What are the 5 payroll steps?

What are the steps to run payroll

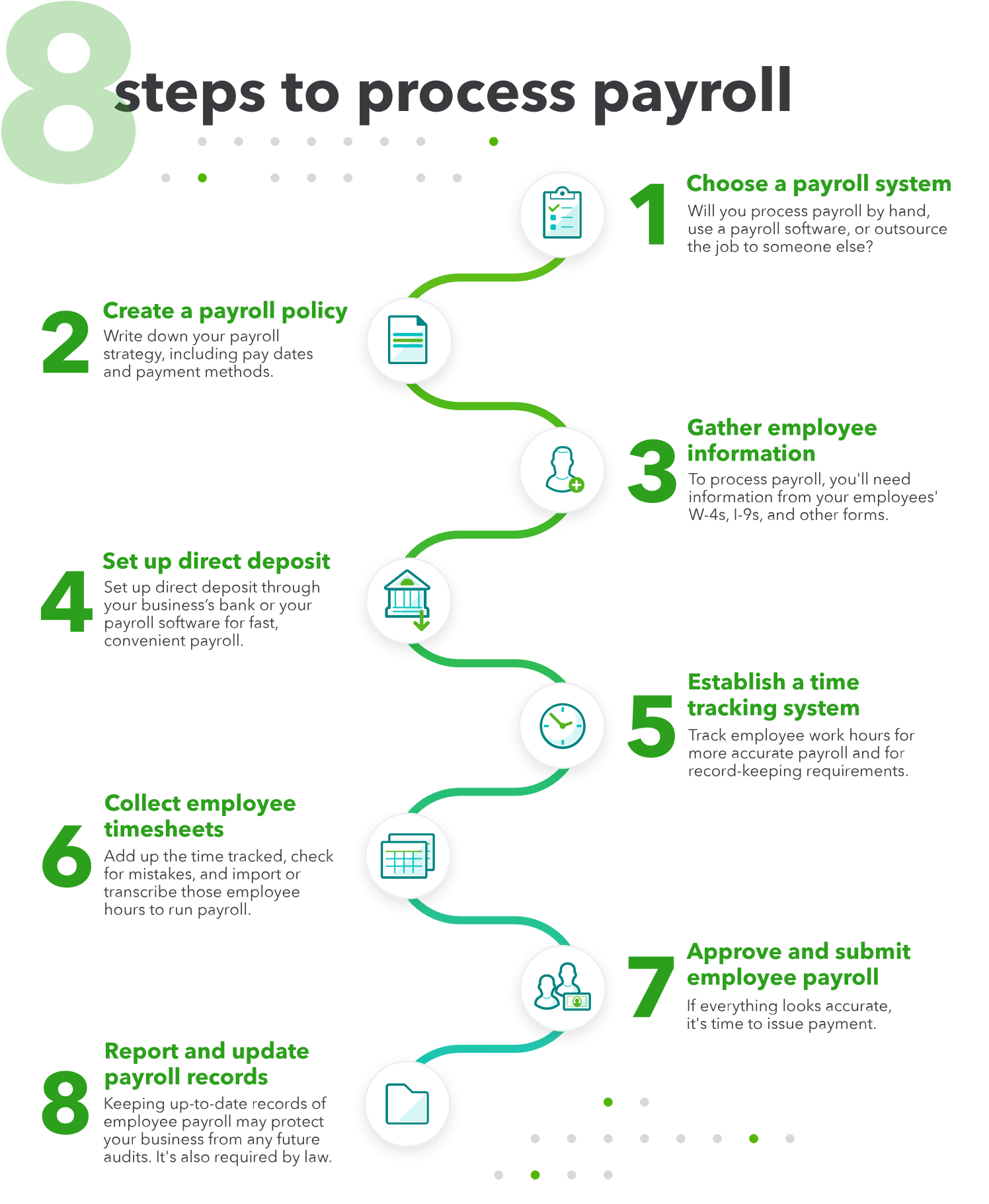

Generally, you will need to follow these eight steps to process payroll:Gather time card information.Compute gross pay.Calculate payroll taxes.Determine employee deductions.Calculate net pay.Approve payroll.Pay employees.Distribute pay stubs.

