What are the 2 resources where you can get credit report?

What are the two types of credit reporting

The two most widely used types of credit scores are FICO Score and VantageScore.

What is the best source to get a credit report

To get the free credit report authorized by law, go to AnnualCreditReport.com or call (877) 322-8228.

What 2 things do credit reports contain

Information about credit that you have, such as your credit card accounts, mortgages, car loans, and student loans. It may also include the terms of your credit, how much you owe your creditors, and your history of making payments.

CachedSimilar

What are the credit score sources

By law, you can get a free credit report each year from the three credit reporting agencies (CRAs). These agencies include Equifax, Experian, and TransUnion.

What are the 2 two basic forms of consumer credit

Total consumer credit comprises two major types: revolving and nonrevolving. Revolving credit plans may be unsecured or secured by collateral and allow a consumer to borrow up to a prearranged limit and repay the debt in one or more installments.

What are the three types of credit reports

There are three main credit bureaus: Experian, Equifax and TransUnion. CNBC Select reviews common questions about them so you can better understand how they work.

What is the most common credit report used

FICO scores are the most widely used credit scores in the U.S. for consumer lending decisions.

Which of the 3 credit reports is best

It's important to note that all three bureaus are used widely in the U.S. None of them are more “important” than the others. There is no “best” credit bureau—all three bureaus can offer helpful information and tools to help you make financial decisions.

What are the 3 main ways to check your credit score

Here are a few ways:Check your credit card, financial institution or loan statement.Purchase credit scores directly from one of the three major credit bureaus or other provider, such as FICO.Use a credit score service or free credit scoring site.

What are the three places for credit score

There are three credit agencies: TransUnion, Equifax, and Experian.

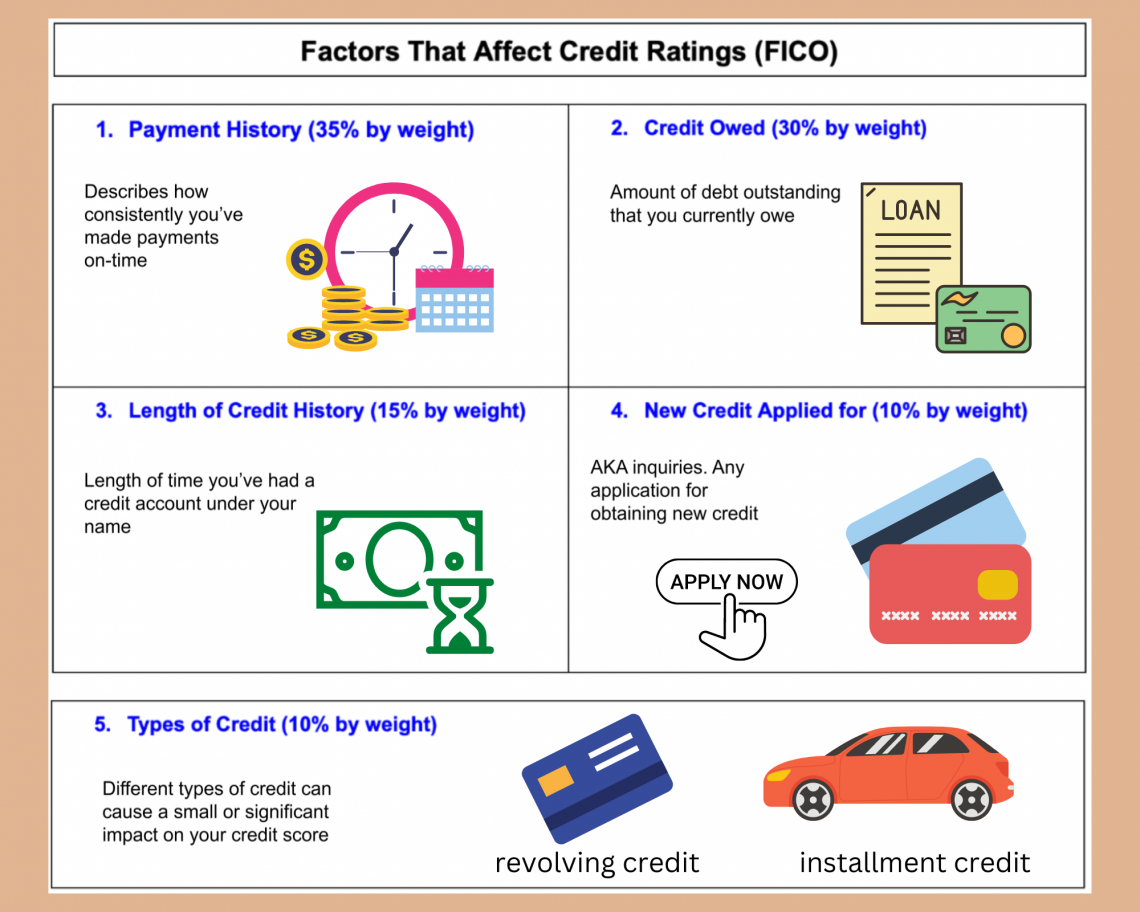

What are the 2 most important credit factors

The most important factor of your FICO® Score☉ , used by 90% of top lenders, is your payment history, or how you've managed your credit accounts. Close behind is the amounts owed—and more specifically how much of your available credit you're using—on your credit accounts. The three other factors carry less weight.

What are the two types of credit instruments

Let us study the main types of credit instruments.Promissory Note:Bill of exchange:Advantages of a bill of exchange:Hundis:Cheques:Advantages of Cheques:Bank Drafts:Clearing House:

Are there different types of credit reports

There are three major credit bureaus in the U.S. — Equifax®, TransUnion® and Experian™ — all of which are used for a variety of different reasons, such as providing a credit report.

What are the three most common credit reporting agencies

There are three main credit bureaus: Equifax, Experian and TransUnion.

What are the 3 types of credit scores

The information in each of your Credit Reports from the three credit bureaus can be different. This is why it's important to review your Experian, Equifax®, and TransUnion® Credit Reports and FICO Scores.

What are the four main ways to check your credit score

There are four main ways to get a credit score.Check your credit card or other loan statement. Many major credit card companies and some auto loan companies have begun to provide credit scores for all their customers on a monthly basis.Talk to a non-profit counselor.Use a credit score service.Buy a score.

Are there ways to check your credit score

You can obtain your free FICO® Score through Experian. Check with your credit card issuer or lender. Many credit card and car loan companies offer complimentary credit scores that you can check by logging into your account online or receiving on your monthly statement.

What is the most common credit scoring system

FICO scores

FICO scores are the most widely used credit scores in the U.S. for consumer lending decisions.

What is the most popular credit score system

FICO scores are generally known to be the most widely used by lenders. But the credit-scoring model used may vary by lender.

What are 3 ways to find out your credit score

Here are a few ways:Check your credit card, financial institution or loan statement.Purchase credit scores directly from one of the three major credit bureaus or other provider, such as FICO.Use a credit score service or free credit scoring site.