What are the 5 factors that influence interest rates?

What are the 3 main factors that affect interest rates

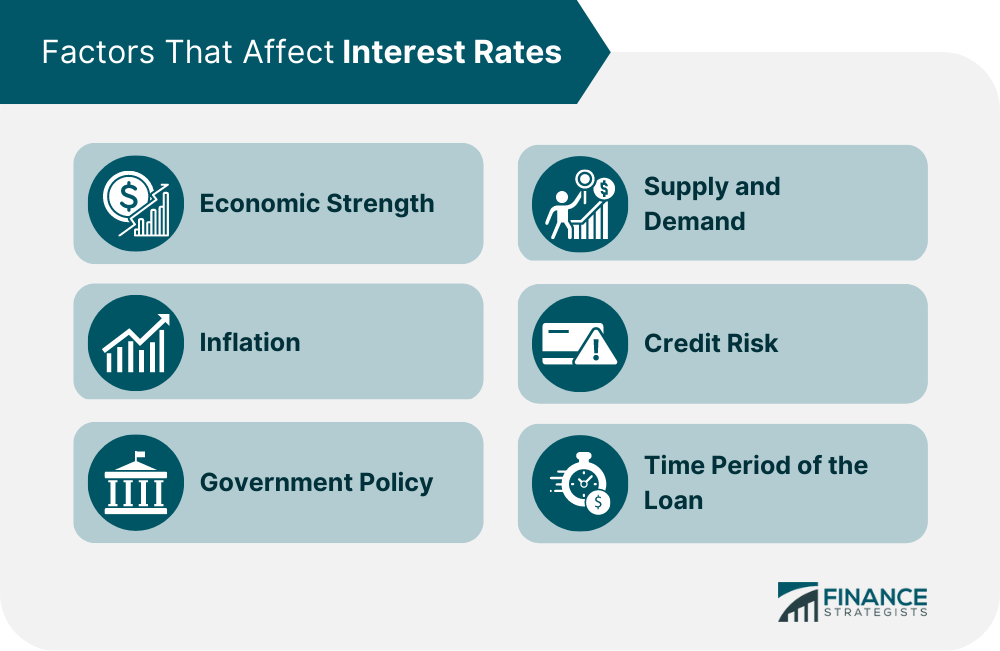

Let us consider five of the most important factors.The strength of the economy and the willingness to save. Interest rates are determined in a free market where supply and demand interact.The rate of inflation.The riskiness of the borrower.The tax treatment of the interest.The time period of the loan.

Cached

What factors influence interest rates

What influences Interest RatesInflation.Stock market conditions.International Investors.Fiscal deficit and government borrowings.

What are the 5 components of interest

Interest Rate ComponentsReal Interest Rates. One of the interest rate components is the real interest rate, which is the compensation, over and above inflation, that a lender demands to lend his money.Inflation.Liquidity Risk Premium.Credit Risk.

What is the most important factor affecting interest rates over time

The most important factor in determining why interest rates change is the supply of funds available from lenders and the demand from borrowers. Let's use the mortgage market for our example. In a period when many people are borrowing money to buy houses, banks need to have funds available to lend.

Cached

What’s causing interest rates to rise

Central banks cut interest rates when the economy slows down in order to reinvigorate economic activity and growth. Rates go up when the economy is hot. The goal of cutting rates is to reduce the cost of borrowing so that people and companies are more willing to invest and spend.

What are two key factors in determining interest rate

Here are seven key factors that affect your interest rate that you should knowCredit scores. Your credit score is one factor that can affect your interest rate.Home location.Home price and loan amount.Down payment.Loan term.Interest rate type.Loan type.

Does inflation affect interest rates

Higher interest rates are generally a policy response to rising inflation. Conversely, when inflation is falling and economic growth slowing, central banks may lower interest rates to stimulate the economy.

What are the three C’s of interest

These 3 C's of Credit are Character, Capital and Capacity based on which the lender decides on lending you.

What is an example of 5 interest

For example, if you borrowed $100 from a friend and agree to repay it with 5% interest, then the amount of interest you would pay would just be 5% of 100: $100(0.05) = $5. The total amount you would repay would be $105, the original principal plus the interest.

What will happen to interest rates in 2023

Are mortgage rates expected to rise or fall during 2023 The consensus is that mortgage rates will gradually decline throughout the year, even if interest rates go up. Some predict that fixed rates could fall below 4 per cent by early 2024.

How high will interest rates go in 2023

Since the start of 2023, the Fed has hiked rates 10 times to combat rising inflation. As of May 2023, the federal funds rate ranges from 5.00% to 5.25%. If this prediction is correct, it won't be surprising to see some of the best high-yield savings accounts offering rates exceeding 4%.

Why raise interest rates when inflation is high

Higher rates may be needed to bring rising inflation under control, while slowing economic growth often lowers the inflation rate and may prompt rate cuts. The Fed targets a range of the federal funds rate, in part, by setting the rate it pays on banking reserve balances.

What causes interest rates to rise

Central banks cut interest rates when the economy slows down in order to reinvigorate economic activity and growth. Rates go up when the economy is hot. The goal of cutting rates is to reduce the cost of borrowing so that people and companies are more willing to invest and spend.

What 2 factors can increase interest paid on a mortgage

Here are seven key factors that affect your interest rate that you should knowCredit scores. Your credit score is one factor that can affect your interest rate.Home location.Home price and loan amount.Down payment.Loan term.Interest rate type.Loan type.

Who benefits from inflation

Inflation benefits those with fixed-rate, low-interest mortgages and some stock investors. Individuals and families on a fixed income, holding variable interest rate debt are hurt the most by inflation.

Do interest rates rise when inflation is high

Real interest rates have rapidly increased recently as monetary policy has tightened in response to higher inflation. Whether this uptick is temporary or partly reflects structural factors is an important question for policymakers.

What is a good credit score

670 to 739

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What are three simple interest examples

Car loans, amortized monthly, and retailer installment loans, also calculated monthly, are examples of simple interest; as the loan balance dips with each monthly payment, so does the interest. Certificates of deposit (CDs) pay a specific amount in interest on a set date, representing simple interest.

What are the 7 types of interest rates

But broadly, here are the seven standard types of interest rates that you'll see among various financial products:Simple interest.Compound interest.Effective Interest.Fixed interest.Variable interest.Real interest.Accrued interest.

What are the four types of interest rates

Table of contents#1 – Fixed Interest Rate.#2 – Variable Interest Rate.#3 – Annual Percentage Rate.#4 – Prime Interest Rate.#5 – Discounted Interest Rate.#6 – Simple Interest Rate.#7 – Compound Interest Rate.Recommended Articles.