What are the requirements to open an Amazon business account?

What does Amazon require to be a business account

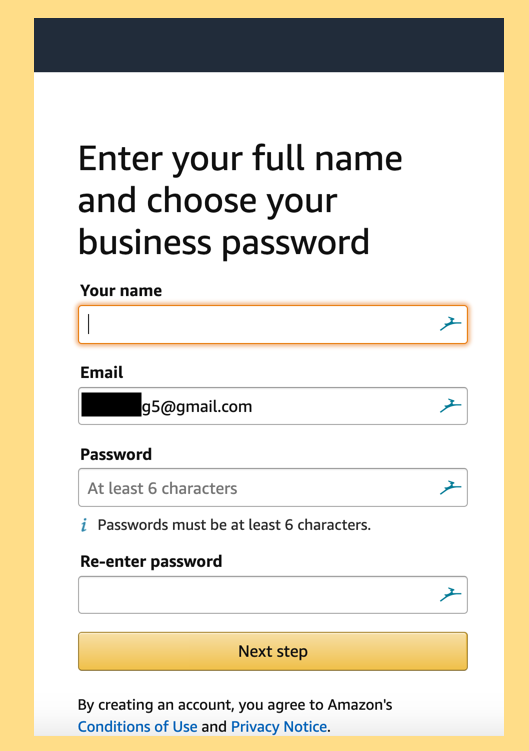

You'll need to provide business information, as well as your email address. The verification process can take up to three business days. Once you've been verified, you're free to start using your account.

Cached

Can anyone create a Amazon business account

You can create a free business account for every type or size organization. Create multiuser accounts, get business-only price savings, sign up for Business Prime, and more with your business account.

Can I have an Amazon business account without a business

Do you have to be a registered business to sell on Amazon No you don't need to be a registered business to sell on Amazon. Amazon doesn't require you to register your business but it's possible your local governments want you to register an online business.

Cached

How much does it cost to have an Amazon business account

Business Prime Duo is $69/year, is meant for 1 user and requires an existing Amazon Prime membership on a personal Amazon.com account. Business Prime Essentials is $179/year for up to 3 users, and includes additional benefits such as Guided Buying, Amazon WorkDocs and Spend Visibility.

Can you open an Amazon seller account without a business license

No, a business license is not required by Amazon when opening a seller account, though it may be required by your state or local government. (This is why consulting with an accountant or attorney is essential when setting the foundation for your business.)

What are the benefits of Amazon business account

With Amazon Business, you get access to hundreds of thousands of sellers who can offer business-only selection, Quantity Discounts, and access to time-saving features that help you run your business better. With Business Prime, you can unlock the best of Amazon Business.

What is the difference between Amazon business account and normal account

An Amazon Business Prime account has perks that are beneficial to small businesses compared to a personal Amazon Prime account. With Business Prime, you can get discounts on large quantities of products and may qualify for tax exemptions.

Do I need a tax ID to sell on Amazon

Once you sign up for your Amazon selling account and online business, you'll be prompted to move through a tax interview through the Amazon Seller Central. You'll need to prove your identity, so have your EIN or SSN ready to go during this portion.

Can you use Amazon business account for personal use

The Amazon Shopping app supports both your personal and business accounts. You can switch seamlessly between accounts on any device, including your work computer, home computer, mobile phone, or tablet.

Do you need a tax ID to sell on Amazon

Why do I need a tax ID number to sell on Amazon Amazon requires sellers to provide a tax identification number so that they can identify sellers and report sales to the IRS. Most businesses will need to provide an EIN, but some businesses—such as US-based sole proprietors with no employees—can use their SSN instead.

Can you sell products on Amazon without an LLC

In short, no. You do not need an LLC to sell on Amazon. You can start selling immediately under your name as a sole proprietor. If you are beginning to explore ecommerce and want to test the waters of selling on Amazon, having a sole proprietorship is perfectly fine.

Do you have to pay extra for Amazon business account

Amazon Business is free to all registered business owners. But if you want to take advantage of Amazon Business Prime, you'll need to pay for an account. The least expensive plan is $69 per year, and you must have a regular Prime account as well.

What are the benefits of a business account on Amazon

With Amazon Business, you get access to hundreds of thousands of sellers who can offer business-only selection, Quantity Discounts, and access to time-saving features that help you run your business better. With Business Prime, you can unlock the best of Amazon Business.

What is the purpose of business account in Amazon

Multi-user business accounts offer flexible ways to manage business purchasing within your organization, helping save time and improve purchasing processes. With Amazon Business, you can create and configure purchasing groups, add administrators, set permissions, and enable approval workflows.

Can I use my SSN to sell on Amazon

United States Tax ID: Either a social security number (for individual sellers only) or an FEIN. Bank Information: You'll need a bank that can take an ACH (automated clearing house) payment from Amazon.

Do you need a business bank account to sell on Amazon

If you aren't looking to sell on Amazon, you obviously don't need a seller account. In that case, opt for only the business account. But if you do want to sell on Amazon, you'll need to get both types of accounts, since a business account is required to create a seller account.

Can I use my business account for personal things

When business owners use business funds for personal expenses, it is bad practice that can lead to operational, legal, and tax problems. Using company funds as a personal piggy bank for one's own benefit is not only a breach of fiduciary duty, but also unlawful.

What documents do I need to sell on Amazon

Before you sign up, make sure you're ready with the following:Business email address or Amazon customer account.Internationally chargeable credit card.Government ID (identity verification protects sellers and customers)Tax information.Phone number.A bank account where Amazon can send you proceeds from your sales.

What is difference between Amazon and Amazon business

Amazon Business is a version of Amazon that offers discounts on millions of products to businesses of all sizes. It makes purchasing easy and cost-effective by combining Amazon's familiar one-stop shopping with quantity discounts, price comparisons, approval workflows and multi-user accounts.

Do you need a tax ID for Amazon business account

If your business is based in the United States, you will need a tax identification number—usually an Employer Identification Number (EIN) or Social Security Number (SSN)—to become an Amazon seller.