What are the 4 types of direct loans?

What are the four types of loans available under the William D Ford Federal Direct Loan Program

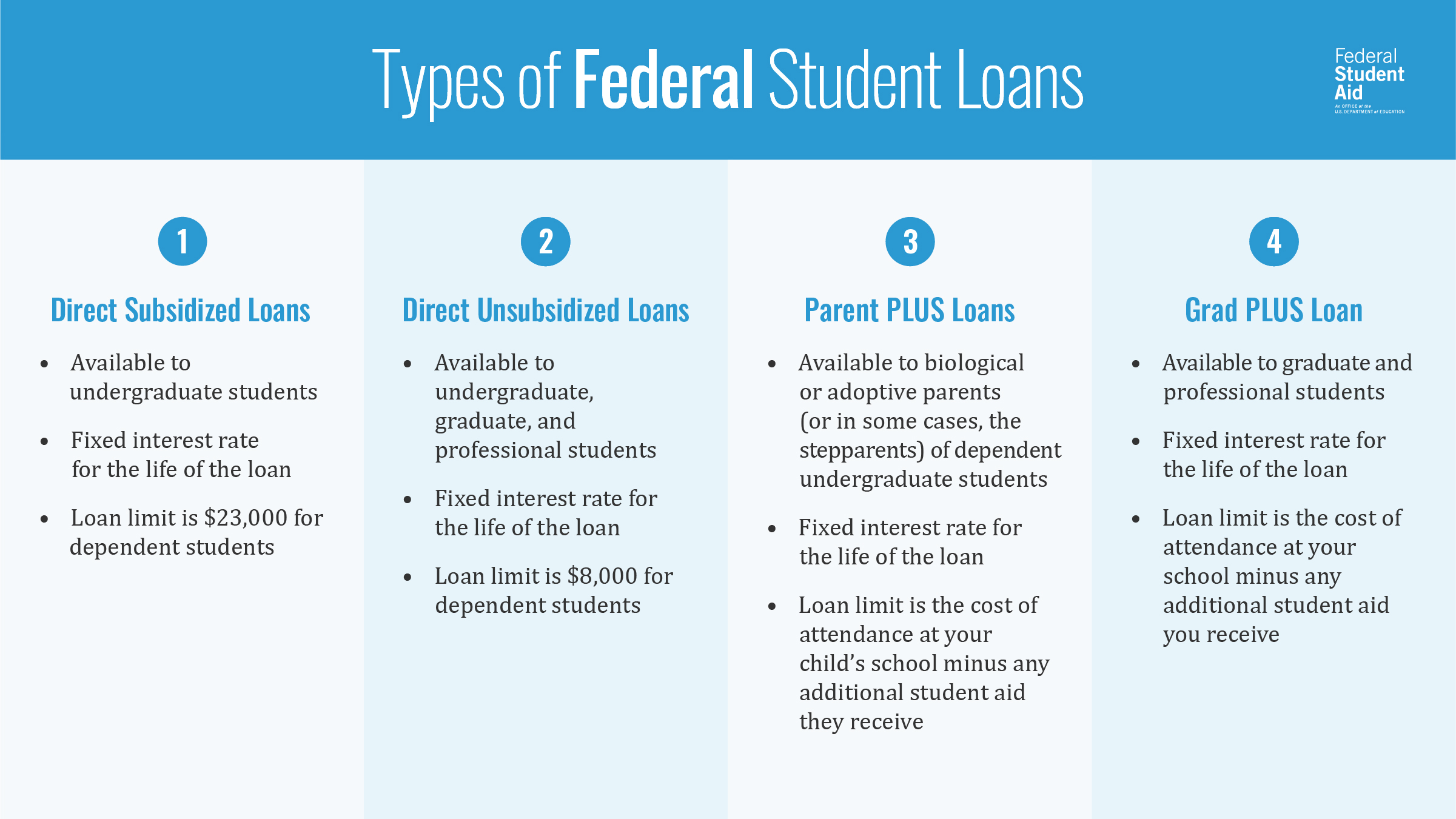

Ford Federal Direct Loan (Direct Loan) Program consists of the following types of loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidated Loans.

