Should you shred pre approved credit card offers?

Is it necessary to shred credit card offers

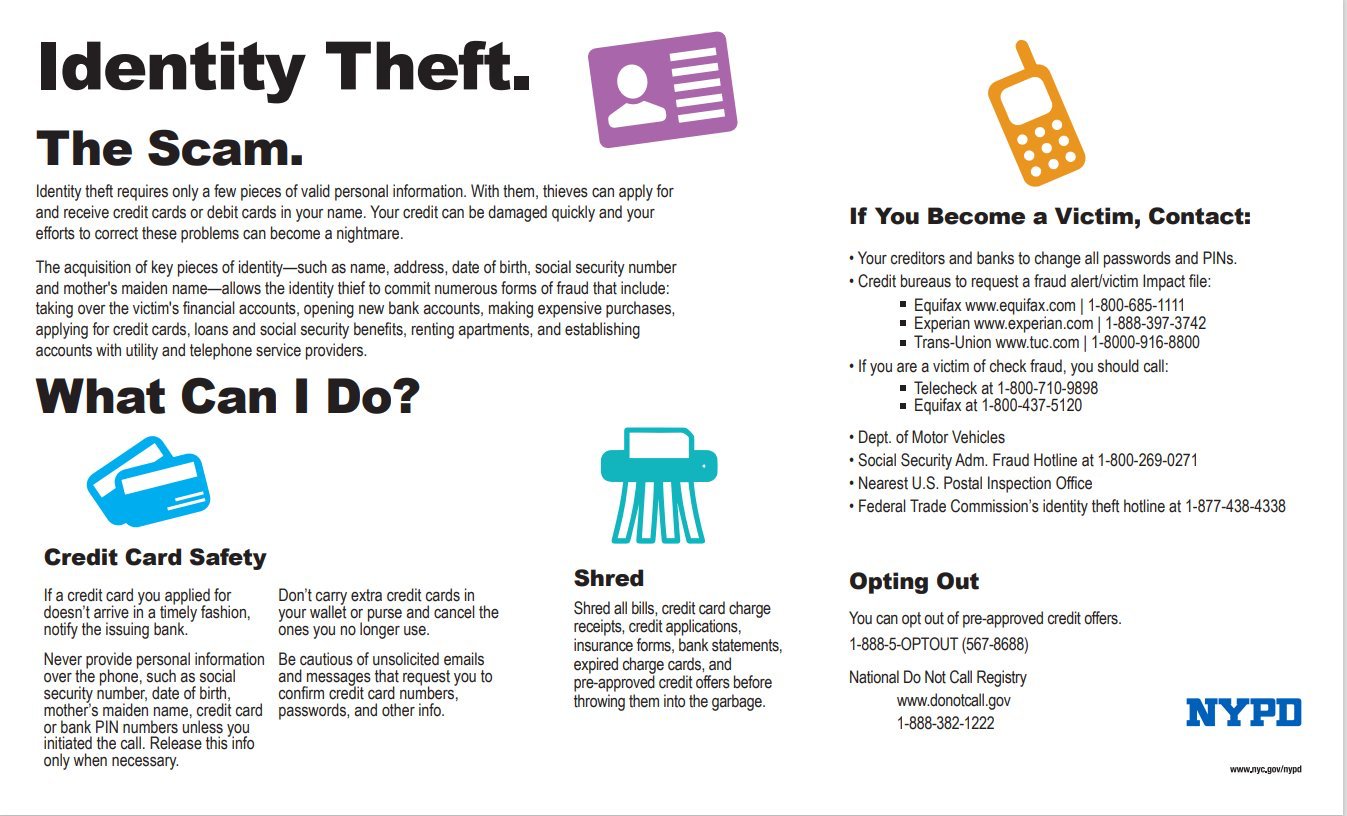

Don't just toss the junk mail in the trash bin; shred it. Given merely your name, address and a credit offer, someone malicious could take out a line of credit in your name and spend money, leaving you on the hook.

Cached

Should you shred your credit card documents before discarding them

After paying credit card or utility bills, shred them immediately. Also, shred sales receipts, unless the items purchased have warranties. Sales and cash withdrawal receipts from ATM's, junk mail credit card offers.

Cached

Is it safe to throw away credit card statements

If you've got a lot of financial documents to keep track of, you might wonder what you need to keep and what can be thrown away. Whether you get paper copies or digital files, it's usually wise to keep credit card statements for at least 60 days. But in some cases, you might want to hang on to them for up to six years.

