Should you use credit card when buying a house?

Is it good to have a lot of credit cards before buying a house

1. Credit cards can help you build credit to make mortgage approval easier. Credit cards can be one of the best tools to build a solid credit history and earn a good credit score.

Cached

Why no big purchases before closing

Lenders will check the borrower's credit report to verify any critical financial details. If the lender spots any big purchases that significantly impact your financial picture, it's possible they won't finalize the mortgage. With that, it is important to wait until after closing day before making any big purchases.

Can you use your credit card before closing date

Can I use my credit card between the due date and the closing date Yes, you can use your credit card between the due date and the credit card statement closing date. Purchases made after your credit card due date are simply included in the next billing statement.

How should my credit be when I buy a house

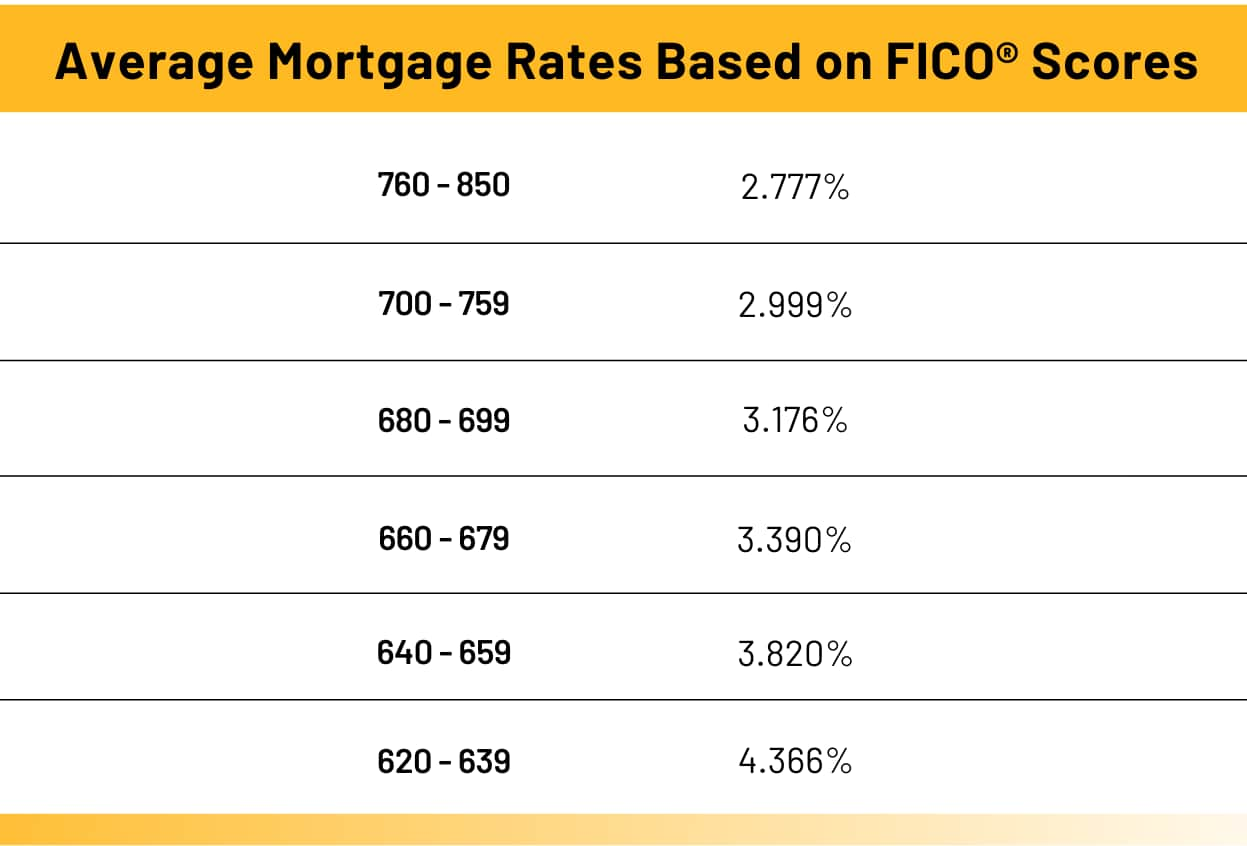

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Cached

Does credit card usage affect mortgage approval

Your credit card usage can make or break your mortgage loan approval. Lenders look not only at your credit score but also at your debt-to-income ratio, which includes the payments on your credit cards. So improper use of your credit cards could make it harder to get approved for a mortgage.

Does having a lot of credit cards hurt mortgage

How does credit card debt affect getting a mortgage Having credit card debt isn't going to stop you from qualifying for a mortgage unless your monthly credit card payments are so high that your debt-to-income (DTI) ratio is above what lenders allow.

What is the largest closing expense for the buyer

Origination fee (or service fee)

Most lenders charge an origination fee to cover service and administrative costs. This is typically the largest fee you pay to close your mortgage.

What happens if you open a credit card before closing on a house

A new credit card application before you close on a home could affect your mortgage application. A mortgage lender will usually re-pull your credit before closing to ensure you still qualify and that new credit was not opened.

Should I pay credit card before or after closing

To avoid paying interest and late fees, you'll need to pay your bill by the due date. But if you want to improve your credit score, the best time to make a payment is probably before your statement closing date, whenever your debt-to-credit ratio begins to climb too high.

How long should I use a credit card before closing it

If you've just started using credit and recently got your first credit card, it's best to keep that card open for at least six months. That's the minimum amount of time for you to build a credit history to calculate a credit score.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

Is 750 a good credit score to buy a house

A 750 credit score generally falls into the “excellent” range, which shows lenders that you're a very dependable borrower. People with credit scores within this range tend to qualify for loans and secure the best mortgage rates. A 750 credit score could help you: Qualify for a mortgage.

Do mortgage lenders look at your spending

They will look at things like how much you spend on credit cards, how much you spend on groceries, and how much you spend on entertainment. Mortgage lenders want to see that you are living within your means and that you are not spending more than you can afford.

Do mortgage lenders look at credit card spending

Your credit card usage can make or break your mortgage loan approval. Lenders look not only at your credit score but also at your debt-to-income ratio, which includes the payments on your credit cards.

What is an OK amount of credit card debt

If your total balance is more than 30% of the total credit limit, you may be in too much debt. Some experts consider it best to keep credit utilization between 1% and 10%, while anything between 11% and 30% is typically considered good.

What is the most seller can pay in closing costs

Conventional LoansIf your down payment is less than 10%, the seller can contribute up to 3%.If your down payment is 10 – 25%, the seller can contribute up to 6%.If your down payment is more than 25%, the seller can contribute up to 9%.

What is the most expensive part of closing costs

Realtor commissions — The seller is usually responsible for real estate agent commissions, the largest part of closing costs. You may be able to negotiate a split with the buyer, but if it's a buyer's market the seller is often asked to cover both agents' fees.

How long should I wait to buy a house after applying for a credit card

At a minimum, apply for a home mortgage at least three months after you apply for a new credit card. Ideally, wait six months. This waiting period gives your credit score time to rebound from the recent inquiry.

What is the 15 3 rule

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

Does paying off credit card early increase credit score

Paying off your credit card balance every month may not improve your credit score alone, but it's one factor that can help you improve your score. There are several factors that companies use to calculate your credit score, including comparing how much credit you're using to how much credit you have available.