What loans are not direct loans

FFELs are also called "indirect loans." Private student loans, though, come from a bank, credit union, or private lender without government involvement. These loans are similar to any other kind of loan you might obtain from a bank or lender, like to buy a house or a car.

Cached

How does a direct loan work

Direct subsidized loans provide borrowers with an interest subsidy that lowers the interest they repay. The loans are deferred while the student is enrolled in college, and interest charges don't apply. Instead, the interest is paid by the Department of Education during deferment.

Cached

Does a direct loan have to be paid back

Once you graduate, drop below half-time enrollment, or leave school, your federal student loan goes into repayment. However, if you have a Direct Subsidized, Direct Unsubsidized, or Federal Family Education Loan, you have a six-month grace period before you are required to start making regular payments.

What are examples of direct loans

There are four types of Direct Loans:Direct Subsidized Loans.Direct Unsubsidized Loans.Direct PLUS Loans.Direct Consolidation Loans.

Do I have to pay back William D Ford Federal Direct loan

Repayment for Direct Stafford Loans begins 6 months after a student graduates or ceases attending school at least half-time. The standard repayment term is 10 years, although one can get access to alternate repayment terms (extended, graduated and income contingent repayment) by consolidating the loans.

How do you tell if a loan is a direct loan

A federal Direct Loan is a federal student loan made directly by the U.S. Department of Education. Generally, if you took out a federal student loan or consolidated your loans on or after July 1, 2010, you have a federal Direct Loan.

What is the difference between direct and non Direct Loans

Indirect vs Direct and What You Need to Know

Direct loans are loans that are originated directly from your credit union to your member or future member, the consumer. Indirect loans come through a car dealership or other venue that has your credit union as one of their network lender options.

Who is eligible for a direct loan

To be eligible for a Direct Subsidized Loan, you must be an undergraduate student with financial need. To apply for any Direct Loan, you must first complete and submit the Free Application for Federal Student Aid (FAFSA®) form.

Will my direct loan be forgiven

Will my student loans be forgiven All federally owned student loans are eligible for forgiveness. If you have Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, Direct Consolidation Loans or FFEL Loans owned by the U.S. Department of Education, they're all included in the forgiveness plan.

What are the disadvantages of a direct loan

Some drawbacks of federal direct loans are that there are no subsidized federal direct loans for graduate students, borrowers who default or become otherwise unable to repay their federal direct loans will not be able to escape them by declaring bankruptcy, and undergraduates who apply for direct unsubsidized loans and …

Does Direct Loans still exist

Direct Subsidized Loans are available only to undergraduate students who have financial need. Direct Unsubsidized Loans are available to both undergraduates and graduate or professional degree students. You are not required to show financial need to receive a Direct Unsubsidized Loan.

Will only direct loans be forgiven

Only federal Direct Loans can be forgiven through PSLF. If you have other federal student loans such as Federal Family Education Loans (FFEL) or Perkins Loans you may be able to qualify for PSLF by consolidating into a new federal Direct Consolidation Loan.

Do Direct Loans go to your bank account

Typically, student loans do not get deposited in your bank account. Instead, the loans are disbursed directly to the school where it is applied to tuition payments and room and board.

What is the direct loan limit

There are no fixed annual or aggregate loan limits for Direct PLUS Loans. The maximum Direct PLUS Loan amount that a graduate/professional student or parent can borrow is the cost of attendance minus other financial aid received. See the annual and aggregate limits for subsidized and unsubsidized loans.

Are Direct Loans eligible for loan forgiveness

The PSLF Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Are direct loans eligible for Biden loan forgiveness

What types of student loans qualify Nearly every type of federal student loan qualifies for forgiveness, including direct subsidized or unsubsidized loans and graduate or parent PLUS loans. If your loans qualified for the federal student loan payment pause, they're eligible for this forgiveness opportunity.

Are all direct loans eligible for forgiveness

All federally owned student loans are eligible for forgiveness. If you have Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, Direct Consolidation Loans or FFEL Loans owned by the U.S. Department of Education, they're all included in the forgiveness plan.

Are Direct Loans forgiven

PSLF forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Who qualifies for direct loan

To be eligible for a Direct Subsidized Loan, you must be an undergraduate student with financial need. To apply for any Direct Loan, you must first complete and submit the Free Application for Federal Student Aid (FAFSA®) form.