be trusted

Mint uses bank-grade security, which means it doesn't even have access to what you type when you connect your financial accounts. According to Mint's security information, "Your login username and passwords are stored securely in a separate database using multi-layered hardware and software encryption.

Is Mint budget app safe

Is Mint a safe app Yes. Intuit, Mint's parent company, employs the latest security and technology measures to keep its customers' personal and financial information safe. Security measures include software and hardware encryption and multifactor authentication.

What does Dave Ramsey recommend for budgeting

Dave recommends telling every dollar where it should go—before the month begins—using a zero-based budget. This means that your income minus your expenses equals zero. Remember that feeling you had when you found $20 in your old coat pocket That's the same feeling you'll have when you create (and stick to) a budget.

What is the rule 4 in YNAB

Rule Four: Age Your Money

You're using “old” money instead of “new” money. We've got a handy little calculated “official age” in the YNAB app. While we don't have a “right” number, we will say once it hits 30 days you will be living on last month's money, and that's something worth celebrating.