What are the benefits of cosigning?

What are the pros and cons of cosigning

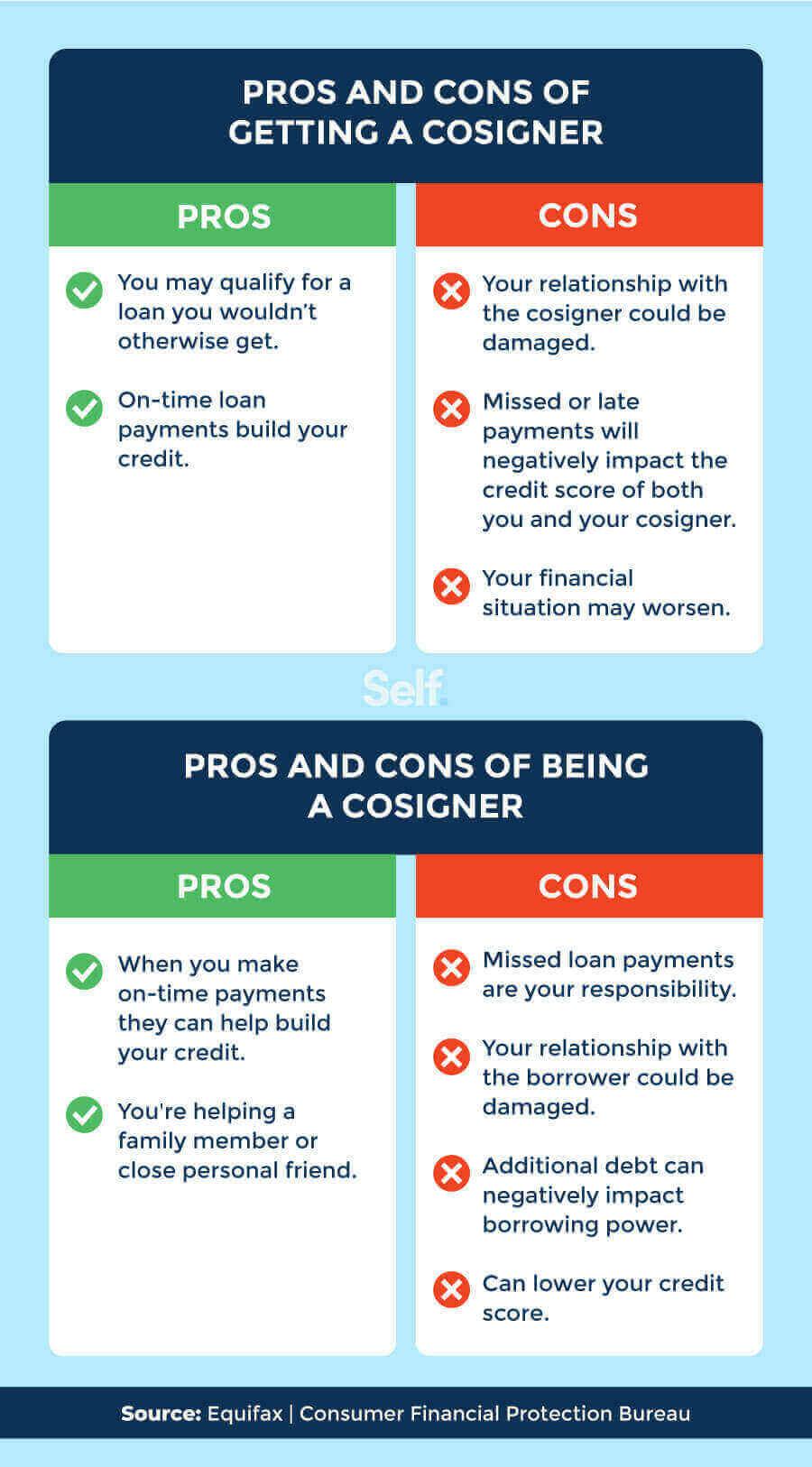

Pros and Cons of Cosigning a LoanPro: You're helping another person. Of course, you want your daughter to have a late-model car with all the newest safety features when she heads to college.Con: Your credit could take a hit.Con: You might get turned down for credit.Con: The relationship could go south.

