What are the 3 types of checking accounts?

What are the three main types of checking accounts

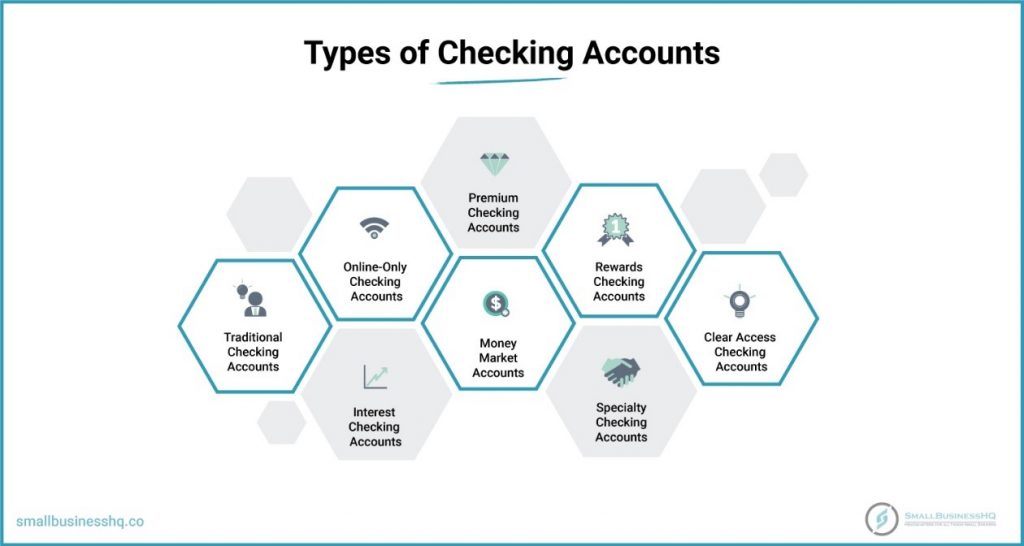

What are the different types of checking accountsStandard (or regular) checking account.Premium checking account.Interest-bearing account: These accounts often require a minimum balance to earn interest on your deposits.

Cached

What are the most common checking accounts

These are some of the most widely available types of checking accounts offered at banks and credit unions.Traditional checking account.Student checking account.Senior checking account.Interest-bearing account.Business checking account.Checkless checking.Rewards checking.Private bank checking.

Cached

Are there different types of checking accounts

Customers have many options to choose from that best suit their needs. The different types of checking accounts include student accounts, premium accounts, basic accounts, senior accounts, business accounts, rewards accounts, and interest accounts.

Cached

What are 3 features of a checking account

A checking account lets you pay bills, transfer money to savings, receive cash from ATMs and make purchases with your debit card.

Should I have 3 checking accounts

Having multiple checking accounts could be a good fit if you have certain transactions you need to keep track of separately. For example, you may want to have one personal checking account and another business checking account if you're self-employed, do gig work or run a small business.

What is better than a checking account

Because savings accounts are not made for everyday transactions, you can store money in the account for longer to collect interest. Savings accounts — especially high-yield savings accounts — typically offer higher annual percentage yields (APYs) than checking accounts, allowing you to grow your money faster.

What is the most I should keep in my checking account

The general rule of thumb is to try to have one or two months' of living expenses in it at all times. Some experts recommend adding 30 percent to this number as an extra cushion.

What is the easiest checking account to get

15 Easiest Bank Accounts to Open OnlineUFB Direct.Varo.Albert.Discover.Marcus.Chime.Chase Bank.Ally Bank.

What is the easiest checking account

15 Easiest Bank Accounts to Open OnlineUFB Direct.Varo.Albert.Discover.Marcus.Chime.Chase Bank.Ally Bank.

What is the most you should keep in a checking account

How much money do experts recommend keeping in your checking account It's a good idea to keep one to two months' worth of living expenses plus a 30% buffer in your checking account.

How much should you keep in checking

The general rule of thumb is to try to have one or two months' of living expenses in it at all times. Some experts recommend adding 30 percent to this number as an extra cushion.

Does it hurt to have too many checking accounts

Having multiple checking accounts could also mean more maintenance — and more fees — from the bank if you fall below the minimum balance requirements or inactivity thresholds. Be sure to stay on top of your finances to avoid paying any unnecessary fees or losing out on accruing interest.

Which is safer checking or savings

Which Is Safer: Checking or Savings In and of themselves, savings and checking accounts are equally safe. However, if you were to pit the two against each other in a “battle royale” of the most secure accounts, your savings account would edge out checking.

How much is too much to keep in a checking account

Unless your bank requires a minimum balance, you don't need to worry about certain thresholds. On the other hand, if you are prone to overdraft fees, then add a little cushion for yourself. Even with a cushion, Cole recommends keeping no more than two months of living expenses in your checking account.

What is the best bank to bank with

The Best Banks of 2023TD Bank: Best for customer service.Regions Bank: Best for avoiding monthly fees.U.S. Bank: Best in-person bank for CDs.Chase Bank: Best for a large branch network.Axos Bank: Best for online account options.Capital One Bank: Best online checking account.

What bank pays you to open a checking account

Best checking account bonuses ranked*

| BANK OR CREDIT UNION | BONUS | OPENING DEPOSIT |

|---|---|---|

| PNC Bank | $400 | $0 |

| SoFI | $250 | $0 |

| TD Bank | $300–$500 | $0 |

| Wells Fargo | $300 | $25 |

How much money is too much in checking account

Unless your bank requires a minimum balance, you don't need to worry about certain thresholds. On the other hand, if you are prone to overdraft fees, then add a little cushion for yourself. Even with a cushion, Cole recommends keeping no more than two months of living expenses in your checking account.

What is the maximum amount of money you should have in one bank

Anything over that amount would exceed the FDIC coverage limits. So if you keep more than $250,000 in cash at a single bank, then you run the risk of losing some of those funds if your bank fails.

What is the maximum you should keep in your checking account

The general rule of thumb is to try to have one or two months' of living expenses in it at all times. Some experts recommend adding 30 percent to this number as an extra cushion.

Is it OK to keep all your money in a checking account

Unless your bank requires a minimum balance, you don't need to worry about certain thresholds. On the other hand, if you are prone to overdraft fees, then add a little cushion for yourself. Even with a cushion, Cole recommends keeping no more than two months of living expenses in your checking account.