Should you shred prescription labels

Prescription Labels and related documents

You may need to soak the container in warm water to destroy the label, if you are able to remove it, it should be shredded. In addition, the paperwork that often accompanies prescriptions should also be shredded.

What should you do with unwanted credit card offers

According to a Federal Trade Commission (FTC) Consumer Report, credit bureaus provide a toll-free number (1-888-5-OPTOUT (567-8688) that consumers can call to opt-out of pre-approved credit offers. Alternately, you can visit the website and fill out an online form to opt out of the pre-screened offers.

What are 5 things credit card companies don t want you to know

7 Things Your Credit Card Company Doesn't Want You to Know#1: You're the boss.#2: You can lower your current interest rate.#3: You can play hard to get before you apply for a new card.#4: You don't actually get 45 days' notice when your bank decides to raise your interest rate.#5: You can get a late fee removed.

What documents should not be shredded

4 Documents You Should Never ShredTax Filing Documents. Holding onto tax records is a crucial component of running your business.Business Receipts. Going through an audit can be a deeply challenging ordeal, but it's one that your business must be prepared for.Property Records.Disputed Bills.

Do I need to shred credit card offers in the mail

You can protect yourself by shredding all documents that contain personal information, including pre-approved loan and credit card offers, insurance forms and financial statements. The information in these documents could be used by an identity thief to open accounts and charge up debts in your name.

When should you get rid of credit card statements

As a financially responsible individual, you might wonder how long you're supposed to keep them. If you are receiving hard copy credit card statements, most experts recommend you keep them for 60 days. However, you might want to keep them longer if you're a business owner or using your card for charitable donations.

How many years of credit card statements should you keep

Credit Card Statements: Keep them for 60 days unless they include tax-related expenses. In these cases, keep them for at least three years. Pay Stubs: Match them to your W-2 once a year and then shred them. Utility Bills: Hold on to them for a maximum of one year.

What should you not shred

Documents You Should Never ShredBirth certificates.Death certificates.Social Security cards.Marriage certificates.Divorce decrees.Citizenship papers or green cards.Adoption papers.Academic records, diplomas, & transcripts.

What items should be shredded

Below is a list of specific items to consider shredding for your safety and privacy:Address labels from junk mail and magazines.ATM receipts.Bank statements.Birth certificate copies.Canceled and voided checks.Credit and charge card bills, carbon copies, summaries and receipts.Credit reports and histories.

How to cancel a credit card without destroying your credit score

A credit card can be canceled without harming your credit score. To avoid damage to your credit score, paying down credit card balances first (not just the one you're canceling) is key. Closing a charge card won't affect your credit history (history is a factor in your overall credit score).

Is it a good idea to opt out of credit card offers

Opting out can secure your mail and your identity stays safe and secure. Less access to your credit information. Although determining if you fit a creditor's criteria does not have a direct effect on your credit, you may prefer to keep your financial information private.

What is the biggest credit card trap

7 credit card qualities that double as a financial trapMinimum payment requirement. One vicious cycle many people fall into is paying only the minimum of their debts.Late payments.Payment processing schedule.Introductory fixed interest rate.Balance transfer.Cash advance.Reward programs.

What are red flags for credit cards

Red Flags for Credit Cards: 7 Things to Watch for When You Have Bad CreditSky-High Interest Rates.High Annual Fees.Tacked-On Fees.Incomplete Credit Reporting.High Credit Limits.A Lack of Monitoring.No Room for Improvement.

Why is shredding not a good idea

Paper shredders increase security risks. You shred your documents to prevent identity theft and maintain the confidentiality of your information. But your paper shredding machine doesn't offer the most secure method for completely destroying confidential information.

What papers are safe to shred

What Documents Should You Always Shred (and When)Sales receipts.ATM receipts.Utility bills (after paying them)Insurance offers.Credit or credit card offers.Unwanted credit card applications or pre-approved cards.Canceled checks.Expired warranties.

Is it good to get credit card offers in the mail

Credit card issuers routinely send attractive card offers to consumers with good to excellent credit. Therefore, when you receive these types of offers in your mailbox, it usually means credit card issuers believe you to be a good credit risk and want to do business with you.

Does paying off your card before the statement date help or hurt your credit score

Paying off your balance early or making additional payments before the billing cycle ends decreases your credit utilization — or the ratio of your total credit to your total debt. Credit utilization makes up 30% of your credit score, and it helps to keep this number low.