What are the 5 liquidation process?

What are the steps of liquidation

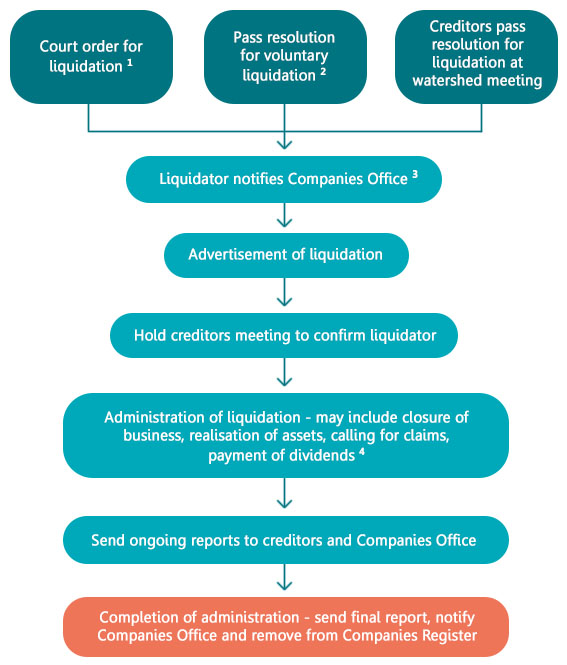

The administration of the liquidation begins.

selling or closing the business. identifying and selling the company's assets. contacting and receiving claims from creditors. sending progress reports to creditors.

What are the 4 causes of liquidation

The business cannot pay its debts as and when they fall due. Liabilities exceed total assets. The business is making losses and there are minimal prospects to turn it around. The directors are finding it hard to cope with the stress and pressure of trading.

What is the start of liquidation process

Any liquidation process usually begins with the company directors recognising that the business is in financial difficulty, or expressing a desire to close the company down. Profits may be down, sales stagnating or creditors may be hounding the accountants to be paid.

What is an example of liquidation process

What is an example of liquidation Liquidation is the process of selling off assets to repay creditors and dissolve a business. An example of liquidation would be a company selling off its inventory, property, and other assets in order to pay its creditors and close its doors.

Cached

What are the six forms of liquidation of a company

We'll explore the three types of liquidation, explaining when each is appropriate.Compulsory Liquidation.Creditors' Voluntary Liquidation.Members' Voluntary Liquidation.

What are the 4 steps in partnership liquidation

The process of liquidating a partnership involves four steps:Adjust and close accounts and prepare a trial balance.Sale of non-cash assets and allocation of gain/loss on realization.Payment of partnership liabilities.Distribution of remaining cash to partners.

What are the 3 types of liquidation

So let's look at the three types of liquidation, starting with the two procedures for insolvent companies.Creditors' Voluntary Liquidation.Compulsory liquidation.Members' Voluntary Liquidation (MVL) for solvent companies.

How long does liquidation process take

The entire process usually takes between six months and two years, depending on the complexity of the company and the number and nature of assets to be realised. If the liquidators embark on litigation, this process can extend for a number of years.

Who gets money first in liquidation

secured creditors

In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders.

What is the order of payment in liquidation

In summary, the priority of payments in a company liquidation is as follows: secured creditors, preferential creditors, unsecured creditors, and finally, shareholders.

What are the methods of liquidation of a company

The three most prevalent kinds of liquidation are compulsory liquidation, members' voluntary liquidation, and creditors' voluntary liquidation.

What are the three different ways a company can be liquidated

creditors' voluntary liquidation – your company cannot pay its debts and you involve your creditors when you liquidate it. compulsory liquidation – your company cannot pay its debts and you apply to the courts to liquidate it. members' voluntary liquidation – your company can pay its debts but you want to close it.

What are the five 5 ways in which a partnership may be dissolved

In simpler words, a partnership may be dissolved by agreement, operation of law, death or bankruptcy, charging on shares, supervening illegalities and lastly by court order.

What are the two methods of liquidation

A solvent company can use Members' Voluntary Liquidation (MVL) to close down following the distribution of funds to shareholders. For insolvent companies, Creditors' Voluntary Liquidation (CVL) and compulsory liquidation are the two procedures.

Who gets the money when you get liquidated

The shareholders appoint a liquidator who dissolves the company by collecting the assets of the solvent company, liquidating the assets, and distributing the proceeds to employees who are owed wages and to creditors in order of priority.

Who gets paid last during a liquidation

the shareholders

The last group to receive payment when a company goes into liquidation are the shareholders. Since shareholders have taken a business risk in lending funds to the company, they have no entitlement to distribution till all other group of creditors have received payment.

What is the order of payout in liquidation

Summary. In summary, the priority of payments in a company liquidation is as follows: secured creditors, preferential creditors, unsecured creditors, and finally, shareholders.

Who gets paid back first in the event of insolvency

Secured creditors

Secured creditors like banks are going to get paid first. This is because their credit is secured by assets—typically ones that your business controls. Your plan and the courts may consider how integral the assets are that secure your loans to determine which secured creditors get paid first though.

How do you force a company to liquidate

Compulsory liquidation is usually initiated by creditors via a winding-up petition in the High Court. Less commonly, it can be initiated by directors, shareholders or: an Official Receiver (an officer of the High Court) administrative receiver.

What are the 4 steps in liquidating a partnership

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.