What are the 3 investment categories?

What are the 3 C’s of investing

Investors must know you, like you, and trust you before they will fund you. And they are looking for what I call the three Cs in a business founder: character, confidence, and coachability.

What are the three 3 key elements of an investment strategy

There are three key factors that determine which investment strategy is right for you.Risk tolerance.Expected returns.Effort required to implement the strategy.

What are the 4 types of investments

Different Types of InvestmentsMutual fund Investment.Stocks.Bonds.Exchange Traded Funds (ETFs)Fixed deposits.Retirement planning.Cash and cash equivalents.Real estate Investment.

What are the 5 classes of investment

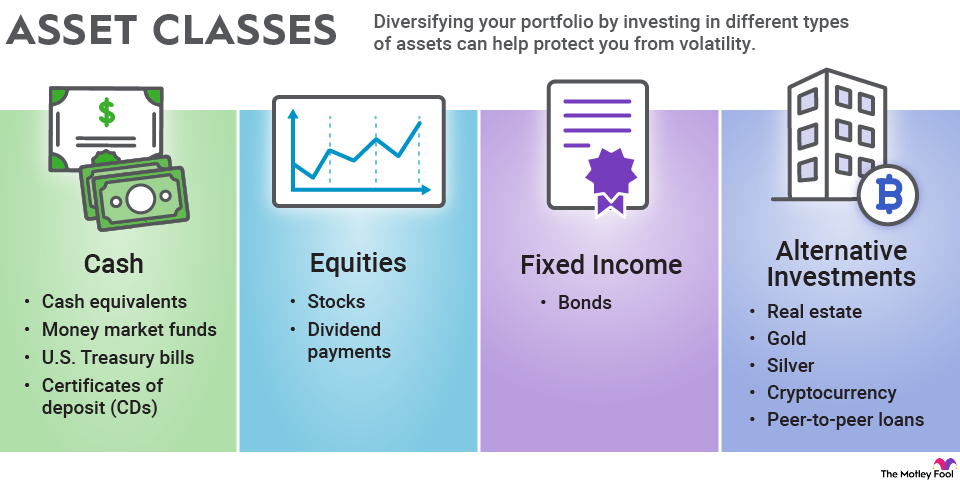

Asset classes are groups of similar investments. The five main asset classes are cash and cash equivalents, fixed-income securities, stocks and equities, funds, and alt investments.

What are the power of 3 investments

However, as you work toward your financial goals, you will find you actually have control over three of the most important drivers of investment success; time, money and return.

What are Level 3 investment assets

Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which determination of fair value requires significant management judgment or estimation.

What are the 4 C’s of investing

Note: This is one of five blogs breaking down the Four Cs and a P of credit worthiness – character, capital, capacity, collateral, and purpose.

What are the 7 types of investment

Read on to know what's right for you.Stocks. Stocks represent ownership or shares in a company.Bonds. A bond is an investment where you lend money to a company, government, and other types of organization.Mutual Funds.Property.Money Market Funds.Retirement Plans.VUL insurance plans.

What are the 6 investment asset classes

Equities (e.g., stocks), fixed income (e.g., bonds), cash and cash equivalents, real estate, commodities, and currencies are common examples of asset classes.

Which are the three most popular investments

The three most common kinds of investmentsBonds. A bond is essentially a loan you give to a government or company. And just like any other loan, it accrues interest over time.Stocks. A stock is a stake in a company.Mutual funds. A mutual fund is a collection of stocks and bonds overseen by an investment specialist.

What are the keys 3 to build wealth through investments

The first step is to earn enough money to cover your basic needs, with some left over for saving. The second step is to manage your spending so that you can maximize your savings. The third step is to invest your money in a variety of different assets so that it's properly diversified for the long haul.

What are the 3 main categories of assets asked for

There are broadly three types of asset distribution – 1) based on Convertibility (Current and Noncurrent Assets), 2) Physical Existence (Tangible and Intangible Assets), and 3) Usage (Operating and Non-Operating Assets).

What is core four portfolio

The Rick Ferri Core Four Portfolio is a Very High Risk portfolio and can be implemented with 4 ETFs. It's exposed for 80% on the Stock Market. In the last 30 Years, the Rick Ferri Core Four Portfolio obtained a 7.77% compound annual return, with a 12.08% standard deviation.

Which are the 4 core characteristics of impact investment

Characteristics of impact investing

These four characteristics are (1) Intentionality, (2) Evidence and Impact data in Investment Design, (3) Manage Impact Performance, and (4) Contribute to the growth of the industry.

What are four types of investments you should avoid

8 Types of Investments You Might Want to AvoidPenny stocks.Companies whose business you don't understand.Promises that seem too good to be true.Buzzworthy stock making headlines.Tips from family members or friends.Company stock.Cash.Companies with changeable leadership.

How do you classify investments

A simple way of classifying investments is to divide them into three categories or “investment methods” which include:Debt investments (loans)Equity investments (company ownership)Hybrid investments (convertible securities, mezzanine capital, preferred shares)

What are the 5 broad categories of assets

Common types of assets include current, non-current, physical, intangible, operating, and non-operating.

What are 3 high risk investments

While the product names and descriptions can often change, examples of high-risk investments include:Cryptoassets (also known as cryptos)Mini-bonds (sometimes called high interest return bonds)Land banking.Contracts for Difference (CFDs)

What are the big 3 in money management

Within the world of corporate governance, there has hardly been a more important recent development than the rise of the 'Big Three' asset managers—Vanguard, State Street Global Advisors, and BlackRock.

What are your top 3 assets

Your 3 greatest assets are not what you sell, it's not your customers, it's not your territory. Your three greatest assets are your time, your mind, and your network.