What are the types of account receivable?

What are the common types of accounts receivable

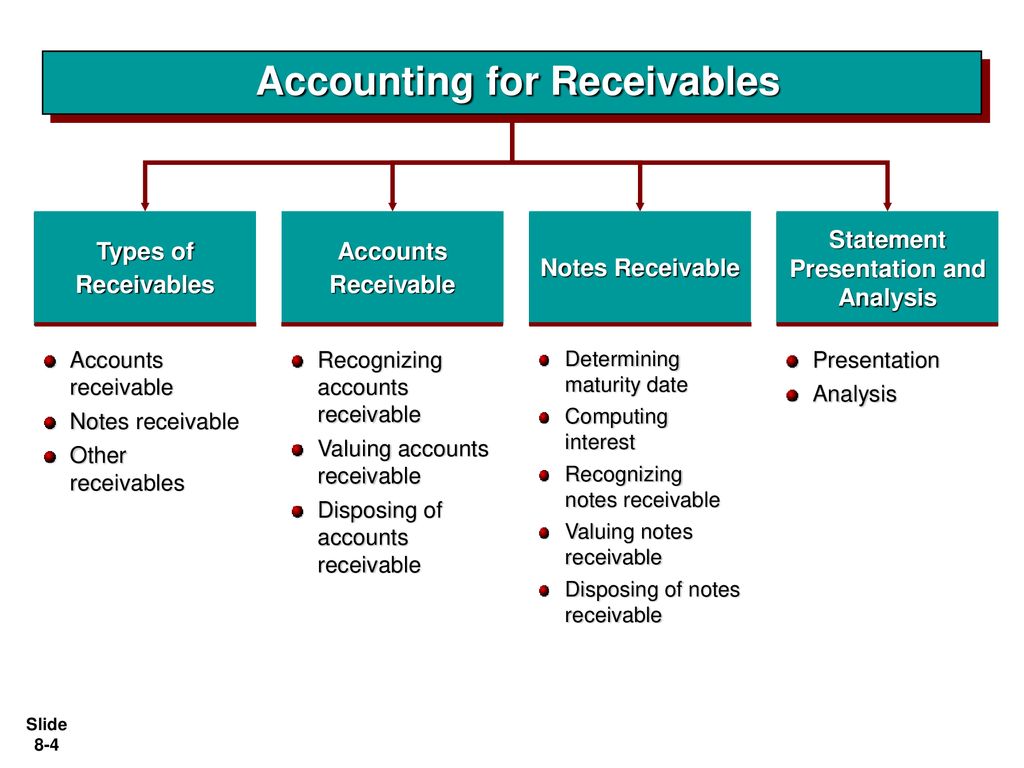

What Are the Types of Receivables Generally, receivables are divided into three types: trade accounts receivable, notes receivable, and other accounts receivable.

What is accounts receivable and its types

In the world of accounting, what is meant by accounts receivable or trade (account receivables) are current assets in a company due to sales transactions in the form of goods or services to a party In existing transactions, payments are made on credit or have not been paid off (accounts receivable).

What is the most common type of receivable

Accounts Receivable are the most common kind of receivable. Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 – 60 days. They are classified on the Balance Sheet as current assets.

Cached

What are the two major types of receivables

The two major types of receivables are Accounts receivables and trade receivables. Uncollectible-account expense is an operating expense on the income statement. Companies are prohibited from combining the percent -of sales and the aging methods when estimating uncollectible accounts.

What are examples of account receivable transactions

For example- Your vendor wants to purchase goods from you to sell to their customers as they have received sales order but do not have enough cash to pay for the goods. They will buy goods from you on credit and send it to their customer warehouse.

What is another name for account receivable

The terms 'trade receivables' and 'accounts receivable' generally mean the same. Both represent the amount of money customers owe a business for the goods or services they've received.

What are the 4 functions of accounts receivable

The various functions that an accounts receivable department performs include:1) Build monthly financial statements.2) Perform account reconciliations.3) Generate invoices and account statements.4) Manage the billing system.

What are the four common forms of receivable financing

Accounts Receivable FinancingAccounts receivable loans.Factoring.Asset-backed securities.

What are the 2 methods of accounting for uncollectible receivables

¨ Two methods are used in accounting for uncollectible accounts: (1) the Direct Write-off Method and (2) the Allowance Method. § When a specific account is determined to be uncollectible, the loss is charged to Bad Debt Expense.

What are the basics of accounts receivable

Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. This money is typically collected after a few weeks and is recorded as an asset on your company's balance sheet. You use accounts receivable as part of accrual basis accounting.

What are the GAAP rules for accounts receivable

According to US GAAP, the company's accounts receivable balance must be stated at “net realizable value”. In basic terms, this just means that the accounts receivable balance presented in the company's financial statements must be equal to the amount of cash they expect to collect from customers.

What is the difference between accounts receivable and accounts receivable

Put simply, accounts payable and accounts receivable are two sides of the same coin. Whereas accounts payable represents money that your business owes to suppliers, accounts receivable represents money owed to your business by customers.

What are the three major types of receivables

Majorly, receivables can be divided into three types: trade receivable/accounts receivable (A/R), notes receivable, and other receivables.

What are the three basic functions of accounts receivable

Accounts receivable duties include ensuring accuracy and efficiency of operations, processing and monitoring incoming payments, and securing revenue by verifying and posting receipts.

What are the five C’s of receivables

Called the five Cs of credit, they include capacity, capital, conditions, character, and collateral. There is no regulatory standard that requires the use of the five Cs of credit, but the majority of lenders review most of this information prior to allowing a borrower to take on debt.

What are two methods of recording accounts receivable

Two different methods of recording accounts receivables

The journal entry will report debit of discount allowed, cash, and credit to accounts receivables on cash receipt. 2. Net method: The business entity reports credit sales after adjusting the discount allowed under net method.

What is the preferred GAAP method for handling uncollectible accounts receivable

Under U.S. GAAP, only the allowance method is an allowable method to estimate uncollectible accounts receivable. The allowance method recognizes bad debt expense when the company believes there is a high likelihood the receivable will not be collected, which follows the matching principle.

What is the 10 rule for accounts receivable

What is Cross-Aged Accounts (10% rule) This amount is deducted when a borrower has a customer with balances over 90 days, and also balances under 90 days. The rule states that when a customer has more than 10% of their total balance aged over 90 days, the remaining balance is also deducted as ineligible.

What are the 3 main criteria of notes receivables

Key Components of Notes Receivable

Payee: The entity that is owed the principal and ensuing interest. The payee “holds” the note receivable. Maker: The entity required to pay back the note, also known as the borrower or debtor. Principal: The original amount of the note.

Should accounts receivable have a Debit or credit balance

debit

Accounts receivable is a debit, which is an amount that is owed to the business by an individual or entity.