What are the main 4 components of income statements?

What are the four 4 financial statements

But if you're looking for investors for your business, or want to apply for credit, you'll find that four types of financial statements—the balance sheet, the income statement, the cash flow statement, and the statement of owner's equity—can be crucial in helping you meet your financing goals.

Cached

What is the basic of income statement

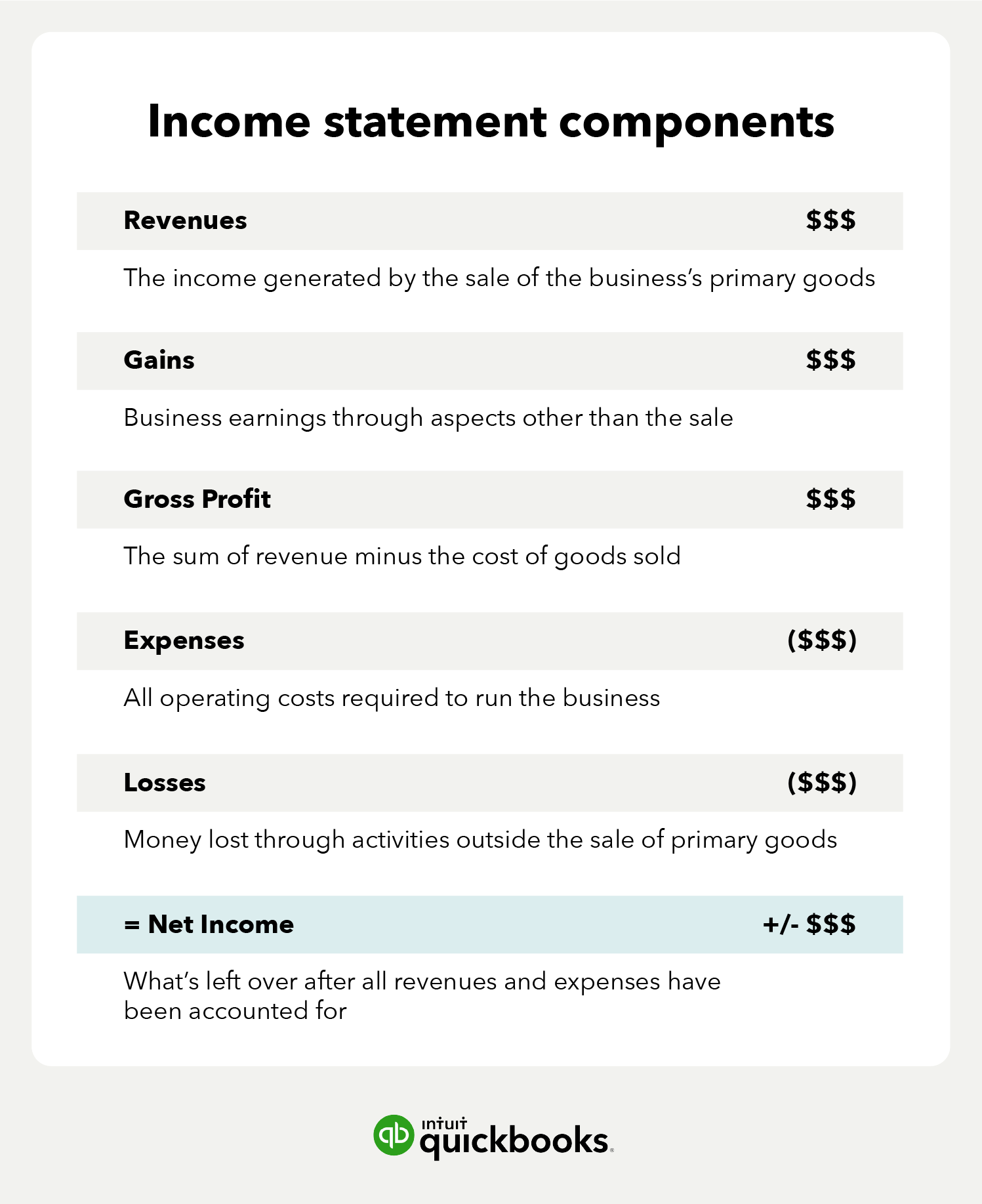

An income statement is a financial report detailing a company's income and expenses over a reporting period. It can also be referred to as a profit and loss (P&L) statement and is typically prepared quarterly or annually. Income statements depict a company's financial performance over a reporting period.

How many major parts are there in the income statement

The Income Statement is divided into four sections: revenue, gross profit, operating expenses, and net income. Revenue is the total amount of money that a company has earned during a given period of time.

What is an income statement composed of

An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement or an earnings statement.

What are the 4 basic financial statements in order of preparation

They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity.

Why do we need the 4 financial statements

Financial statements are important to investors because they can provide information about a company's revenue, expenses, profitability, debt load, and ability to meet its short-term and long-term financial obligations.

What is the most basic form of the income statement

What is the basic format of an income statement The basic formula for an income statement is Revenues – Expenses = Net Income. This simple equation shows whether the company is profitable. If revenues are greater than expenses, the business is profitable.

What are three basic income statements

The three basic Financial Statements are; A Balance Sheet. An Income Statement. A Cash Flow Statement.

What is the most important thing on an income statement

Revenues constitute one of the most important lines of the income statement. A company can exist only to the extent that it is able to generate sufficient revenues to cover all of its costs and provide a return to its investors.

What are the major accounts in income statement

In general, there are 5 major account subcategories: revenue, expenses, equity, assets, and liabilities. A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period.

What are all the types of income statements

There are two different types of income statement that a company can prepare such as the single-step income statement and the multi-step income statement.

What are the 4 basic financial statements What is the purpose of each

They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time. Income statements show how much money a company made and spent over a period of time.

What is the order of an income statement

The income statement is read from top to bottom, starting with revenues, sometimes called the "top line." Expenses and costs are subtracted, followed by taxes. The end result is the company's net income—or profit—before paying any dividends. This is where the term "bottom line" comes from.

How do the 4 financial statements flow together

Finally, it is important to note that the income statement, statement of retained earnings, and balance sheet articulate. This means they “mesh together” in a self-balancing fashion. The income for the period ties into the statement of retained earnings, and the ending retained earnings ties into the balance sheet.

What is the most important report among the 4 basic financial statements

The income statement presents the revenues, expenses, and profits/losses generated during the reporting period. This is usually considered the most important of the financial statements, since it presents the operating results of an entity.

What are the three major data of an income statement

Broadly, the income statement shows the direct, indirect, and capital expenses a company incurs.

Which item would not be found on an income statement

The income statement focuses on four key items: sales revenues, expenses, gains and losses. It does not concern itself with cash or non-cash sales, or anything regarding cash flow.

What are the 4 most important financial statements

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings. Read on to explore each one and the information it conveys.

What accounts go on an income statement

A few of the many income statement accounts used in a business include Sales, Sales Returns and Allowances, Service Revenues, Cost of Goods Sold, Salaries Expense, Wages Expense, Fringe Benefits Expense, Rent Expense, Utilities Expense, Advertising Expense, Automobile Expense, Depreciation Expense, Interest Expense, …

What are the 4 major accounts in accounting

These are asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts. These categories are universal to all businesses. If necessary, you may include additional categories that are relevant to your business.