What are the types of bill of exchange?

What are the three forms of bill of exchange

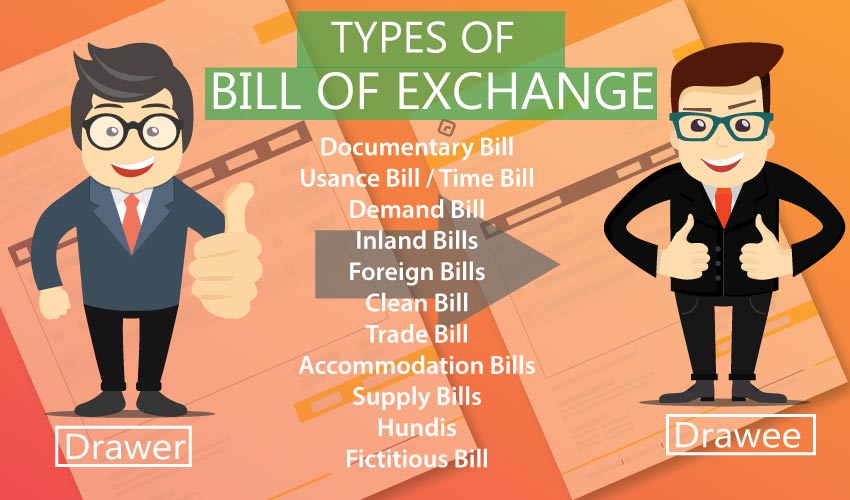

The three main types of bill exchange are accommodation bills, time bills, and trade bills. The accommodation bill is drawn and accepted for mutual help while the trade bill is drawn and accepted to trade a transaction and the time bill is meant to ensure payment is made on the specified date.

Cached

What are examples of bills of exchange

A bill of exchange is sometimes called draft or draught, but draft usually applies to domestic transactions only. The term bill of exchange may also be applied broadly to other instruments of foreign exchange. For example, a check is a type of bill of exchange.

CachedSimilar

What is included in bill of exchange

The bill of exchange contains an unconditional order to pay a certain amount on an agreed date while the promissory note contains an unconditional promise to pay a certain sum of money on a certain date. In India these instruments are governed by the Indian Negotiable Instruments Act 1881.

What type of document is a bill of exchange

What is a Bill of Exchange A Bill of Exchange is an important document in export process that contains reference details of an export shipment like amount of invoice from the buyer, time of payment, bank details, etc. It is used in international shipping as a negotiable instrument.

What is the difference between a promissory note and a bill of exchange

A promissory note is a written promise, whereas a bill of exchange is a written order. The promissory note allows no copies, whereas a bill of exchange can have multiple copies. Three parties are involved in a bill of exchange, but a promissory note only involves two parties.

Is a promissory note a bill of exchange

A promissory note is a specific form of a bill of exchange with the essential difference being that a promissory note is a promise by the maker to pay whereas an 'ordinary' bill of exchange is an order to someone else to pay.

Is an invoice a bill of exchange

A bill of exchange includes what items are being shipped and how many are in the order, an invoice requesting payment and details about when the payment is due and often bank information to fulfill the charge.

What is the difference between a bill of exchange and an invoice

Bills provide limited details such as prices and VAT, invoices provide detailed information and are therefore legally binding. Bills are commonly used to pay for goods and services received instantaneously, invoices can be used for immediate transactions, but are also used to request payment before a pre-approved date.

Is a bill of exchange the same as an invoice

A bill of exchange includes what items are being shipped and how many are in the order, an invoice requesting payment and details about when the payment is due and often bank information to fulfill the charge.

What is the main advantage of bill of exchange or promissory note

It is a legal document and in case the drawee fails to pay the amount, then the drawer can take legal action against the drawee and get the amount. The bill of exchange can be discounted at nominal rates from a third party in cases where the drawer is in urgent need of money.

What is the difference between a check and a bill of exchange

What Are Some Differences Between a Bill of Exchange and a Check A check always involves a bank while a bill of exchange can involve anyone, including a bank. Checks are payable on demand while a bill of exchange can specify that payment is due on demand or at a specified future date.

What is the difference between bills of exchange and promissory note

Promissory Notes: An Overview. Bills of exchange and promissory notes are written commitments between two parties that confirm a financial transaction has been agreed upon. Bills of exchange are more often used in international trade, whereas promissory notes are used most often in domestic trade.

Who prepares bill of exchange

Drawer is the one who draws the bill of exchange, drawee is the person towards whom the bill of exchange is drawn and payee is the person who will be getting the payment from the bill of exchange. In most cases the drawer is also the payee.

What is the main advantage of a bill of exchange

A bill of exchange is signed by both parties. For this reason, both parties are aware of the amount of the bill and its due date. Another advantage of a bill of exchange is that it can be discounted if the drawer or holder needs funds before the due date.

What is the main purpose of bill of exchange

A bill of exchange is used in international trade to help importers and exporters fulfill transactions. While a bill of exchange is not a contract itself, the involved parties can use it to specify the terms of a transaction, such as the credit terms and the rate of accrued interest.

What is another name for bill of exchange

synonyms for bill of exchange

On this page you'll find 6 synonyms, antonyms, and words related to bill of exchange, such as: bank note, draft, federal reserve note, and order of payment.

What is a bill of exchange How does it differ from promissory note

Bills of exchange and promissory notes are written commitments between two parties that confirm a financial transaction has been agreed upon. Bills of exchange are more often used in international trade, whereas promissory notes are used most often in domestic trade.

Is a check a bill of exchange drawn on a bank

A “cheque” is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand. 7. The maker of a bill of exchange or cheque is called the “drawer;” the person thereby directed to pay is called the “drawee.”

What are the disadvantages of the bill of exchange

Disadvantages of a Bill of Exchange

The drawee becomes legally bound to clear the payment on demand or on the specified date. The discount on a bill of exchange is an additional cost to parties. It's an additional burden for the drawer if a bill of exchange is not accepted.

When can you treat a bill of exchange as a promissory note

Explanation (i) – A promissory note, bill of exchange or cheque is payable to order which is expressed to be so payable or which is expressed to be payable to a particular person, and does not contain words prohibiting transfer or indicating an intention that it shall not be transferable.