Cached

How do you do payroll for beginners

How to do payroll yourself in 9 stepsStep 1: Collect your tax information.Step 2: Ask employees to fill out an Employee Withholding Certificate.Step 3: Determine a payroll schedule.Step 4: Calculate gross pay and withhold tax deductions.Step 5: Process payroll deductions.Step 6: Calculate net pay and run payroll.

What is a payroll processing checklist

The checklist should include things to check for when paying wages. This includes: entering and coding regular and overtime hours; making wage adjustments; paying bonuses, commissions, severance pay, salaries and company benefits, such as auto payments and vacation, personal and sick time.

What are the six steps in managing a payroll system

What are the six steps in managing a payroll systemApply for an employer identification number (EIN)Gather employee tax documents.Determine a payroll schedule.Document terms of compensation.Choose a method for processing payroll.Open a bank account for payroll.

What are the 4 steps of accounting for payroll transactions

The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare an unadjusted trial balance.

What are the four payroll processing methods

It also requires employers to adhere to all current local, state and federal mandates regarding payroll taxes, benefits and worker's compensation. There are four main ways employees can be paid (cash, check, direct deposit or debit card).

Is payroll easy to learn

As we've seen, payroll is something that can be difficult and challenging for beginners, but it's not something that necessarily has to be like this. If you want to stick to manual methods, you'll want to first break down each aspect of payroll into its necessary parts, and make your way through one at a time.

What is the full cycle payroll

What is full-cycle payroll processing The amount of time in between each pay day is known as a payroll cycle. It can be as short as a week or as long as a month. During this period, several repeatable steps take place: Employees work and track their hours.

What 4 things are employers payroll systems required to do

The Five Payroll Basics Every Employer Should KnowPay periods and paydays.Collecting employee and employer taxes.Paying and filing taxes.Federal, state, and local laws.Timekeeping.

How do I manually prepare payroll

How to do payroll taxes manuallyStep 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.

What is the basic accounting of payroll

Payroll accounting consists of filing and tracking employee compensation data like money withheld from each paycheck and taxes and benefits the employee receives. Payroll accountants use financial journal entries to summarize an organization's transactions and total cash flow.

What is journal entry for payroll

What Is a Payroll Journal Entry A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. That way, you can look back and see details about employee compensation, such as when you paid it, how much it was, and where the money went.

What are 2 different types of payroll systems

Four Types Of Payroll Systems Internally Managed Payroll Systems. Professionally Managed Payroll Systems. Payroll Services Managed by Payroll System Agencies. Software Managed Payroll Systems.

Do you have to be good at math to work in payroll

Strong Mathematical Abilities

A great payroll specialist will have strong math skills. Payroll involves a lot of calculations, including determining gross pay, deductions, and net pay for each employee. A payroll specialist must be able to perform these calculations quickly and accurately.

How many hours does it take to do payroll

Businesses with payroll processing solutions typically finish internal processes in one to two days. After payroll is submitted to the bank, it takes two to three days for wages to be deposited into employee bank accounts. So, employees receive their paychecks, on average, within five days of the pay period end date.

What is the most common payroll cycle

The biweekly pay period is the most common, followed next by weekly, then semimonthly, then monthly.

What are the 4 common pay cycles

Weekly, bi-weekly (every two weeks), semi-monthly (twice a month on a specific day), and monthly are the four most typical pay periods (once a month).

What are the three payroll records usually needed by an employer

For each employee, payroll records commonly consist of: Personal information (name, address, etc.) Employment information (offer letters, evaluations, etc.) Exemption status and rate of pay.

How hard is payroll to learn

As we've seen, payroll is something that can be difficult and challenging for beginners, but it's not something that necessarily has to be like this. If you want to stick to manual methods, you'll want to first break down each aspect of payroll into its necessary parts, and make your way through one at a time.

Can I process my own payroll

Yes, you can run your own small business payroll, but it is not always the best idea. Running payroll without services can save you a few hundred dollars today, but it could cost you in the long run. In order to save money, many small business owners do payroll manually rather than using payroll software or services.