Should you pay closed accounts?

Should I continue to pay on a closed account

It's important that you keep making at least the minimum payment on time each month, even after the account is closed, to protect your credit score. Late payments will hurt your credit score just as if the credit card was still open.

What happens if you don’t pay closed accounts

Your creditor canceled your account because of delinquencies. If you fall behind on your payments, your lender may close your account. Keep in mind that negative payment history for these accounts may remain on your report for seven years.

Cached

Does paying a closed accounts help credit score

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

Cached

Do I still owe if the account is closed

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

Can closed accounts hurt your credit

As TransUnion and Experian note, a closed account that shows a positive history of payments is likely to help your credit score. Generally, a closed account with negative history can continue to hurt your credit score for seven years.

Should I still pay off a closed credit card

What happens to your balance after you close a credit card When you close a credit card that has a balance, that balance doesn't just go away — you still have to pay it off. Keep in mind that interest will keep accruing, so it's a good idea to pay more than the minimum each billing period.

Should you pay off open or closed accounts first

For this reason, leaving your credit card accounts open after you pay them off is usually better for credit scores as their credit limit will continue to factor into your utilization ratio.

Can a closed account still be charged

If you still have a balance when you close your account, you still must pay off the balance on schedule. The card issuer can still charge interest on the amount you owe.

Should I remove closed accounts from credit report

Should you remove closed accounts from your credit report You should attempt to remove closed accounts that contain inaccurate information or negative items that are eligible for removal. Otherwise, there is generally no need to remove closed accounts from your credit report.

Is it better to pay off a closed credit card or an open one

There are good reasons to keep your credit card open, even if you recently paid it off: Lower credit utilization: Keeping your credit card account open can preserve your credit utilization rate, which is how much of your available credit you're using.

What happens if I stop paying a closed credit card

The primary cardholder is still liable for any remaining balance of a closed credit account. However, if you were seriously delinquent on the account and the credit card issuer sold the balance to a third-party collection agency, you now owe the third-party debt collector.

Do closed accounts look bad on your credit

Closed accounts that were never late can remain on your credit report for up to 10 years from the date they were closed. If the accounts you mentioned are showing as potentially negative, it's likely due to delinquencies noted in the history of the account.

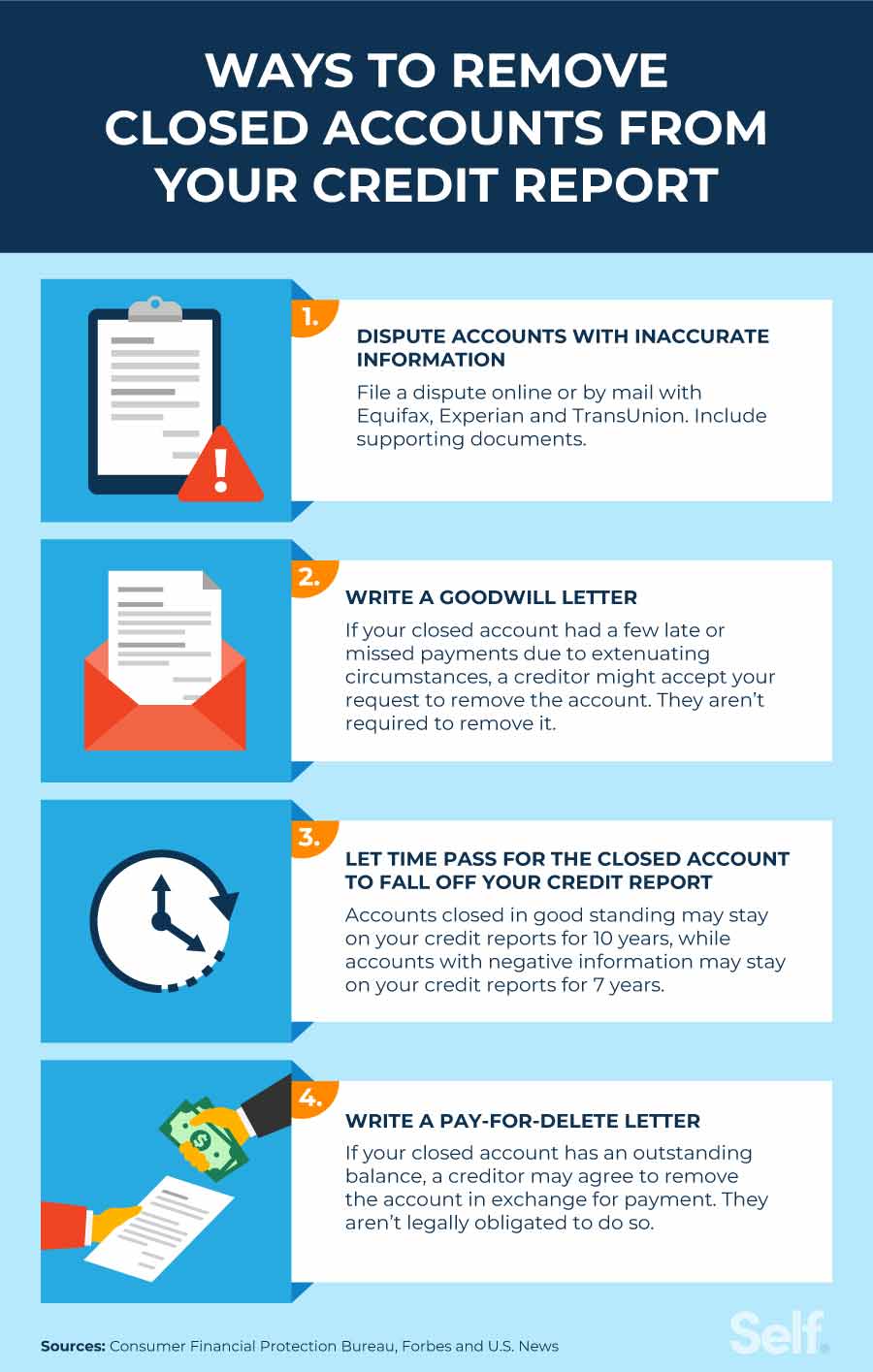

How do I get a closed account off my credit report

If you want a closed account removed from your credit report, you have a few options: disputing inaccuracies, waiting for it to fall off your report, requesting it by writing a goodwill letter, or writing a pay-for-delete letter.

What happens if I make a payment to a closed account

A closed account cannot receive money. If you send money to a closed bank account, the money should bounce back to your bank.

Can you remove closed accounts from your credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Should I still pay a closed credit card

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor.

Should I pay off a closed credit card

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

How much does credit score drop with closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Should I remove old closed accounts from credit report

You only need to consider removing a closed account if it has an adverse payment history. Otherwise, an account that is in good standing is OK to leave. It shows future lenders you can pay off a loan and make payments on time.

Is it bad to have closed credit accounts

Generally, a closed account with negative history can continue to hurt your credit score for seven years. McClary says that this can be frustrating for the borrower but adds that the damage will eventually fade.