Cached

What is the advantage of cosigning

The benefits of cosigning a loan

Cosigning for your child allows them to start building the credit history they need while reassuring the lender that they'll get repaid.

Cached

What are the benefits of taking out a loan with a cosigner

A co-signer may increase your chance of approval, give you access to better loan terms and — over time — help you improve your credit score as you pay back your auto loan. Improve your chance of approval. A co-signer adds to your application if you don't have an extensive credit history or have a poor credit score.

Cached

Is it ever a good idea to cosign

The bottom line is this: co-signing on a loan for anyone is never a good idea. If you feel compelled, lend them some money with a written agreement on how it is to be repaid. But never put your credit on the line by co-signing documents with a lender.

Cached

Why is it risky to be a co-signer

The lender can sue the cosigner for interest, late fees, and any attorney's fees involved in collection. If the primary borrower falls on hard times financially and cannot make payments, AND the cosigner fails to make the payments, the lender may also decide to pursue garnishment of the wages of the cosigner.

Is it smart to cosign

The bottom line. The decision to sign on as a co-signer comes down to the trust you have in the primary borrower. If you believe they will meet their payments and are willing to risk your own finances, then helping a friend or family member may be the right thing to do. Otherwise, it is best to say no to this agreement …

Does cosigning raise your credit score

How does being a co-signer affect my credit score Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

Who gets the credit on a cosigned loan

The cosigner is responsible for paying back loan if the primary signer stops paying or is unable to pay. The loan becomes part of the co-signer's credit history. It's hard to get removed from the loan.

Can a cosigner take themselves off

Fortunately, you can have your name removed, but you will have to take the appropriate steps depending on the cosigned loan type. Basically, you have two options: You can enable the main borrower to assume total control of the debt or you can get rid of the debt entirely.

What are the risks for a co-signer

Be sure you can afford to pay the loan. If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

How do I protect myself as a cosigner

5 ways to protect yourself as a co-signerServe as a co-signer only for close friends or relatives. A big risk that comes with acting as a loan co-signer is potential damage to your credit score.Make sure your name is on the vehicle title.Create a contract.Track monthly payments.Ensure you can afford payments.

Does Cosigning raise your credit score

How does being a co-signer affect my credit score Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

Who gets the credit score if you have a cosigner

Co-signing a loan can help or hurt your credit scores. Having a co-signer on the loan will help the primary borrower build their credit score (as long as they continue to make on-time payments).

What are the risks of cosigning

Precautions to Take Before You Cosign

Be sure you can afford to pay the loan. If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

What credit score does a cosigner have to have

670 or better

Although lender requirements vary, a cosigner generally needs a credit score that is at least considered "very good," which usually means at least 670 or better.

How much credit does a cosigner get

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

What rights does a co-signer have

Being a co-signer doesn't give you rights to the property, car or other security that the loan is paying for. You are the financial guarantor, meaning you must make sure the loan gets paid if the primary borrower fails to do so.

What power does a cosigner have

Being a co-signer doesn't give you rights to the property, car or other security that the loan is paying for. You are the financial guarantor, meaning you must make sure the loan gets paid if the primary borrower fails to do so.

Can a cosigner take your name off

Fortunately, you can have your name removed, but you will have to take the appropriate steps depending on the cosigned loan type. Basically, you have two options: You can enable the main borrower to assume total control of the debt or you can get rid of the debt entirely.

Does Cosigning help build credit

A co-signer can also help you improve your credit score if it is low due to past financial missteps. Payment history accounts for 35 percent of your credit score, so keeping current on the auto loan payments over the loan term could help boost your score — assuming you manage all other debts responsibly.