What account is insurance expense under?

Where is insurance expense in accounting

The company records this expenditure in the prepaid expense account as a current asset.

Cached

Is insurance expense an expense account

Insurance expense is the amount that a company pays to get an insurance contract and any additional premium payments. The payment made by the company is listed as an expense for the accounting period.

Cached

Where does insurance expense go on a balance sheet

Insurance expense does not reflect on the balance sheet since it displays the amount one has spent instead of the liability or asset at a specific time.

Cached

What type of expense is an insurance expense

Insurance expense is a fixed & regular expense incurred per period by the insured person (i.e. the person who has taken the insurance cover) against any kind of uncertain risk in the future that may occur due to any event (which may or may not be known today) and the same is based on a certain percentage of the sum …

Is insurance an asset or liability

Insurance, on the whole, is attached to fixed assets and becomes a part of fixed assets, hence it is considered a fixed asset.

What category of account is expenses

Expense accounts are records of the amount a company spends on day-to-day costs during a given accounting period. These accounts exist for a set period of time – a month, quarter, or year – and then new accounts are created for each new period. For this reason, they're considered temporary accounts.

Is insurance an expense or liability

This is because the insurance protects the business from liability, and the cost of the insurance is directly related to the risk of liability. This expense category is typically used for all types of insurance, such as property insurance, health insurance, and liability insurance.

How is insurance expense recorded

At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current asset account, Prepaid Insurance. The prepaid amount will be reported on the balance sheet after inventory and could part of an item described as prepaid expenses.

Is insurance expense an expense or liability

Insurance Expenses

This expense category is typically used for all types of insurance, such as property insurance, health insurance, and liability insurance.

Is insurance considered liabilities

Any type of life insurance that doesn't earn cash value is considered a liability. The most common type of non-cash value life insurance is term life insurance. With a term policy, you owe regular payments and you're not guaranteed anything in return.

What type of asset is expenses

An asset is an expenditure that has utility through multiple future accounting periods. If an expenditure does not have such utility, it is instead considered an expense. For example, a company pays its electrical bill.

Are expenses considered liabilities or assets

Expenses are what your company pays on a monthly basis to fund operations. Liabilities, on the other hand, are the obligations and debts owed to other parties. In a way, expenses are a subset of your liabilities but are used differently to track the financial health of your business.

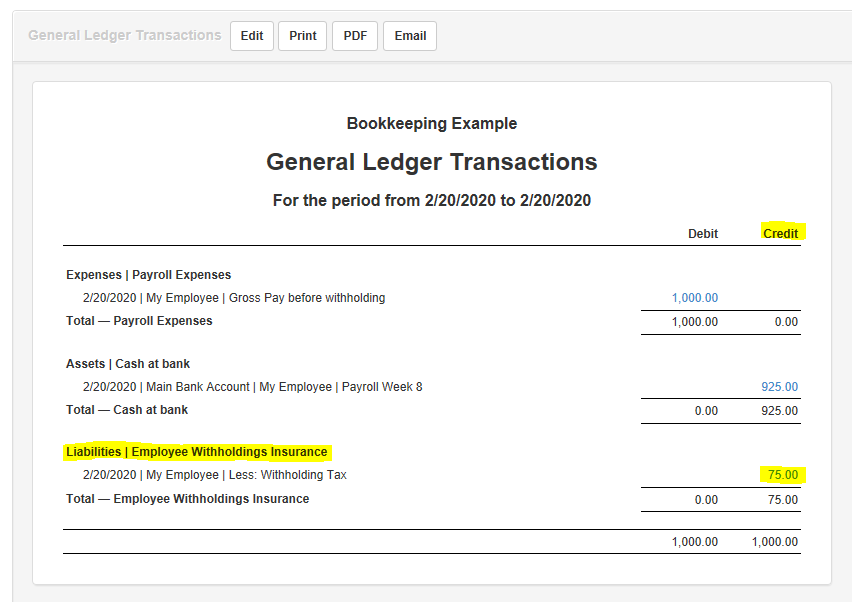

How do you record insurance expenses in journal entry

Prepaid Insurance Journal Entry

When the asset is charged to expense, the journal entry is to debit the insurance expense account and credit the prepaid insurance account. Thus, the amount charged to expense in an accounting period is only the amount of the prepaid insurance asset ratably assigned to that period.

Is insurance an asset or expense

Insurance is an expense to a business and is carried as prepaid expense (paid in advance) under the head of current assets in the balance sheet of a company till it is paid.

Is insurance an asset

Insurance, on the whole, is attached to fixed assets and becomes a part of fixed assets, hence it is considered a fixed asset.

Is insurance a current liabilities

Common examples of current liabilities include regular accounts payable and business taxes due (or anticipated) but not yet paid. This includes any income tax or insurance a business pays on behalf of its employees.

What type of expense is insurance expense

Insurance expense is a fixed & regular expense incurred per period by the insured person (i.e. the person who has taken the insurance cover) against any kind of uncertain risk in the future that may occur due to any event (which may or may not be known today) and the same is based on a certain percentage of the sum …

Is insurance a liability or expense

Protection Expenses

This is because the insurance protects the business from liability, and the cost of the insurance is directly related to the risk of liability. This expense category is typically used for all types of insurance, such as property insurance, health insurance, and liability insurance.

Is insurance considered a liability

Any type of life insurance that doesn't earn cash value is considered a liability. The most common type of non-cash value life insurance is term life insurance. With a term policy, you owe regular payments and you're not guaranteed anything in return.

Is insurance expense a liability

Insurance expense does not go on the balance sheet because it reflects a specific amount you have spent, rather than an asset or liability at a particular moment in time.