What are 5 organizations that can request to see your credit report?

What are the 3 4 people or organizations that may check your credit history

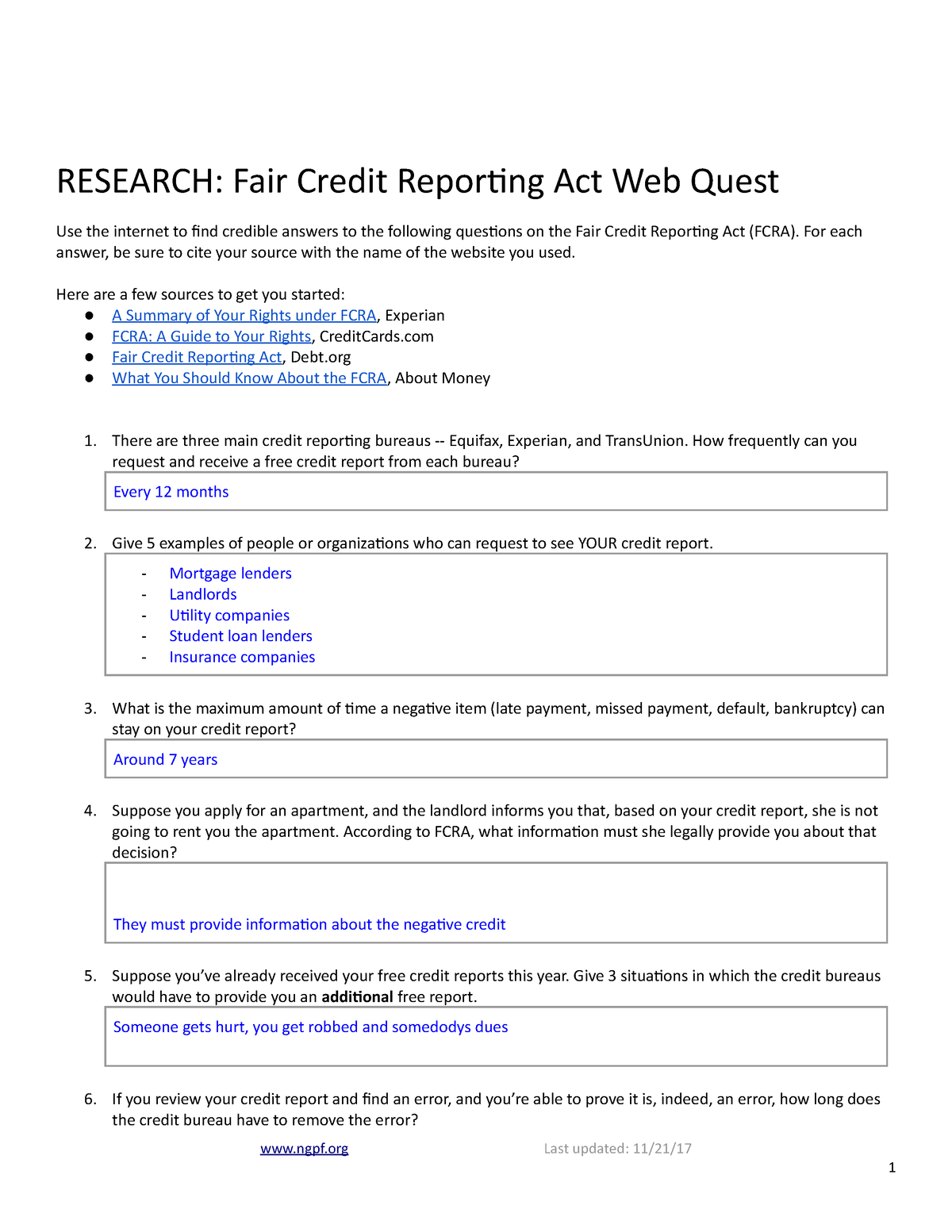

Equifax, Experian and TransUnion are the three major credit bureaus in the U.S. According to the Consumer Financial Protection Bureau (CFPB), credit bureaus are companies that compile and sell credit reports.

