What are the types of P&L?

What are the three main categories of a profit and loss statement

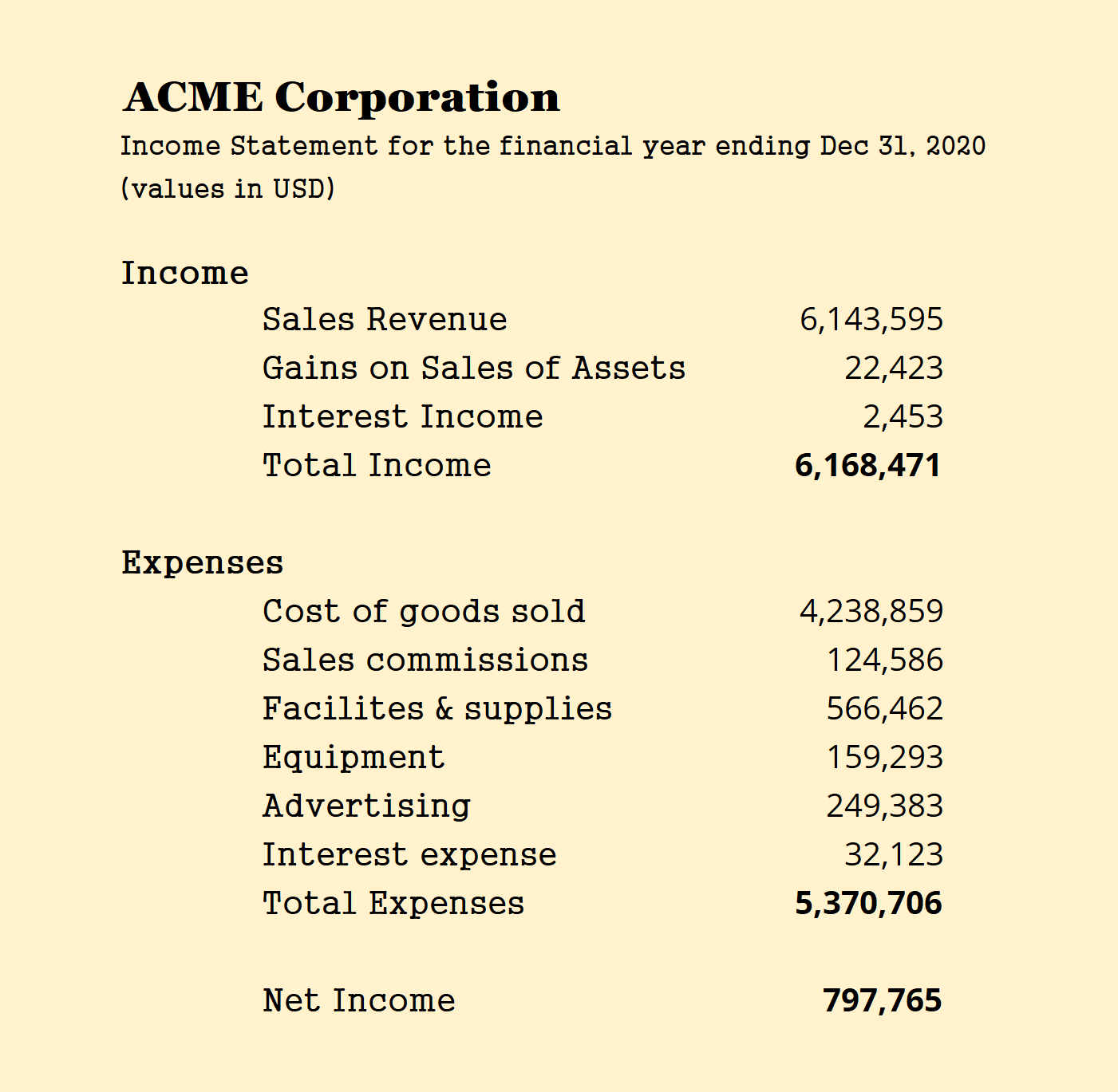

There are three main sections of a P&L statement: revenues, COGS, and Operational Expenses. Any listed line item on a P&L goes under either revenue or an expense account, and all these items determine the bottom line.

