What are the 4 types of investment income?

What are the 4 types of investments

Different Types of InvestmentsMutual fund Investment.Stocks.Bonds.Exchange Traded Funds (ETFs)Fixed deposits.Retirement planning.Cash and cash equivalents.Real estate Investment.

What are 4 types of income

What You Need To Know About the 4 Types of IncomeEarned or Active Income. What it is: Earned or Active income is the most common way that people are taught to make money.Portfolio or Investment Income.Passive Income.

Cached

How do you categorize investment income

Investment income, money earned by financial assets or financial accounts, comes in three basic forms: interest, dividends, and capital gains. Bonds generate interest; stocks generate dividends; and capital gains (profits) can come from any investment.

Cached

What is considered investment income for tax purposes

In general, net investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income.

What are the 5 classes of investment

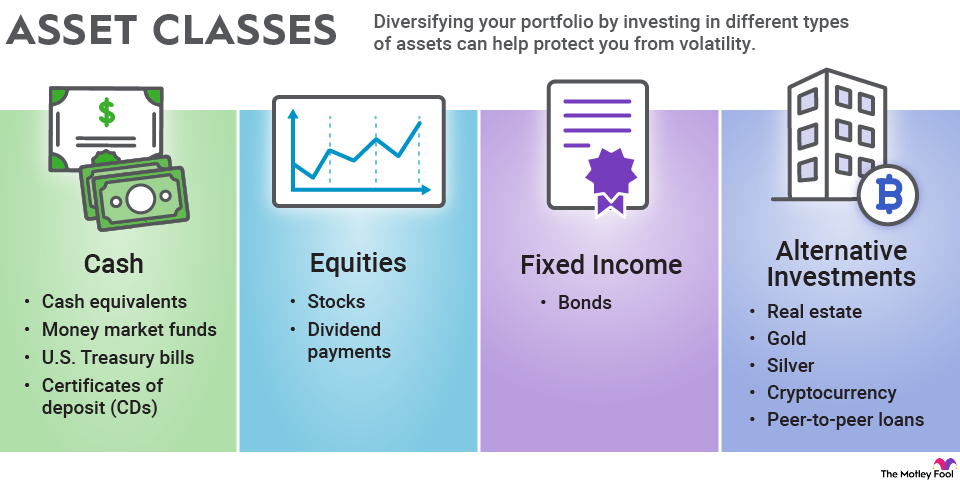

Asset classes are groups of similar investments. The five main asset classes are cash and cash equivalents, fixed-income securities, stocks and equities, funds, and alt investments.

What are the 4 C’s of investing

Note: This is one of five blogs breaking down the Four Cs and a P of credit worthiness – character, capital, capacity, collateral, and purpose.

What are the 5 classes of income

One objective way some researchers divide individuals into economic classes is by looking at their incomes. From that data, they split earners into different classes: poor, lower-middle class, middle class, upper-middle class and wealthy.

What are the 6 types of income

Let's dig in.Earned Income. Earned income is the most common and traditional form of income that most people receive through their employment.Capital Gains.Interest Income.Dividend Income.Rental Income.Business Income.Royalty Income.

What is the difference between earned income and investment income

Earned income includes wages, salary, tips and commissions. Passive or unearned income could come from rental properties, royalties and limited partnerships. Portfolio or investment income includes interest, dividends and capital gains on investments.

How do you record investment income

The investor records their share of the investee's earnings as revenue from investment on the income statement. For example, if a firm owns 25% of a company with a $1 million net income, the firm reports earnings from its investment of $250,000 under the equity method.

How do you avoid tax on investment income

9 Ways to Avoid Capital Gains Taxes on StocksInvest for the Long Term.Contribute to Your Retirement Accounts.Pick Your Cost Basis.Lower Your Tax Bracket.Harvest Losses to Offset Gains.Move to a Tax-Friendly State.Donate Stock to Charity.Invest in an Opportunity Zone.

How much investment income is tax free

Here are the MAGI thresholds for net investment income tax:

| Filing status | MAGI threshold |

|---|---|

| Single | $200,000 |

| Married filing jointly | $250,000 |

| Married filing separately | $125,000 |

What are the 7 types of investment

Read on to know what's right for you.Stocks. Stocks represent ownership or shares in a company.Bonds. A bond is an investment where you lend money to a company, government, and other types of organization.Mutual Funds.Property.Money Market Funds.Retirement Plans.VUL insurance plans.

What are the 6 investment asset classes

Equities (e.g., stocks), fixed income (e.g., bonds), cash and cash equivalents, real estate, commodities, and currencies are common examples of asset classes.

What is the 5 rule of investing

This sort of five percent rule is a yardstick to help investors with diversification and risk management. Using this strategy, no more than 1/20th of an investor's portfolio would be tied to any single security. This protects against material losses should that single company perform poorly or become insolvent.

What are the 8 types of income

Here are 8 types of income streams that you should know about.Earned income. The most basic form of income stream – it's the income that we get in exchange for our time and effort like the salary from our jobs.Profit.Interest income.Dividend income.Rental income.Capital gains.Royalty income.Residual income.

What are the 7 types of income

These included, earned income (the main job), business income (the hobbies/side hustles), dividend income, interest income, rental income, capital gains, and royalty income. She went on to highlight the importance of keeping track of all these streams of income as well as the money that's going out.

What are the 5 income categories

One objective way some researchers divide individuals into economic classes is by looking at their incomes. From that data, they split earners into different classes: poor, lower-middle class, middle class, upper-middle class and wealthy.

What does the IRS consider earned income

For the year you are filing, earned income includes all income from employment, but only if it is includable in gross income. Examples of earned income are: wages; salaries; tips; and other taxable employee compensation. Earned income also includes net earnings from self-employment.

Does retirement income count as earned income

Earned income does not include investment income, pension payments, government retirement income, military pension payments, or similar types of "unearned" income.