What are three advantages to having and using credit?

What are 3 advantages of using credit

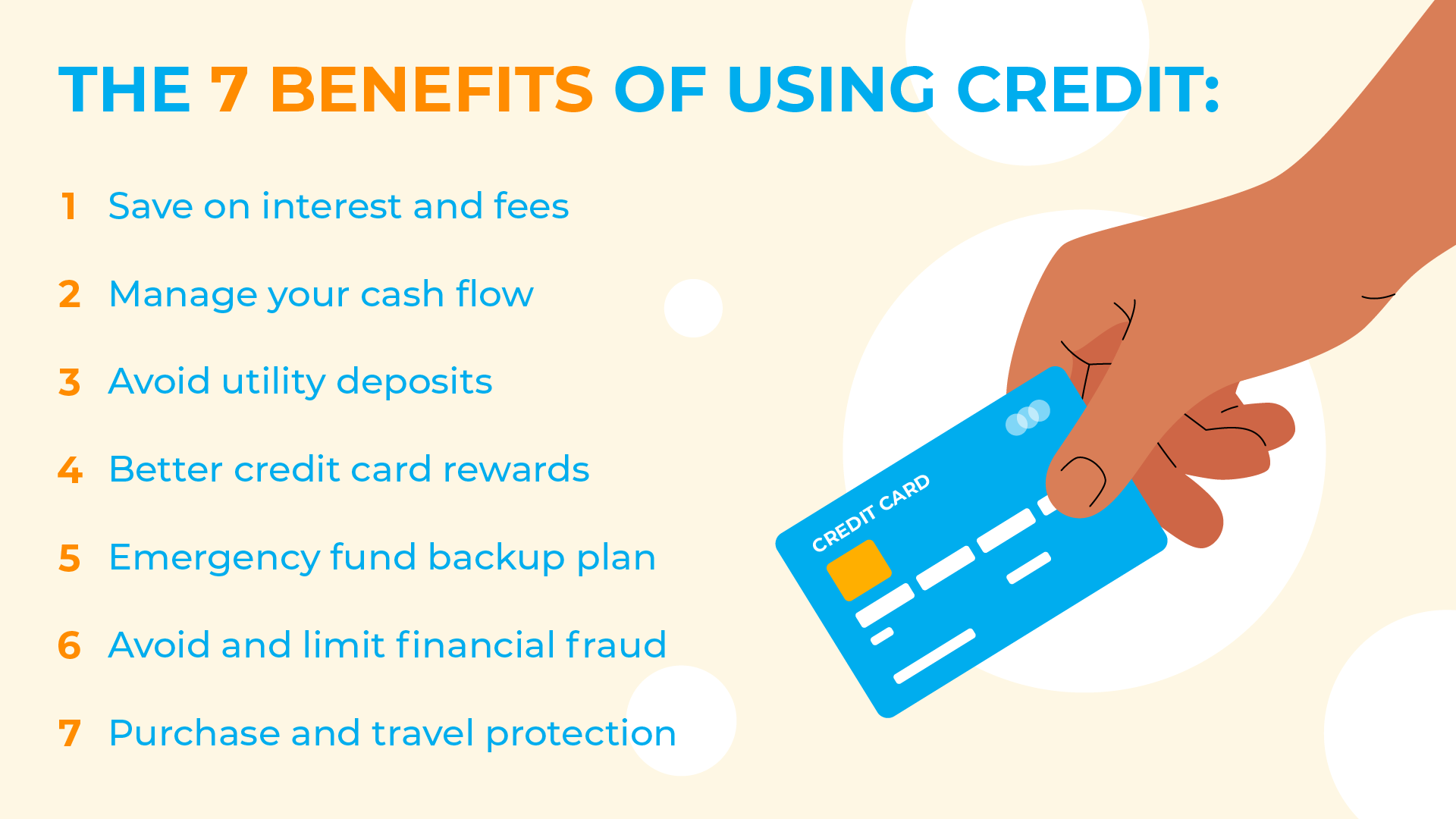

Pros of using credit cardsBuild credit. Credit cards, when used properly, can help you build credit.Earn rewards.Fraud protection.Don't have to carry cash.Track your spending.Perks.Potential to overspend.Can fall into debt.

Cached

What are 3 advantages and 3 disadvantages of using credit

The pros of credit cards range from convenience and credit building to 0% financing, rewards and cheap currency conversion. The cons of credit cards include the potential to overspend easily, which leads to expensive debt if you don't pay in full, as well as credit score damage if you miss payments.

