Were Ninja loans real?

What was the problem with Ninja loans

Disadvantages of NINJA Loans

NINJA loans carried an increased risk for both borrowers and lenders. On the lender side, the loans required no evidence of collateral, which essentially made them unsecured loans. It meant that in the event of a default, the lender could not seize any assets to cover their losses.

Cached

What was a ninja loan

Ninja Loan. Ninja loans are those loans allotted with less or no verification from the lender's end. Therefore, despite a poor credit score, when a particular amount is given to a borrower, the loan carries significant risk as the lender is not sure if the borrower will repay the entire amount.

Cached

Who created Ninja loans

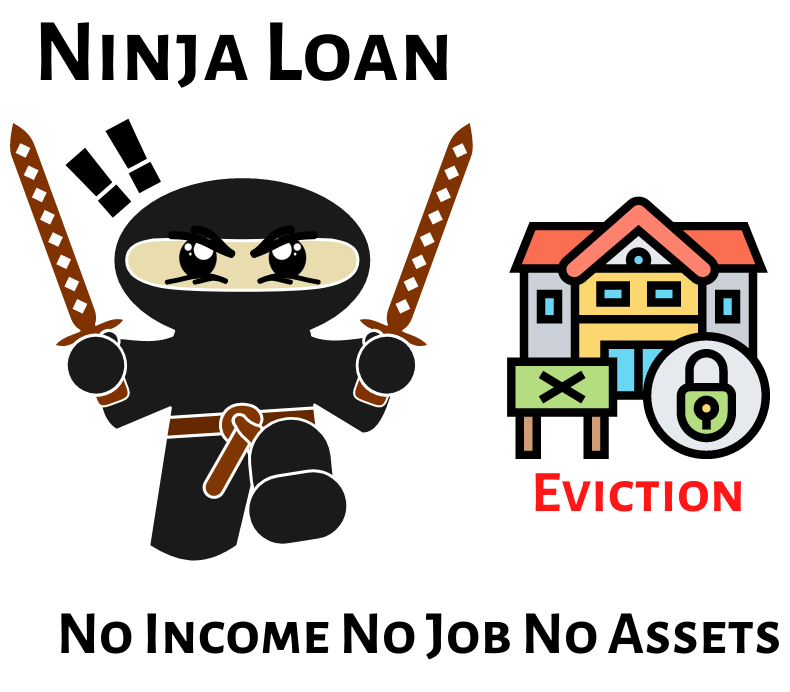

Coined by the American lending company HCL Finance from an approximate initialism of no income, no job, no assets.

What is a ninja loan when did these loans become popular

A NINJA loan is a “no income, no job, no assets” loan. NINJA loans are made when lenders do not independently verify that borrowers have the income and assets they claim. They were once common in the mortgage industry before the 2008 financial crisis, but regulations have made them more difficult to obtain.

Cached

Is CreditNinja a real site

CreditNinja is a reputable and trustworthy online lender, offering personal installment loans to borrowers in need. At CreditNinja our top priority is getting you the cash you need exactly when you need it most.

Are Ninja loans coming back

NINJA loans have disappeared from the market, likely never to be seen again, but one lender is about to bring back a similar ghost of the mortgage market's past: the NINA loan. NINA loans are loans that do not include a requirement for a borrower to prove income or assets. No Income, No Assets = NINA.

Are Ninja loans back

NINJA loans have disappeared from the market, likely never to be seen again, but one lender is about to bring back a similar ghost of the mortgage market's past: the NINA loan. NINA loans are loans that do not include a requirement for a borrower to prove income or assets. No Income, No Assets = NINA.

Are there still ninja loans

In the aftermath of the crisis, the U.S. government issued new regulations to improve standard lending practices across the credit market, which included tightening the requirements for granting loans. 2 At this point, NINJA loans are rare, if not extinct.

Is CreditNinja a lender

CreditNinja is a Chicago-based online lender offering high-cost personal loans — in some cases, you could end up paying double (or more) the amount you borrow, no matter how quickly you pay off the loan.

How do I know if a loan company is scamming me

5 ways to spot personal loan scamsThe lender asks for fees upfront.The lender guarantees you're approved before you apply.The lender promises to clear your debt.The lender isn't registered in your state.The lender calls you with an offer.

What type of loan is CreditNinja

CreditNinja is a Chicago-based online lender offering high-cost personal loans — in some cases, you could end up paying double (or more) the amount you borrow, no matter how quickly you pay off the loan.

Do loans ruin your credit

Taking out a personal loan is not bad for your credit score in and of itself. However, it may affect your overall score for the short term and make it more difficult for you to obtain additional credit before that new loan is paid back.

Are payday loans a trap

Here's How the Debt Trap Works

The interest rates are so high (over 300% on average) that people cannot pay off their loans while covering normal living expenses. The typical borrower is compelled to take out one loan after another, incurring new fees each time out. This is the debt trap.

How do you check if a company is legit

Check out the company's address, phone number, and website to make sure they look legitimate. Be aware, though, that it's pretty easy for a company to get a fake address, phone number, and website. If you can, visit the company's physical address and talk to the people who work there.

What do I do if I get scammed by a loan company

5 Steps to take if you are the victim of a loan scamConstruct a narrative. Start by writing down your story.Report the crime to the FTC.File a complaint with the IC3 (Internet Crime Complaint Center).File a complaint with the Consumer Financial Protection Bureau (CFPB).Call the Police.Write your credit bureaus.

Can you get a loan with a 550 credit score

Though it may be more challenging to find a lender that's willing to work with you, it is indeed possible to obtain a loan with a credit score of 550. Most lenders require a minimum credit score of between 600 and 650, but some lenders specialize in personal loans for those with lower scores.

Is it bad to pay off a loan early

If you have personal loan debt and are in a financial position to pay it off early, doing so could save you money on interest and boost your credit score. That said, you should only pay off a loan early if you can do so without tilting your budget, and if your lender doesn't charge a prepayment penalty.

Do payday loans ever go away

No, unpaid payday loans won't just go away. Defaulting on a payday loan will likely result in your debt getting sent to collections, which can stay on your credit report for up to seven years, and you could be sued until the statute of limitations for your unpaid debt ends.

What happens if I close my bank account and default on a payday loan

If you close the checking account to keep the lender from taking what you owe, the lender might keep trying to cash the check or withdraw money from the account anyway. That could result in you owing your bank overdraft fees. The payday lender might send your loan to collections. Then there will be more fees and costs.

How do I verify a company account

Bank account statement reflecting the company name and bank account number. A letter from bank reflecting the company name and bank account number. A cancelled cheque reflecting the company name and bank account number.