What are the types of credit card users?

What are credit card users called

The person who owns the credit account is called the primary cardholder. Authorized users may be issued their own credit card with their name on it, but the account belongs to the primary cardholder.

Cached

What are the 4 main credit card types

The four major credit card networks are Mastercard, Visa, American Express and Discover.

What is a credit card 2nd user called

An authorized user is someone who's been added to a credit card account by the card's owner, also known as the primary cardholder. The authorized user can make purchases with the credit card as if it were their own. However, the responsibility to pay any charges remains with the primary cardholder.

Cached

What are credit card convenience users

Are you the classic credit card “convenience” user That term refers to someone who pays their entire balance off in full every single month, never paying interest charges. Some do this in order to gain credit card rewards (cash back, airline miles, gift cards, etc.), and others do it simply for the, well, convenience.

What are the three types of credit users

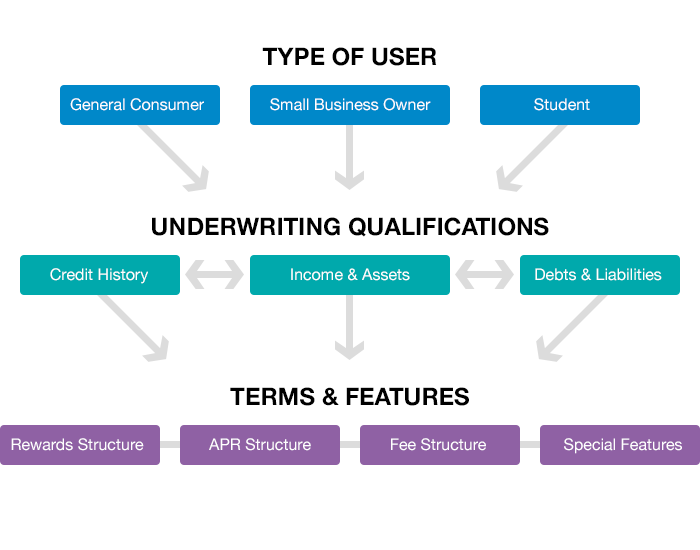

There are three major types of credit cards based on the type of user: general consumer, student, and business.

What are the three types of credit card users

Yes, there are 3 ways to share credit card ownership: authorized users, joint account holders, and co-signers.

What are 3 types of credit card accounts

Fortunately, most cards can be classified into three major categories based on the features they offer: rewards credit cards, low interest and balance transfer cards, and credit-building cards. This classification can help you narrow down your choices.

What are the two main types of consumer credit

Consumer credit falls into two broad categories:Closed-end (installments)Open-end (revolving)

What are the three C’s of credit

capacity, character, and collateral

Students classify those characteristics based on the three C's of credit (capacity, character, and collateral), assess the riskiness of lending to that individual based on these characteristics, and then decide whether or not to approve or deny the loan request.

What are the 3 credit accounts

What are the 3 credit bureaus Equifax, Experian and TransUnion are the three major credit bureaus in the U.S. According to the Consumer Financial Protection Bureau (CFPB), credit bureaus are companies that compile and sell credit reports.

How many credit card users are there

84% of U.S. adults had a credit card in 2023. About 73% of Americans have a credit card by age 25, making credit cards the most common first credit experience for young adults. In Q4 2023, credit card users reached a total of 166 million according to TransUnion, up from the prior three years.

What are the 3 C’s of credit

Students classify those characteristics based on the three C's of credit (capacity, character, and collateral), assess the riskiness of lending to that individual based on these characteristics, and then decide whether or not to approve or deny the loan request.

What are the 5 C’s of credit

Lenders score your loan application by these 5 Cs—Capacity, Capital, Collateral, Conditions and Character. Learn what they are so you can improve your eligibility when you present yourself to lenders.

What are the 3 credit types

There are three types of credit accounts: revolving, installment and open. One of the most common types of credit accounts, revolving credit is a line of credit that you can borrow from freely but that has a cap, known as a credit limit, on how much can be used at any given time.

What is a good credit score

670 to 739

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Do credit card companies like when you pay in full

Yes, credit card companies do like it when you pay in full each month. In fact, they consider it a sign of creditworthiness and active use of your credit card. Carrying a balance month-to-month increases your debt through interest charges and can hurt your credit score if your balance is over 30% of your credit limit.

What is the most common credit type

The two most widely used types of credit scores are FICO Score and VantageScore.

What are the 3 credit names

The three main credit bureaus are Equifax, Experian and TransUnion.

Who has the highest credit card users

At the end-January 2023, there were nearly 8.25 crore credit cards issued by different banks. HDFC Bank, SBI Card, ICICI Bank, Axis Bank and Kotak Bank are the top five credit issuers in the country.

What age group uses credit cards the most

Baby Boomers, Gen X Have Most Credit Cards on Average

(Gen Zers are ages 9 to 25 this year.) The youngest adult consumers, ages 18 to 25, had an average of two credit cards each, with only a slight increase from 2023 and 2023.