Cached

What are 3 disadvantages of using credit

5 Disadvantages of Credit CardsHigh-Interest Rates. If you carry a balance on your card, the interest rate can be as high as 30% or more.Potential for Overspending. It's easy to get caught up in the moment when using a credit card instead of cash or a debit card.High Annual Fees.Hidden Costs.Credit Card Debt.

Cached

What are 5 advantages of credit

What are the advantages of creditCash flow. Cash flow refers to the money flowing in and out of your accounts.Credit card rewards. Many credit cards offer rewards or cash back.Fraud prevention.Purchase protection.Building credit.Buying more than you can afford.Interest.Annual fees.

Cached

What is the best advantage of credit

You'll get the best rates on car and homeowners insurance

According to McClary, having a good credit score can help you save money on your car and/or homeowners insurance. Most U.S. states allow credit-based insurance scoring, where insurance companies assess your risk based on how well you handle your money.

What is the biggest advantage of credit

If you have a good credit score, you have a much better chance of qualifying for the best interest rates, which means you'll pay lower finance charges on credit card balances and loans.

What are 2 disadvantages of using credit

There may also be fees for cash advances (or the ability to withdraw cash on the balance of the credit card). Missed or insufficient minimum payments can lead to costly penalty fees, as well as credit score damage. Make sure the benefits outweigh the costs of fees and interest rates before selecting a card.

What are 3 factors that affect credit

The 5 factors that impact your credit scorePayment history.Amounts owed.Length of credit history.New credit.Credit mix.

What are the 4 main reasons credit is important

Here are some of the major benefits of building credit.Better approval rates. If you have a good credit score, you're more likely to be approved for credit products, like a credit card or loan.Lower interest rates. The higher your credit score, the lower interest rates you'll qualify for.Better terms.Robust benefits.

What are four reasons why credit is useful

Your Superpower: Good CreditDetermine whether a lender approves a new loan.Influence your interest rates and fees on the loan.Be reviewed by employers before they offer you a new job.Be used by landlords when deciding whether to rent to you.Determine your student loan eligibility, including most private loans.

What are the advantages of using credit quizlet

Advantages of using credit include the ability to make purchases when cash inflow is low and the convenience of not carrying cash or checks.

What are 2 reasons for using credit

10 Reasons to Use Your Credit CardOne-Time Bonuses. There's nothing like an initial bonus opportunity when getting a new credit card.Cash Back.Rewards Points.Frequent-Flyer Miles.Safety.Keeping Vendors Honest.Grace Period.Insurance.

What are 3 advantages of a debit card

Debit CardsEasy to obtain. Once you open an account most institutions will issue you a debit card upon request.Convenience. Purchases can be made using a contactless or chip-enabled terminal or by swiping the card rather than filling out a paper check.Safety.Readily accepted.

What are the 2 most important credit factors

The most important factor of your FICO® Score☉ , used by 90% of top lenders, is your payment history, or how you've managed your credit accounts. Close behind is the amounts owed—and more specifically how much of your available credit you're using—on your credit accounts. The three other factors carry less weight.

What are the three elements of credit

Character, capital (or collateral), and capacity make up the three C's of credit. Credit history, sufficient finances for repayment, and collateral are all factors in establishing credit. A person's character is based on their ability to pay their bills on time, which includes their past payments.

What are the 3 main types of credit

The different types of credit

There are three types of credit accounts: revolving, installment and open. One of the most common types of credit accounts, revolving credit is a line of credit that you can borrow from freely but that has a cap, known as a credit limit, on how much can be used at any given time.

What are the 3 factors that determine credit

The 5 factors that impact your credit scorePayment history.Amounts owed.Length of credit history.New credit.Credit mix.

How do you use credit as an advantage

Ask for a Lower Interest Rate. First, the good news: Two out of three credit card holders who ask for a lower interest rate get their request honored.Consider a Limit Increase.Move Your Due Date.Pay Mid-Cycle.The Secret to Avoiding Interest.Double Dip Rewards.Plan Ahead When Traveling.Bring Down Your Balance.

What are 2 good examples of using credit

Common examples include car loans, mortgages, personal loans, and lines of credit. Essentially, when the bank or other financial institution makes a loan, it "credits" money to the borrower, who must pay it back at a future date.

What are 2 advantages of a good credit score

Benefits of having good creditBetter qualification odds. Whether you're applying for a new credit card, personal loan or another type of financing, having good credit could work to your advantage.Lower interest rates.Higher credit limits and larger loan amounts.Lower insurance premiums.Smaller security deposits.