What are the benefits of joining a credit union?

What are 5 benefits of a credit union

In addition to financial education and counseling, credit unions often offer consumer loans, shared branches with other credit unions, electronic banking, ATMs, home equity loans, mortgage loans, car loans, member business loans, credit cards, overdraft protection and more.

Cached

What is an advantage of joining a credit union instead of a regular bank

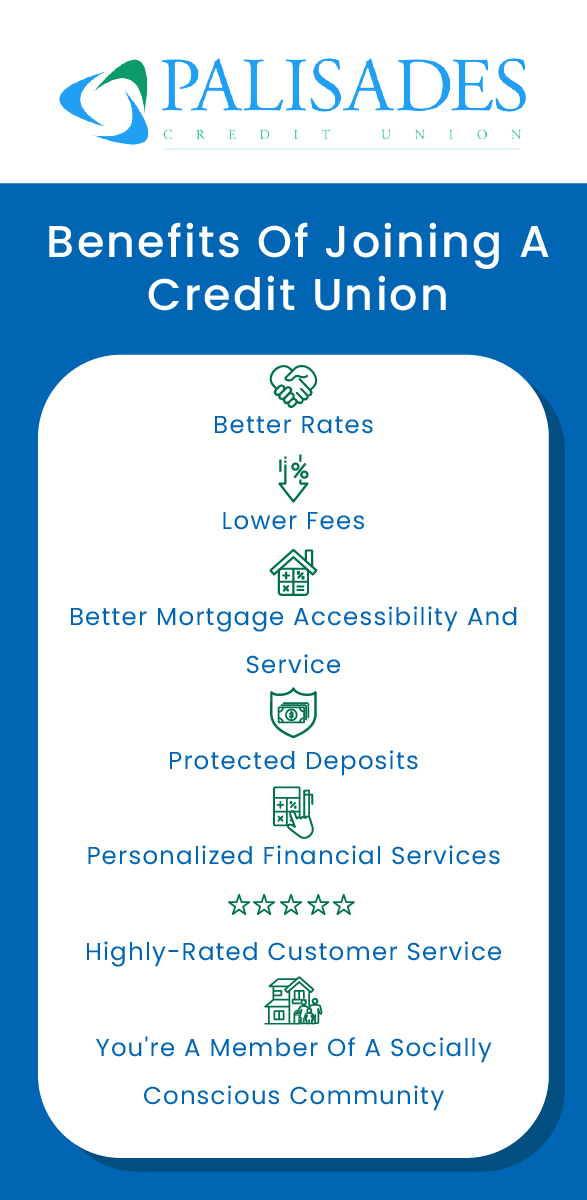

Credit unions typically offer lower fees, higher savings rates, and a more personalized approach to customer service for their members. In addition, credit unions may offer lower interest rates on loans.

Are credit unions worth it

Why Choose a Credit Union Lower interest rates on loans and credit cards; higher rates of return on CDs and savings accounts. Since credit unions are non-profits and have lower overhead costs than banks, we are able to pass on cost savings to consumers through competitively priced loan and deposit products.

What are one of the drawbacks of a credit union

The downside of credit unions include: the eligibility requirements for membership and the payment of a member fee, fewer products and services and limited branches and ATM's. If the benefits outweigh the downsides, then joining a credit union might be the right thing for you.

Do credit unions build credit

Joining a credit union won't help build your credit score on its own, but it can be a good first step toward building your credit. Here are a few other ways that you can build your credit score: Use a credit card cosigner to increase your approval odds. Apply for a secured credit card, which requires making a deposit.

Why should I switch to a credit union

You'll save more money.

Instead of paying shareholders a portion of the profit generated, credit unions return their profits to their member-owners in the form of better dividends on savingsOpens in a new window, lower interest rates on loans, interest-earning checking and fewer fees.

Do credit unions help build credit

Joining a credit union won't help build your credit score on its own, but it can be a good first step toward building your credit. Here are a few other ways that you can build your credit score: Use a credit card cosigner to increase your approval odds. Apply for a secured credit card, which requires making a deposit.

Are banks safer than credit unions

Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks.

Do credit unions increase credit score

Does a Credit Union Credit Card Help Build Your Credit Score A credit union credit card helps you build your credit score just like any other credit card. When you make payments toward your credit union card, you can expect your card's issuer to report your payment history to credit bureaus.

Is your money safer in a credit union or a bank

Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks.

Why would you not use a credit union

Limited accessibility. Credit unions tend to have fewer branches than traditional banks. A credit union may not be close to where you live or work, which could be a problem unless your credit union is part of a shared branch network and/or a large ATM network like Allpoint or MoneyPass.

Do credit unions affect credit score

Does a Credit Union Credit Card Help Build Your Credit Score A credit union credit card helps you build your credit score just like any other credit card. When you make payments toward your credit union card, you can expect your card's issuer to report your payment history to credit bureaus.

What are three cons of a credit union

Cons of credit unionsMembership required. Credit unions require their customers to be members.Not the best rates.Limited accessibility.May offer fewer products and services.

Do credit unions help credit score

Does a Credit Union Credit Card Help Build Your Credit Score A credit union credit card helps you build your credit score just like any other credit card. When you make payments toward your credit union card, you can expect your card's issuer to report your payment history to credit bureaus.

Do credit unions run your credit score

A bank or credit union may make a soft inquiry on your credit when you open a new checking account to check for a history of fraud. These soft checks do not affect your credit score. However, in some cases, a bank may perform a hard credit check, which does affect your credit score.

Who is the best credit union

Here are the highest credit union savings account rates for June 2023Blue Fed, APY: 5.00%, Min. Balance to Earn APY: $0.Alliant Credit Union, APY: 3.10%, Min. Balance to Earn APY: $100.Consumers Credit Union, APY: 2.00%, Min.First Tech Federal Credit Union, APY: 0.90%, Min.Navy Federal Credit Union, APY: 0.25%, Min.

Are credit unions safe from banking collapse

Rest assured, Tom. Credit unions are generally safe. These financial institutions are not-for-profit cooperatives owned by their members and focused on their communities' needs, while banks are for-profit enterprises. Experts told us that credit unions do fail, like banks (which are also generally safe), but rarely.

Where is the safest place to keep your money

What are the safest types of investments U.S. Treasury securities, money market mutual funds and high-yield savings accounts are considered by most experts to be the safest types of investments available.

What credit scores do credit unions require

A credit score of 690-719 is considered “good.” In general, having a credit score of at least 700 will make your loan application process quicker, as it's less likely you'll have to explain blemishes on your credit.

What is a good credit score for credit union

between 670 and 739

A good FICO Score falls between 670 and 739, while an exceptional score measures 800 and above. A good VantageScore ranges from 700 to 749, while an excellent score is 750 and above. The higher the number, the lower the perceived credit risk.