What are COGS on balance sheet?

What is COGS on a balance sheet

The cost of goods sold (COGS) is the sum of all direct costs associated with making a product. It appears on an income statement and typically includes money mainly spent on raw materials and labour. It does not include costs associated with marketing, sales or distribution.

How do you record COGS on a balance sheet

When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference between your COGS Expense and Purchases accounts. Your COGS Expense account is increased by debits and decreased by credits.

Is COGS an asset or liability

Cost of goods sold is not an asset (what a business owns), nor is it a liability (what a business owes). It is an expense. Expenses is an account that contains the cost of doing business. Expenses is one of the five main accounts in accounting: assets, liabilities, expenses, equity, and revenue.

Cached

What is included in cost of goods sold

Cost of goods sold is the total amount your business paid as a cost directly related to the sale of products. Depending on your business, that may include products purchased for resale, raw materials, packaging, and direct labor related to producing or selling the good.

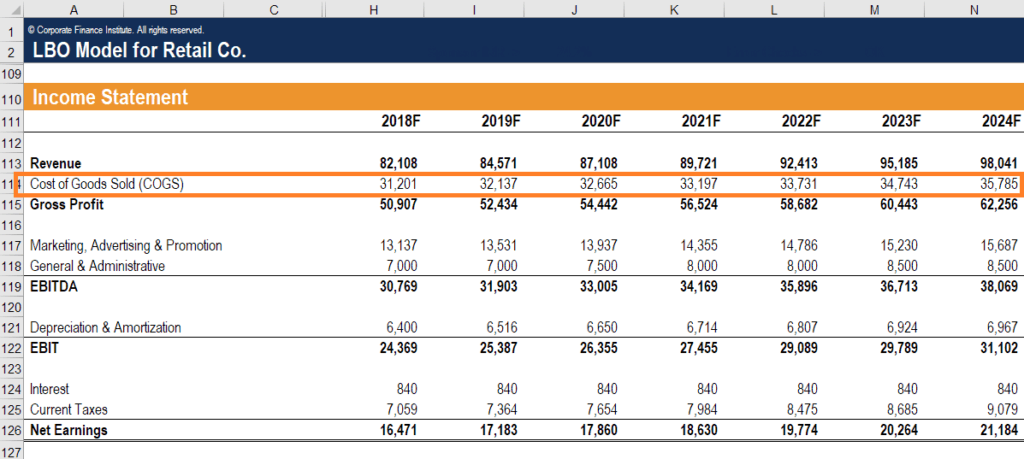

Is COGS on the balance sheet or income statement

COGS is often the second line item appearing on the income statement, coming right after sales revenue. COGS is deducted from revenue to find gross profit. Cost of goods sold consists of all the costs associated with producing the goods or providing the services offered by the company.

Is COGS P&L or balance sheet

COGS includes direct costs, such as material and labor, but does not include indirect costs, such as sales, marketing or distribution. In accounting, COGS is a standard item in the expense section of a company's profit and loss statement (P&L).

Where does COGS go on chart of accounts

COGS in the Chart of Accounts

A business' Income State (Profit & Loss) starts with Revenue at the top. COGS is listed next and is subtracted from Revenue to arrive at Gross Profit. Operating Expenses are then subtracted from Gross Profit to arrive at Net Income.

Is COGS part of accounts payable

For purposes of forecasting accounts payable, A/P is tied to COGS in most financial models, especially if the company sells physical goods – i.e. inventory payments for raw materials directly involved in production.

Is COGS same as cost of revenue

The difference between cost of revenue and COGS is that cost of revenue is COGS plus distribution and marketing costs. To take this distinction a step further, your cost of revenue includes all the costs the company incurs to obtain a sale (which includes any fixed costs or variable costs) plus the cost of goods sold.

What is the difference between expenses and COGS

The difference between these two lines is that the cost of goods sold includes only the costs associated with the manufacturing of your sold products for the year, while your expenses line includes all your other costs of running the business.

Does COGS affect accounts payable

For purposes of forecasting accounts payable, A/P is tied to COGS in most financial models, especially if the company sells physical goods – i.e. inventory payments for raw materials directly involved in production.

What is the relationship between COGS and accounts payable

Here, COGS refers to beginning inventory plus purchases subtracting the ending inventory. Accounts payable, on the other hand, refers to company purchases that were made on credit that are due to its suppliers.

What is the difference between COGS and selling expense

Selling expenses include the costs associated with getting orders for the products or services as well as getting those things into the hands of the customer, as opposed to COGS, the explicit costs of producing the product or service.

What is the difference between COGS and total expenses

The difference between these two lines is that the cost of goods sold includes only the costs associated with the manufacturing of your sold products for the year, while your expenses line includes all your other costs of running the business.

How does COGS affect balance sheet

Cost of goods sold (COGS) includes all of the costs and expenses directly related to the production of goods. COGS excludes indirect costs such as overhead and sales and marketing. COGS is deducted from revenues (sales) in order to calculate gross profit and gross margin. Higher COGS results in lower margins.

Is COGS the same as profit

Gross profit refers to your earnings after subtracting the cost of your revenue, otherwise known as the cost of goods sold (COGS). COGS and SaaS cost of revenue include the cost of your raw products and any costs directly associated with the production.

What happens to COGS when you sell inventory

Inventory is recorded and reported on a company's balance sheet at its cost. When an inventory item is sold, the item's cost is removed from inventory and the cost is reported on the company's income statement as the cost of goods sold.

Does COGS affect gross profit

COGS is an important metric on financial statements as it is subtracted from a company's revenues to determine its gross profit. Gross profit is a profitability measure that evaluates how efficient a company is in managing its labor and supplies in the production process.

What is the difference between inventory cost and COGS

The Difference Between Inventory and Cost of Goods Sold

Inventory includes all of the raw materials, work-in-progress, and finished goods that a company has on hand. COGS only includes the direct costs associated with the production of the goods that were sold.

Does COGS show up on balance sheet

On your income statement, COGS appears under your business's sales (aka revenue). Deduct your COGS from your revenue on your income statement to get your gross profit. Your COGS also play a role when it comes to your balance sheet. The balance sheet lists your business's inventory under current assets.