What are the disadvantages of auto pay?

What are the pros and cons of autopay

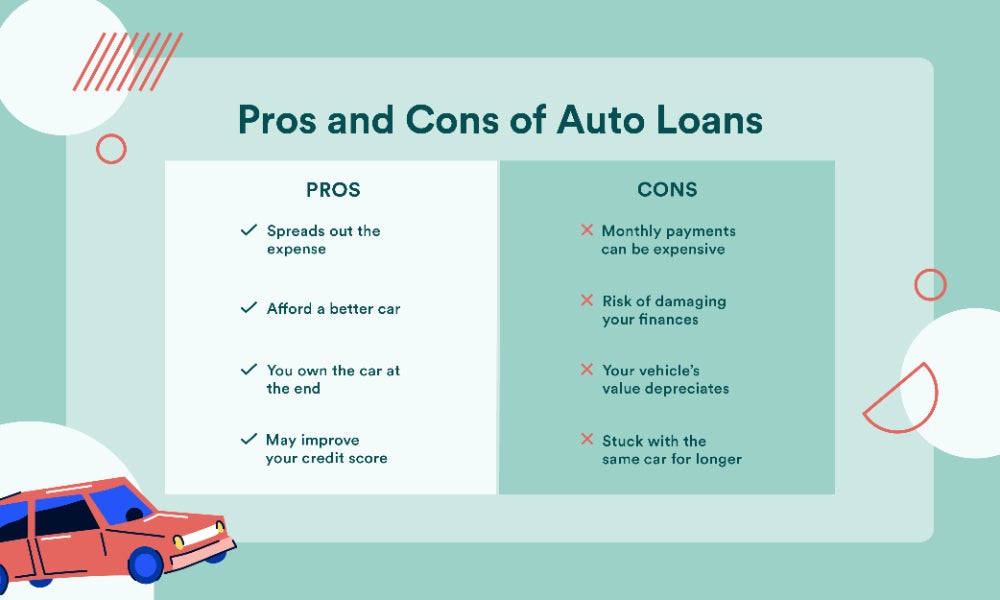

The Pros and Cons of AutopayPro: On-Time Payments. Automatic bill pay means your bills are scheduled to be paid automatically, and on time, every month.Con: Potential Overdraft Fees.Pro: Builds Credit.Con: Potential Billing Mistakes.Con: Potential Identity Theft.Pro: Good for the Environment.

Cached

Is autopay good or bad

Autopay is best suited for essential, non-variable bills, but isn't necessarily the best option for every type of bill payer. Autopay eases a lot of the stress associated with remembering to pay bills. It helps you avoid lapses in important services — even if that means you acquire a fee in the process.

Why do companies want you to use autopay

By far, the biggest benefit is that it brings in more cash flow. When customers know that they can automatically pay their bill each month without having to worry about late fees or penalties, they are more likely to stick with your company and less likely to go elsewhere.

Does autopay hurt credit score

When it comes to payments that are reported to credit bureaus, as long as your payment arrives on time, automatic payments don't affect your credit scores any more than if you'd dropped your payment in the nearest mailbox. That being said, auto payments can help you consistently pay your bills on time.

What bills should you never put on autopay

Don't use automatic payments for bills where the total fluctuates each time: think utility bills and cable bills that could end up being a different total each month. You should also avoid paying certain bills with cash—including utility bills.

Is setting up autopay a good idea

It Could Save You Money

Some lenders give borrowers a small interest rate discount for using autopay, and a reduced interest rate could save you money over the life of your loan. Using autopay can also save you money by helping you avoid late payment penalties.

Should you turn on automatic payments

Automatic payments could help your credit score, but only if you time the payment to happen before the credit card's statement due date and around the same time you know there will be enough money into your bank account. Making even one late payment could ultimately hurt your credit score.

Is autopay safe and secure

Yes, autopay is a safe practice and carries no more inherent risks than other types of payment. However, because you are providing the company with your bank account info, some additional safety steps should be taken. Verify the company: Never provide your bank account information to a company you do not fully trust.

Can you opt out of auto pay

Call and write the company. Tell the company that you are taking away your permission for the company to take automatic payments out of your bank account. This is called "revoking authorization."

Is it better to auto pay with credit card or bank account

Paying bills with a credit card might help your credit score if: It helps you pay on time. If you struggle to remember payment due dates, setting up automatic payments with a credit card can help prevent missed payments without worrying about insufficient funds in your checking account.

What is the best way to automatically pay bills

Set up an automatic bill pay with your bank.

This is a pretty straightforward process. You'll offer up account information on each creditor to your bank, and your bank will automatically pay those bills each month from your checking account.

What is the best way to pay monthly bills

How to pay bills on timeGet organised. Get a folder and keep your bills in it.Choose a payment method that suits you.Check your bills regularly.Don't let your bills get on top of you.Make sure you're not paying too much.Pay online or phone banking.Other payment methods.

What is the safest way to autopay

Set it up as online bill pay through either your bank or credit card. Do NOT use automated debit transactions. Set up alerts in advance of your bill due dates to make sure you have money to cover the bills. Always check your statements carefully for incorrect, duplicate or fraudulent transactions.

What is the safest way to pay bills

What is the safest method of payment for paying bills The safest method of payment for paying bills is to use a credit card. That's because a credit card number does not give anyone a way to get access to your cash. With a credit card number, they can make a charge on your account.

Why not to use auto pay

With autopay, some bills become out of sight and out of mind. As a result, there's a risk of losing track of money being drafted from your account. Or, you become so accustomed to paying certain expenses you fall into a rut of paying for a membership you never use.

What is the safest way to set up automatic payments

Set it up as online bill pay through either your bank or credit card. Do NOT use automated debit transactions. Set up alerts in advance of your bill due dates to make sure you have money to cover the bills. Always check your statements carefully for incorrect, duplicate or fraudulent transactions.

Should I turn on autopay

Yes, it is a good idea to set up autopay on a credit card, as this is the best way to make sure that you never miss a payment due date. Credit card autopay allows you to set up recurring, automatic payments for your credit card accounts.

What is the safest way to pay monthly bills

What is the safest method of payment for paying bills The safest method of payment for paying bills is to use a credit card. That's because a credit card number does not give anyone a way to get access to your cash. With a credit card number, they can make a charge on your account.

Is it better to set up AutoPay

Setting up autopay can help ensure your payments are always made on time, which can keep all of your accounts in good standing and help your credit score.

What is the difference between bill pay and AutoPay

The main difference between auto pay vs bill pay is that, with bill pay, you are the one initiating the payment, while with auto pay, the vendor initiates the charge to your credit or debit card. Another difference is that, with auto pay, you are authorizing the vendor to charge your card on a recurring basis.