What are the nonrefundable credits?

What are 3 nonrefundable credits

The nonrefundable credits on Schedule 3 include: Foreign Tax Credit. Child and Dependent Care Credit. Lifetime Learning Credit.

What are examples of nonrefundable tax credits

Examples of nonrefundable tax credits include:Adoption Tax Credit.Electric Vehicle Tax Credit.Foreign Tax Credit.Mortgage Interest Tax Credit.Residential Energy Property Credit.Credit for the Elderly or the Disabled.Credit for Other Dependents.The Saver's Credit.

Cached

What is the difference between nonrefundable and refundable credits

What is the difference between a refundable and nonrefundable tax credit (A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero. A refundable tax credit allows taxpayers to lower their tax liability to zero and still receive a refund.)

What is a non refundable tax credit and tax withholding

Non-refundable tax credits are a type of credit that gets applied to certain tax deductions. The credit can only reduce a taxpayer's total liability to zero. Basically, a non-refundable tax credit cannot get refunded to the taxpayer or create an overpayment. Any amount that exceeds the taxpayer's income tax is lost.

Cached

What is the $500 non refundable tax credit

The maximum credit amount is $500 for each dependent who meets certain conditions. For example, ODC can be claimed for: Dependents of any age, including those who are age 18 or older. Dependents who have Social Security numbers or individual taxpayer identification numbers.

Is the ERC refundable or nonrefundable

Unlike the nonrefundable portion, the refundable part of the ERC can reduce an employer's total tax liability below zero. Therefore, an employer claiming the ERC on Form 941-X will likely generate a tax refund larger than the amount actually paid or assessed for a qualified period.

Which credits are refundable tax credits

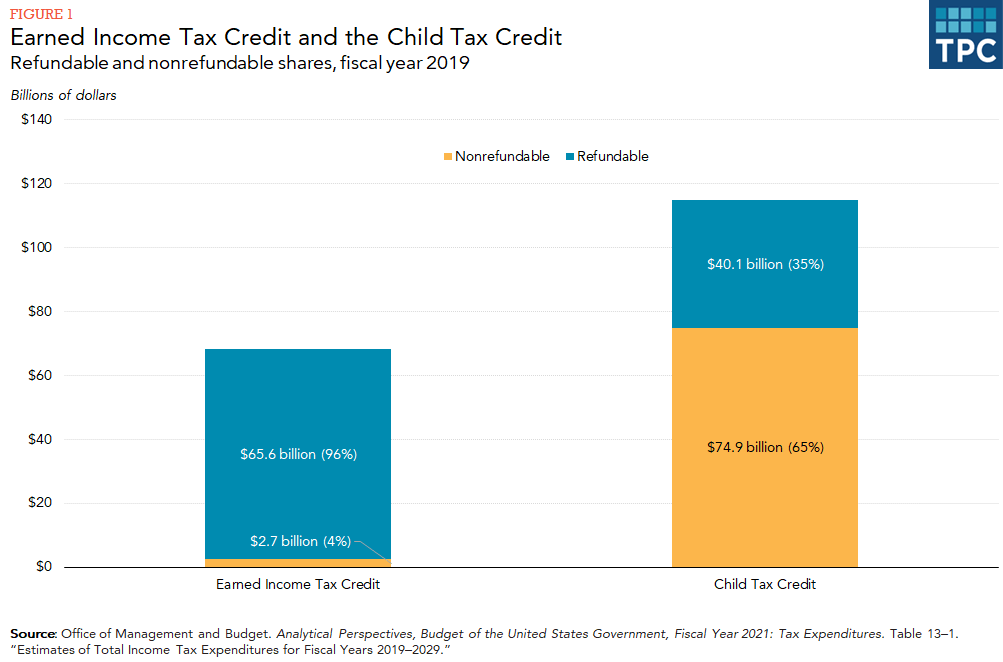

In U.S. federal policy, the two main refundable tax credits are the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC).

Is EIC a nonrefundable credit

EITC is a refundable tax credit, which means that even if you don't owe any tax, you can still receive a refund.

Which is better refundable or nonrefundable

Nonrefundable Tax Credits. Both refundable and nonrefundable tax credits lower your tax bill dollar for dollar. Nonrefundable credits only apply to your tax liability, while refundable tax credits can wipe out your tax bill and provide a refund for the remaining credit.

What does non-refundable mean

/ˌnɑːn rɪˈfʌndəbl/ (also non-returnable) (of a sum of money) that cannot be returned. a non-refundable deposit. a non-refundable ticket (= you cannot return it and get your money back)

What does federal income tax after non refundable credits mean

A nonrefundable tax credit will reduce your tax liability. This credit may reduce your tax liability down to zero, but it will never generate a refund. An example of this type of credit is the Tuition and Textbook Credit or any other credit taken in Step 9 of the IA 1040 individual income tax form.

What does nonrefundable mean

adjective. Britannica Dictionary definition of NONREFUNDABLE. 1. of something you buy : not allowed to be returned in exchange for the money you paid.

What is a non refundable tax credit for dummies

What Is a Nonrefundable Tax Credit A nonrefundable tax credit is a reduction in the amount of income taxes that a taxpayer owes. It can reduce the amount owed to zero, but no further. In other words, the taxpayer forfeits any credit that exceeds the total amount of taxes owed.

What is the $500 nonrefundable credit for qualifying dependents

The maximum credit amount is $500 for each dependent who meets certain conditions. This credit can be claimed for: Dependents of any age, including those who are age 18 or older. Dependents who have Social Security numbers or Individual Taxpayer Identification numbers.

What portion of ERC is nonrefundable

The ERC's non-refundable portion is 6.4% of profits. This is the employer's Social Security contribution. The Employee Retention Credit, which would be a wage credit, rewards employers for retaining workers on their payroll.

What part of employee retention credit is refundable

The Employee Retention Credit is a fully refundable tax credit that eligible employers claim against certain employment taxes. It is not a loan and does not have to be paid back. For most taxpayers, the refundable credit is in excess of the payroll taxes paid in a credit-generating period.

What are the three types of tax credits

There are three categories of tax credits: nonrefundable, refundable, and partially refundable.

What types of credits can you claim when filing taxes

Claim Federal Tax Credits and DeductionsStandard Deduction.Earned Income Tax Credit – EITC.Child Tax Credit and Credit for Other Dependents.Child and Dependent Care Credit.Individual Retirement Arrangements (IRAs)Education Credits and Deductions.

Is the ERC credit refundable or nonrefundable

Unlike the nonrefundable portion, the refundable part of the ERC can reduce an employer's total tax liability below zero. Therefore, an employer claiming the ERC on Form 941-X will likely generate a tax refund larger than the amount actually paid or assessed for a qualified period.

Can I get refund on non-refundable

When an airline says that a ticket is nonrefundable, it doesn't mean that you can't cancel a ticket. Depending on the ticket type, often, 'nonrefundable' simply means: The airline will not give you all of your money back if you cancel (true for most basic economy tickets).