What are the two types of beneficiaries?

What are the 3 types of beneficiaries

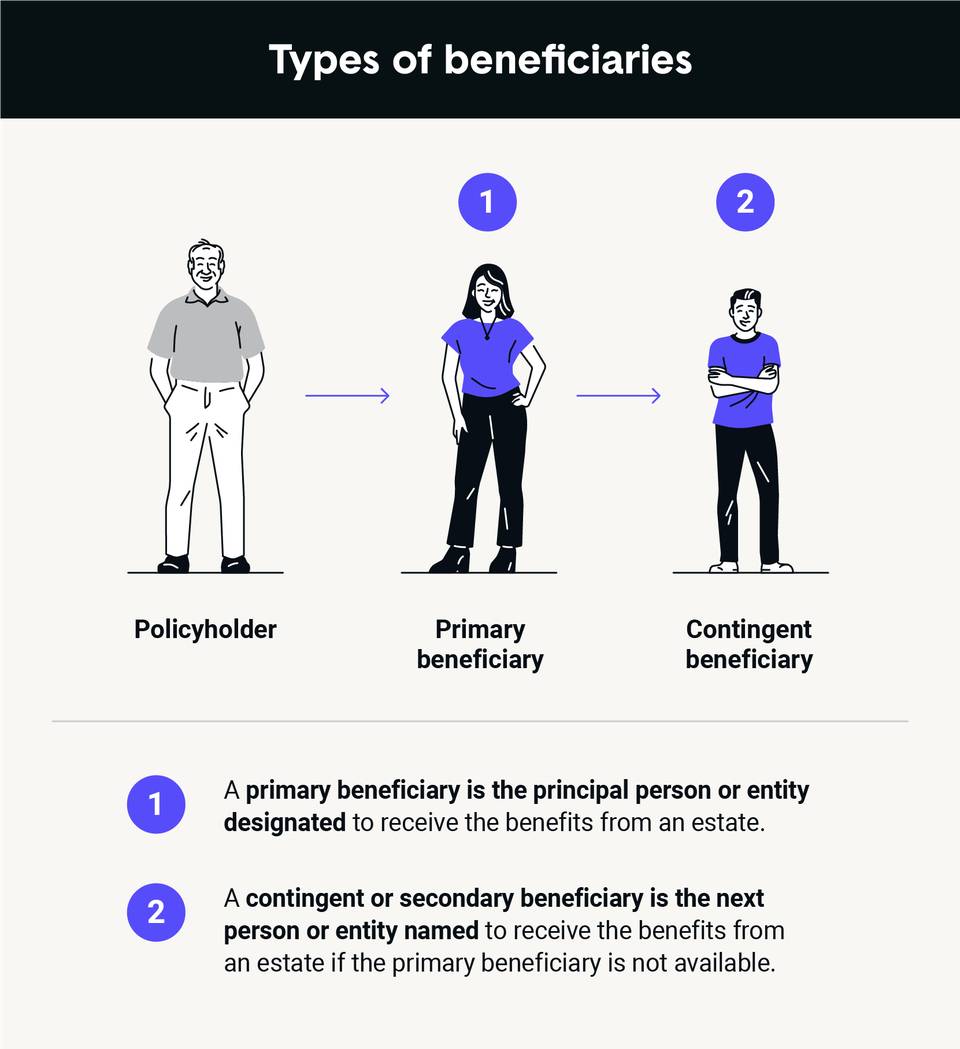

There are three types of beneficiaries: primary, contingent and residuary.

Who should be primary and secondary beneficiary

Your primary beneficiary is first in line to receive your death benefit. If the primary beneficiary dies before you, a secondary or contingent beneficiary is the next in line. Some people also designate a final beneficiary in the event the primary and secondary beneficiaries die before they do.

Cached

What happens if you have 2 primary beneficiaries

If there are two primary beneficiaries listed on a life insurance policy and one dies, beneficiary number two would receive the entire payout. The same situation can be in play if all primary beneficiaries are dead or are unable to receive the distributions, but there are multiple contingent beneficiaries.