What companies can show you a credit report

Nationwide consumer reporting companies

There are three big nationwide providers of consumer reports: Equifax, TransUnion, and Experian. Their reports contain information about your payment history, how much credit you have and use, and other inquiries and information.

Cached

What 3 agencies are responsible for collecting information for a credit report

Check your reports regularly

It's important to review your credit reports from the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—every twelve months to ensure they are accurate and complete.

What are the 8 different companies that might look at your report

8 Types of Companies That Look at Your Credit ReportCredit card companies. A credit card company can look at your credit report when you apply for a card.Insurance companies.Employers.Telecommunications companies.Public utilities.Government agencies and courts.Landlords.Assisted living facilities and nursing homes.

Cached

What are the 5 categories that credit reporting agencies use to come up with credit scores plus %’ s

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%).

What are 4 types of common information on your credit report

Each credit report has four basic categories: identity, existing credit information, public records and recent inquiries.

Can companies see your credit report

What are your legal rights as a job applicant Thanks to the Fair Credit Reporting Act (FCRA), employers can't go checking your credit history behind your back. They must have written consent before pulling an applicant's credit history.

Can a company check your credit without permission

Now, the good news is that lenders can't just access your credit report without your consent. The Fair Credit Reporting Act states that only businesses with a legitimate reason to check your credit report can do so, and generally, you have to consent in writing to having your credit report pulled.

What is the most important credit reporting agency

The Top Three Credit BureausEquifax. Based in Atlanta, Equifax has approximately 14,000 employees and does business in 24 countries.Experian.TransUnion.

What are the 5 secondary credit bureaus

Alternative Credit Bureaus

| Reporting Agency | Type of Info |

|---|---|

| ChexSystems | Banking |

| CL Verify Microbilt | Banking, Credit History, Background Checks, Employment History |

| Clarity Services | Credit History from Small or High Risk Lenders, Banking |

| Contemporary Information Corp. | Background Checks, Rental History |

Who looks at your credit report and why

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Why do government agencies and courts look at your credit report

Government agencies can request your credit report for a number of reasons: To determine whether you are eligible for public assistance (to look for hidden income or assets). To help determine whether, and how much, you can pay in child support.

What are the 5 Cs of credit and why are they important

The five Cs of credit are important because lenders use these factors to determine whether to approve you for a financial product. Lenders also use these five Cs—character, capacity, capital, collateral, and conditions—to set your loan rates and loan terms.

What are the five 5 levels of credit scores

Credit scores typically range from 300 to 850. Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and excellent.

What are the 3 credit report agencies that track all of your credit information quizlet

In the United States, the three major credit bureaus are Equifax, Experian, and TransUnion. Credit history is a record of a person's borrowing and repayment activity.

Can someone check my credit report without my permission

Your credit report can't be obtained by just anyone. The FCRA lays out in what situations a credit reporting agency can provide others access to your report. Even those who want access to your report can only ask for it if they have a legally permissible reason to do so.

Can anyone check your credit report without your knowledge

Now, the good news is that lenders can't just access your credit report without your consent. The Fair Credit Reporting Act states that only businesses with a legitimate reason to check your credit report can do so, and generally, you have to consent in writing to having your credit report pulled.

Who can view your credit report without permission

Potential investors or servicers, and current insurers, can access your credit report to gauge any credit risk that your loan poses, or to determine whether you will prepay (pay off a loan before it is due).

Are there only 3 credit reporting agencies

There are three major consumer credit bureaus: Equifax, Experian and TransUnion.

What are the four hidden credit bureaus

How Many Credit Reporting Agencies Are There You're probably familiar with the three main credit reporting agencies: Experian, Equifax, and TransUnion. Did you know there are actually six agencies The additional four agencies are PRBC, SageStream, Advanced Resolution Service (ARS), and Innovis.