Cached

What are the main sections of P&L

Key Components of a Profit and Loss ReportRevenues. This entry represents the net sales or receipts during the accounting period.Cost of Goods Sold.Gross Profit.Operating Expenses.Operating Income.Other Income and Expenses.Net Profit.

Cached

What are the 5 types of financial statements

5 Types of Financial Reports and Their Benefits for BusinessBalance Sheet.Income Statement.Cash Flow Statement.Statement of Changes in Capital.Notes to Financial Statements.

What are the five major categories the profit and loss P&L statement is divided into

The P&L statement is divided into five major categories: (1) sales or revenue, (2) cost of goods sold/cost of sales, (3) gross profit, (4) operating expenses, and (5) net income.

What should a P&L include

The P & L statement contains uniform categories of sales and expenses. The categories include net sales, costs of goods sold, gross margin, selling and administrative expense (or operating expense), and net profit. These are categories that you, too, will use when constructing a P & L statement.

What are the 6 basic financial statements

The usual order of financial statements is as follows:Income statement.Cash flow statement.Statement of changes in equity.Balance sheet.Note to financial statements.

What are the three 3 most common financial statements

The income statement, balance sheet, and statement of cash flows are required financial statements. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

How do you structure a P&L

How to Write a Profit and Loss StatementStep 1 – Track Your Revenue.Step 2 – Determine the Cost of Sales.Step 3 – Figure Out Your Gross Profit.Step 4 – Add Up Your Overhead.Step 5 – Calculate Your Operating Income.Step 6 – Adjust for Other Income and/or Expenses.Step 7 – Net Profit: The Bottom Line.

What does a typical P&L look like

A P&L statement shows a company's revenue minus expenses for running the business, such as rent, cost of goods, freight, and payroll. Each entry on a P&L statement provides insight into the cash flow of the company and shows where money is coming from and how it is used.

What are the 5 required financial statements

Here's why these five financial documents are essential to your small business. The five key documents include your profit and loss statement, balance sheet, cash-flow statement, tax return, and aging reports.

What are the 4 commonly used financial statements

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings. Read on to explore each one and the information it conveys.

What are the 5 components of the financial statements

The elements of the financial statements will be assets, liabilities, net assets/equity, revenues and expenses. It is noted in Study 1 that moving along the spectrum from cash to accrual accounting does not mean a loss of the cash based information which can still be generated from an accrual accounting system.

What does a basic P&L look like

A P&L statement shows a company's revenue minus expenses for running the business, such as rent, cost of goods, freight, and payroll. Each entry on a P&L statement provides insight into the cash flow of the company and shows where money is coming from and how it is used.

How do you read a P&L for dummies

How to read a P&L reportDefine the revenue. The revenue or top-line portion of the P&L report documents company revenue for analysis.Understand the expenses.Calculate the gross margin.Calculate the operating income.Use budget vs.Check the year-over-year (YoY)Determine net profit.

How do you structure P&L

How to Write a Profit and Loss StatementStep 1 – Track Your Revenue.Step 2 – Determine the Cost of Sales.Step 3 – Figure Out Your Gross Profit.Step 4 – Add Up Your Overhead.Step 5 – Calculate Your Operating Income.Step 6 – Adjust for Other Income and/or Expenses.Step 7 – Net Profit: The Bottom Line.

What are the four 4 financial statements

But if you're looking for investors for your business, or want to apply for credit, you'll find that four types of financial statements—the balance sheet, the income statement, the cash flow statement, and the statement of owner's equity—can be crucial in helping you meet your financing goals.

What are the four 4 types of financial statements

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings. Read on to explore each one and the information it conveys.

What are the five 5 basic financial statements

The five key documents include your profit and loss statement, balance sheet, cash-flow statement, tax return, and aging reports.

What are the 4 main financial statements

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.

Which two types of information can be found on a profit and loss statement

The main categories that can be found on the P&L include: Revenue (or Sales) Cost of Goods Sold (or Cost of Sales)