What is the difference between a primary and contingent beneficiary

A contingent beneficiary is a person or entity next in line to receive benefits from a policy, plan, or estate if the primary beneficiary dies or is otherwise unable to collect. The contingent beneficiary only receives benefits if the primary beneficiary cannot.

Can there be 2 beneficiaries

In the event your primary beneficiary dies before or at the same time as you, most policies also allow you to name at least one backup beneficiary, called a “secondary” or “contingent” beneficiary. If the primary beneficiaries are all deceased, the secondary beneficiaries receive the death benefit.

Who should be primary beneficiary

Your spouse

A spousal beneficiary has more flexibility to delay taxed distributions and move assets to their own account. For 401(k) or pension plans, your spouse must be the primary beneficiary unless spousal consent is given to the naming of another beneficiary.

Who is the best person to name as beneficiary

Immediate family as beneficiaries

Anyone who will suffer financially by your loss is likely your first choice for a beneficiary. You can usually split the benefit among multiple beneficiaries as long as the total percentage of the proceeds equal 100 percent.

What is the 2nd beneficiary called

A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. When you pass away, if all of your primary beneficiaries have also passed away, your contingent beneficiaries will receive the payout.

Who should I put as my primary beneficiary

Anyone who will suffer financially by your loss is likely your first choice for a beneficiary. You can usually split the benefit among multiple beneficiaries as long as the total percentage of the proceeds equal 100 percent.

How will the policy money be paid if there are two beneficiaries

Who Gets the Life Insurance Payout The life insurance payout will be sent to the beneficiary listed on the policy. If there's more than one, each beneficiary has to submit their own claim. Then, the insurance company will pay each person or organization the amount the policyholder left them.

Who to put as contingent beneficiary

You set your contingent beneficiaries as your parents; they would be the ones to take care of your kids if you and your spouse passed away, so the payout would likely still benefit your children.

What does it mean to have 2 beneficiaries

In the event your primary beneficiary dies before or at the same time as you, most policies also allow you to name at least one backup beneficiary, called a “secondary” or “contingent” beneficiary. If the primary beneficiaries are all deceased, the secondary beneficiaries receive the death benefit.

Who is the first beneficiary of inheritance

The primary beneficiary is the person or entity who has the first claim to inherit your assets after your death. Despite the term “primary," you may name more than one such beneficiary and designate how the assets will be divided among them.

Does the primary beneficiary get everything

An IRA can name a spouse as the primary beneficiary, while the same person's will may name the children as primary beneficiaries. The spouse will receive the proceeds of the IRA, and the children will receive the assets for which they are named primary beneficiaries in the will—but nothing from the IRA.

Who should I not name as beneficiary

Avoid naming children as direct beneficiaries of life insurance at all costs! The insurance company would be unable to distribute the funds to a minor, and the proceeds would end up in the courts. (You can name a minor as the beneficiary to a bank account, just be cautious if the balance is high.)

Who should be your primary beneficiary

Anyone who will suffer financially by your loss is likely your first choice for a beneficiary. You can usually split the benefit among multiple beneficiaries as long as the total percentage of the proceeds equal 100 percent.

Can the same person be a primary and contingent beneficiary

Can the Same Person be My Primary and Contingent Beneficiary Naming the same person as both a primary and a contingent beneficiary is a common Estate Planning mistake. Since the contingent beneficiary is a back up, it's important to not name the same person in both roles.

What are the levels of beneficiaries

Two “levels” of beneficiaries

Your life insurance policy should have both “primary” and “contingent” beneficiaries. The primary beneficiary gets the death benefits if he or she can be found after your death. Contingent beneficiaries get the death benefits if the primary beneficiary can't be found.

How do beneficiaries get their money

Individuals can receive inheritance money in different ways including through a trust and from a will, which can come with restrictions, or as a beneficiary on a bank or retirement account.

Can you be both a primary and contingent beneficiary

Any person or entity that can be a primary beneficiary can also be a contingent beneficiary. This includes: Any person, like your spouse, child(ren), relatives, or friends. You don't have to be related to someone to name them as a beneficiary in your will.