What are credit cards classified on balance sheet?

Where do credit cards go on balance sheet

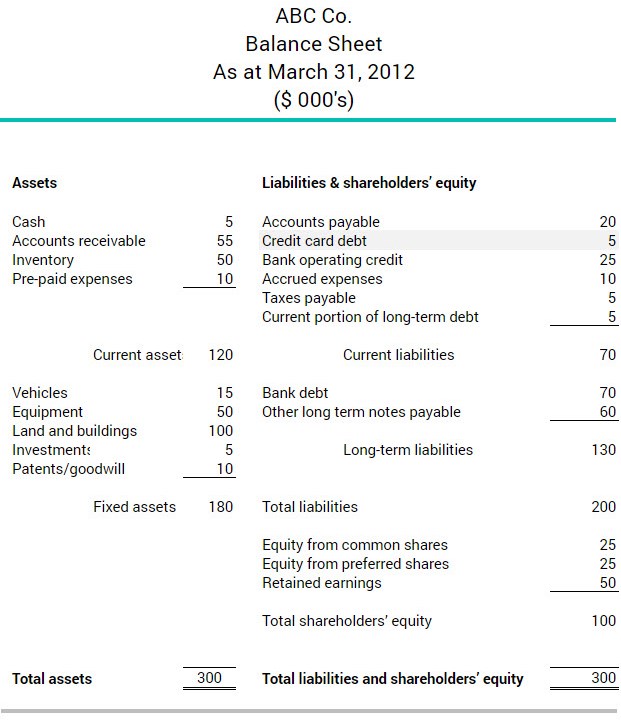

It appears under liabilities on the balance sheet. Credit card debt is a current liability, which means businesses must pay it within a normal operating cycle, (typically less than 12 months).

What classification is credit card in accounting

Credit Cards as Liabilities

The balance owed on a credit card can be treated either as a negative asset, known as a “contra” asset, or as a liability.

Cached

What type of asset is a credit card

Credit cards are a liability and not an asset, as the money on the card is not yours and this credit line does not increase your net worth.

Is a credit card an asset on the balance sheet

If it holds value and could be used to offset your liabilities, it's an asset. Liabilities are debts. Loans, mortgages and credit card balances all fit into this category.

How do you categorize credit card payments in accounting

A payment against a Card Balance is paying against that credit card type of liability account in your file, the same as ane debt payment is not expense but Liability payment. In other words, paying VISA or AMEX is a debt payment, it isn't the purchase of something.

Are credit cards financial liabilities

When calculating the money supply, the Federal Reserve includes financial assets like currency and deposits. In contrast, credit card debts are liabilities. Each credit card transaction creates a new loan from the credit card issuer. Eventually the loan needs to be repaid with a financial asset—money.

How do I categorize a credit card in Quickbooks

Navigate to Banking.Select the credit card account.Select "For review ".Select the transaction you want to categorize.Click the "Select payee" field and record payee.Click the "Select category" field.Select the expense account.Click the "Memo" field and record the payment details.

Why are credit cards a liability

In contrast, credit card debts are liabilities. Each credit card transaction creates a new loan from the credit card issuer. Eventually the loan needs to be repaid with a financial asset—money.

Is credit an asset or equity

A credit is an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. It is positioned to the right in an accounting entry.

Is a credit on the balance sheet a liability

An increase in liabilities or shareholders' equity is a credit to the account, notated as "CR." A decrease in liabilities is a debit, notated as "DR." Using the double-entry method, bookkeepers enter each debit and credit in two places on a company's balance sheet.

Is credit cards debt and assets or liabilities

liabilities

When calculating the money supply, the Federal Reserve includes financial assets like currency and deposits. In contrast, credit card debts are liabilities. Each credit card transaction creates a new loan from the credit card issuer. Eventually the loan needs to be repaid with a financial asset—money.

How do you record credit card expenses in accounting

Credit card expenses can be entered into your accounting system in one of three ways: Summary – Enter the information from the credit card statement by account summary through a journal entry or into Accounts Payable by summarizing the credit card statement each month to a credit card vendor.

Is credit a liability or owner’s equity

The credit side of the entry is to the owners' equity account. It is an account within the owners' equity section of the balance sheet.

How do I record a credit card in QuickBooks

This is the main way to record your credit card payments in QuickBooks.Select + New.Under Money Out (if you're in Business view), or Other (if you're in Accountant view), select Pay down credit card.Select the credit card you made the payment to.Enter the payment amount.Enter the date of the payment.

How do I record credit card expenses in QuickBooks

How do I enter credit card chargesGo to the + New icon and then choose Expense.Choose the credit card account under the Payment account drop-down menu.Select the credit card type under the Payment method drop-down list.Fill in the other necessary information.Once done, click on Save and Close.

How do you record credit card transactions in accounting

In your journal entry, you must:Debit your Cash account in the amount of your Sale – Fees.Debit your Credit Card Expense account the amount of your fees.Credit your Sales account the total amount of the sale.

Is credit an equity

A credit is an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. It is positioned to the right in an accounting entry.

Is a credit line an asset or liability

liabilities

Lines of credit appear under liabilities on the balance sheet. They are considered current liabilities because they must be paid within the current 12-month operating cycle.

What is a credit and debit on a balance sheet

On a balance sheet or in a ledger, assets equal liabilities plus shareholders' equity. An increase in the value of assets is a debit to the account, and a decrease is a credit.

Is credit card balance considered debt

There are several types of credit cards. Although they can be used in different ways, they have one thing in common: they are all considered revolving debts. This means that they allow consumers to carry balances from month-to-month and repay loans over time.