What are the 3 Income Statements?

What are the three 3 types of income statement

What Are the Different Types of Income Statements and How Are They CalculatedSingle-Step Income Statement.Multi-Step Income Statement.Generate Your Income Statement Using Deskera Books.

What are the 3 main statements in accounting

The income statement, balance sheet, and statement of cash flows are required financial statements.

Cached

What are the 3 financial statements and what do they do

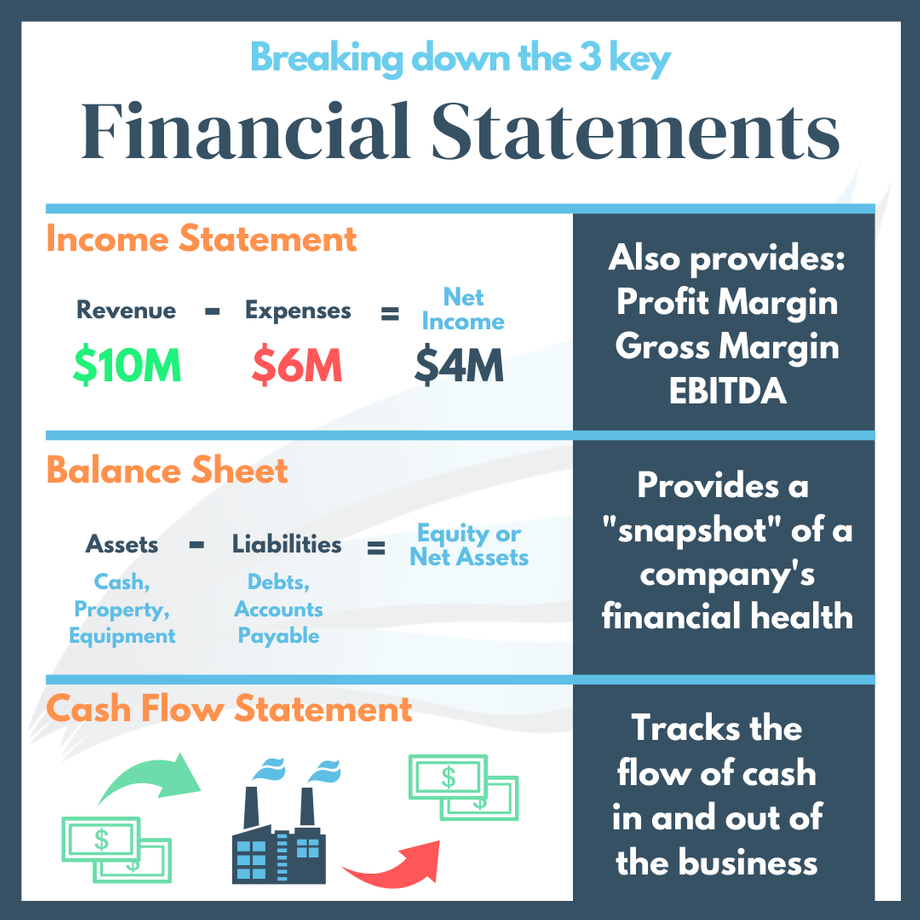

The income statement illustrates the profitability of a company under accrual accounting rules. The balance sheet shows a company's assets, liabilities, and shareholders' equity at a particular point in time. The cash flow statement shows cash movements from operating, investing, and financing activities.

Cached

How are the 3 income statements related

In summary, net income from the income statement flows to the top of the cash flow statement, which flows into the bottom of the balance sheet as retained earnings. Net income also impacts cash, which is reported at the bottom of the cash flow statement, which then flows into the top of the balance sheet.

Cached

What are the three types of statements

The primary three types of financial statements are the balance sheet, the income statement, and the cash flow statement.

Which 2 of the 3 financial statements is most important

Types of Financial Statements: Income Statement. Typically considered the most important of the financial statements, an income statement shows how much money a company made and spent over a specific period of time.

Which of the 3 financial statements is most important

Income Statement

Types of Financial Statements: Income Statement. Typically considered the most important of the financial statements, an income statement shows how much money a company made and spent over a specific period of time.

What is on the income statement

An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement or an earnings statement. It shows your: revenue from selling products or services. expenses to generate the revenue and manage your business.

What are 3 examples of financial statements

The three major financial statement reports are the balance sheet, income statement, and statement of cash flows.

What is the 3 statement model

A three-statement financial model is an integrated model that forecasts an organization's income statements, balance sheets and cash flow statements. The three core elements (income statements, balance sheets and cash flow statements) require that you gather data ahead of performing any financial modeling.

What are the 3 types of financial analysis

Horizontal, vertical, and ratio analysis are three techniques that analysts use when analyzing financial statements.

What are the 3 conditional statements

Conditional Statements : if, else, switch.

What is the most important income statement

Net income: Net income is the income left over after you subtract all of your expenses from your gross profits. It's the most important line of the income statement.

What are the 4 primary financial statements

But if you're looking for investors for your business, or want to apply for credit, you'll find that four types of financial statements—the balance sheet, the income statement, the cash flow statement, and the statement of owner's equity—can be crucial in helping you meet your financing goals.

Which of the 3 financial statement should be prepared first

The income statement

The income statement, which is sometimes called the statement of earnings or statement of operations, is prepared first. It lists revenues and expenses and calculates the company's net income or net loss for a period of time.

What are the 4 basic financial statements

But if you're looking for investors for your business, or want to apply for credit, you'll find that four types of financial statements—the balance sheet, the income statement, the cash flow statement, and the statement of owner's equity—can be crucial in helping you meet your financing goals.

What are the 4 income statements

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.

What are the 4 parts of an income statement

What Are the Four Key Elements of an Income Statement (1) Revenue, (2) expenses, (3) gains, and (4) losses. An income statement is not a balance sheet or a cash flow statement.

What are the 3 most common financial statement prepared by business

The balance sheet, income statement, and cash flow statement each offer unique details with information that is all interconnected.

What are the major financial statements

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.